Stay up to date with notifications from The Independent

Notifications can be managed in browser preferences.

Thank you for registering

Please refresh the page or navigate to another page on the site to be automatically logged inPlease refresh your browser to be logged in

How Trump triggered the biggest crypto crash in history

Half a trillion dollars wiped from the market in the latest sell-off, with Trump’s own meme coin hitting a new all-time low

Just days after hitting a new all-time high, thecrypto market suffered its largest liquidation in its history last Friday. In the space of a few hours, half a trillion dollars was wiped from the the market, withbitcoin alone losing more than $200 billion in value – all from a single post on social media.

The sell-off began when Donald Trump announced on Truth Social that the US would impose new tariffs of 100 per cent on Chinese imports from 1 November. The US president’s threat came in response to Chinese controls on rare earth minerals, triggering market wide turmoil amid fears of an escalating trade war between the world’s two biggest economies.

More than 1.6 million traders were hit by the chaos, according to figures from crypto analytics firm CoinGlass, as all of the top cryptocurrencies plummeted in value. Trump’s own meme coin fell by nearly 40 per cent of its value to a new low of $4.65, leaving thousands of his followers mulling losses from a crypto token once valued at $45.

Panic spread online that the sudden collapse would lead to a longer downward trend, as seen inprevious price cycles, however another post from Trump seemed to assuage such fears. Over the weekend, the US president appeared to tone back his tariffs threat to China, claiming “it will all be fine... The USA wants to help China, not hurt it”.

Financial markets subsequently rebounded, with bitcoin returning from $103,000 to around $112,000 by Tuesday – still a long way off the all-time high it reached a week ago.

It is still not clear whether Trump plans to impose any new tariffs on China, and industry experts have said that the short-term market trajectory will depend on whether the dispute is resolved within the next couple or weeks.

“Over $19 billion of perpetual futures crypto positions were liquidated across centralised exchanges and decentralised market places, the largest ever one-day liquidation in crypto history,” Simon Peters, a crypto analyst at the online trading platform eToro, wrote in a research note on Monday.

“Now with this glimmer of light that Trump may not follow through with the tariff increases on China, crypto markets are on their way to recovering Friday’s losses. No doubt all eyes this week will be on Trump’s Truth Social account for any further positive updates or developments to encourage more investors to return to the market.”

It is not the first time Trump’s comments has caused such severe shifts in market sentiment. Billing himself as the first ever “crypto president” during his 2024 presidential campaign, he pledged to set up a bitcoin treasury, bring allcryptocurrency mining operations to the US, and protect the crypto industry from strict regulation.

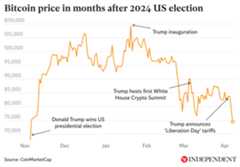

Bitcoin hit a record high when he was inaugurated in January, before sliding in the subsequent months due to a perceived lack of action in the space. There was a brief price spike in the build up to the fist ever White House Crypto summit, but it was not enough to reverse a downward trend that was further exacerbated by his ‘Liberation Day’ tariffs in April.

The price movements, which were felt even more forcefully by meme coins and smaller crypto tokens, highlight the fragility of the nascent space. Shawn Young, chief market analyst at MEXC, described the latest losses as “a wake-up call” for traders and investors, though said that bitcoin’s relative lack of movement compared to less established cryptocurrencies suggests it is more resilient to risk sentiment.

Describing the liquidation event as the ‘Great Reset’, he warned that the latest relief rally could still prone to the president’s whims.

“Cooling trade frictions between the U.S and China have been a key catalyst in stabilizing global risk sentiment,” Mr Young toldThe Independent.

“The market is digesting the lower probability of an extended trade war and seeing Trump’s actions as a move to foster negotiations. However, until a counter announcement is made regarding the reversal of the planned tariff increase on Chinese imports, further escalations can not be ruled out.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

CommentsMost popular

Popular videos

Bulletin

Read next

Thank you for registering

Please refresh the page or navigate to another page on the site to be automatically logged inPlease refresh your browser to be logged in