TWI699724B - Method and system for loan management under a blockchain - Google Patents

Method and system for loan management under a blockchainDownload PDFInfo

- Publication number

- TWI699724B TWI699724BTW107114694ATW107114694ATWI699724BTW I699724 BTWI699724 BTW I699724BTW 107114694 ATW107114694 ATW 107114694ATW 107114694 ATW107114694 ATW 107114694ATW I699724 BTWI699724 BTW I699724B

- Authority

- TW

- Taiwan

- Prior art keywords

- loan

- blockchain

- user

- account

- management system

- Prior art date

Links

- 238000000034methodMethods0.000titleabstractdescription20

- 230000007246mechanismEffects0.000claimsabstractdescription14

- 238000007726management methodMethods0.000claimsdescription124

- 239000000463materialSubstances0.000claimsdescription3

- 230000008859changeEffects0.000abstractdescription3

- 238000005516engineering processMethods0.000description17

- 238000010586diagramMethods0.000description5

- 230000006870functionEffects0.000description5

- 230000008569processEffects0.000description5

- 238000012546transferMethods0.000description4

- 238000004364calculation methodMethods0.000description3

- 238000013475authorizationMethods0.000description2

- 230000008901benefitEffects0.000description2

- 230000000694effectsEffects0.000description2

- 238000012797qualificationMethods0.000description2

- 238000012552reviewMethods0.000description2

- 230000004913activationEffects0.000description1

- 238000012790confirmationMethods0.000description1

- 238000013524data verificationMethods0.000description1

- 230000005611electricityEffects0.000description1

- 238000007429general methodMethods0.000description1

- PCHJSUWPFVWCPO-UHFFFAOYSA-NgoldChemical compound[Au]PCHJSUWPFVWCPO-UHFFFAOYSA-N0.000description1

- 239000010931goldSubstances0.000description1

- 229910052737goldInorganic materials0.000description1

- 238000011835investigationMethods0.000description1

- 238000012423maintenanceMethods0.000description1

- 238000012986modificationMethods0.000description1

- 230000004048modificationEffects0.000description1

- 230000008520organizationEffects0.000description1

- 238000012502risk assessmentMethods0.000description1

- XLYOFNOQVPJJNP-UHFFFAOYSA-NwaterSubstancesOXLYOFNOQVPJJNP-UHFFFAOYSA-N0.000description1

Images

Landscapes

- Financial Or Insurance-Related Operations Such As Payment And Settlement (AREA)

Abstract

Description

Translated fromChinese說明書公開一種貸款管理的技術,特別是指利用區塊鏈技術記錄貸款交易記錄的一種貸款管理方法與系統。The manual discloses a loan management technology, especially a loan management method and system that uses blockchain technology to record loan transaction records.

金融服務中的貸款項目是依據消費者的信用(credit)提供有資金需求的客戶一定額度的金錢,此稱為授信額度(Credit Line),或是一種綜合授信額度(General Credit Line)。當銀行客戶有資金需求,銀行可以核定客戶的信用,經精算後核定一筆授信額度,可以一次或多次發送。對於企業而言,將可符合各種融資需求,可降低企業籌資成本,提高財務工作效率。The loan program in financial services is to provide a certain amount of money to customers who need funds based on the consumer's credit (credit), which is called a credit line (Credit Line), or a general credit line (General Credit Line). When a bank customer has a financial need, the bank can verify the customer's credit. After actuarial calculations, the bank can verify a credit line, which can be sent one or more times. For enterprises, it will meet various financing needs, reduce corporate financing costs and improve financial efficiency.

對銀行而言,在需要降低放貸風險的條件中,一般授信程序包括,銀行接收到某客戶提出的授信額度申請,銀行即開始進行調查,收集客戶的營業項目、財務、信用、負債情況等,並根據客戶提出的貸款額度需求、資金用途、還款期限等項目進行評估,並取得客戶抵押或質押物品清單,以評估客戶資格與等級,當符合授信資格後,可以得出一授信額度。之後,銀行與客戶之間協議授信額度,若客戶有意要高額授信額度,可提出條件,經銀行相關部門評估後,可以批准一定額度的授信額度。For banks, among the conditions that need to reduce the risk of lending, the general credit procedures include: when the bank receives an application for a credit line from a customer, the bank will begin investigations to collect the customer’s business items, finances, credit, and liabilities. According to the customer’s proposed loan limit requirements, use of funds, repayment period and other items to evaluate, and obtain a list of customer mortgage or pledge items to evaluate the customer’s qualifications and grades. When the credit qualifications are met, a credit line can be obtained. After that, the bank and the customer agree on the credit line. If the customer intends to request a high credit line, they can propose conditions. After the relevant department of the bank evaluates the credit line, a certain credit line can be approved.

由於一般授信貸款門檻較高,比較適合較大金額的用戶,因此也有金融機構提出小額信貸(或稱微貸)的服務,一般特色是 低利率、快速審查、手續簡便,且要求客戶提出信用資料門檻極低。Since general credit loans have a higher threshold and are more suitable for users with larger amounts, there are also financial institutions offering microfinance (or microfinance) services. The general features are low interest rates, fast review, simple procedures, and require customers to submit credit information The threshold is extremely low.

不論是一般貸款,或是小額信貸,都是在一種信用評等與貸款平衡的機制下,所述信用評等多半基於貸款者(借方)的歷史信用資訊、收入、繳稅記錄,甚至包可學歷、居住地,以及提出的抵押品(如不動產),以綜合評斷一個貸款額度。Whether it is a general loan or a microfinance, it is under a credit rating and loan balance mechanism. The credit rating is mostly based on the historical credit information of the lender (borrower), income, tax payment records, and even credit Educational background, place of residence, and the collateral (such as real estate) provided to comprehensively judge a loan limit.

然而,對於沒有以上條件的客戶,銀行端不容易評斷出信用等級,也就無法提供貸款。However, for customers who do not have the above conditions, it is not easy for the bank to judge the credit rating and cannot provide loans.

揭露書公開一種區塊鏈下的貸款管理方法與系統,所提出的方法可提供合法具有可以提供貸款資金的單位,能針對貸款用戶核撥貸款,並以區塊鏈的分散式帳本技術記載交易記錄,例如用戶動支貸款,而非如習知技術直接將所有貸款金額匯入用戶帳戶,如此,除了通過區塊鏈記載交易記錄的方式具有安全性外,更因此可以在擔負較小風險的情況下針對沒有信用記錄或是信用不足的人提供貸款服務。The disclosure book discloses a method and system for loan management under the blockchain. The proposed method can provide legal entities that can provide loan funds, can approve loans for loan users, and record it with blockchain decentralized ledger technology Transaction records, such as user loans, instead of directly remitting all loan amounts to user accounts as in the conventional technology. In this way, in addition to the security of recording transaction records through the blockchain, it can also bear less risk Under the circumstances, it provides loan services for people who have no credit history or insufficient credit.

根據實施例,在區塊鏈下的貸款管理方法中,通過貸款管理系統接收一貸款用戶的貸款請求與申請資料,並由一金融機構根據貸款用戶的貸款請求與申請資料核撥一貸款額度,先記錄於貸款用戶的金融帳戶中,此金融帳戶與一區塊鏈帳戶建立關聯,區塊鏈帳戶記錄專屬貸款用戶的一區塊鏈總帳,在區塊鏈技術下,貸款用戶得到一金鑰,儲存於用戶裝置中。其中特別的是,金融機構核發的貸款額度記錄於金融帳戶中,區塊鏈帳戶用以記載貸款用戶產生的交易記錄,貸款用戶並不直接取得或動用整得貸款額度的金額。According to an embodiment, in the loan management method under the blockchain, a loan request and application materials of a loan user are received through the loan management system, and a financial institution allocates a loan limit based on the loan request and application materials of the loan user, It is first recorded in the financial account of the loan user. This financial account is associated with a blockchain account. The blockchain account records a blockchain ledger exclusively for the loan user. Under the blockchain technology, the loan user gets a gold The key is stored in the user device. In particular, the loan line issued by financial institutions is recorded in the financial account, and the blockchain account is used to record the transaction records generated by the loan user. The loan user does not directly obtain or use the amount of the loan line.

在應用區塊鏈的技術時,各用戶會在各自的用戶裝置中安裝一軟體程式,經執行後,得到金鑰,金鑰用途是對貸款額度演算 一雜湊值後,儲存於用戶裝置中,貸款額度同時形成的一交易記錄成為區塊鏈帳戶中散布於區塊鏈上各運算節點的分散式帳本,各運算節點亦通過各自的金鑰演算雜湊值,並儲存在節點的記憶體中。當貸款用戶產生下一筆交易記錄時,同樣以金鑰演算一對應的雜湊值後儲存於用戶裝置中,並形成區塊鏈帳戶中散布於區塊鏈上各運算節點的分散式帳本。When applying blockchain technology, each user installs a software program in their respective user device, and after execution, obtains a key. The purpose of the key is to calculate a hash value for the loan amount and store it in the user device. A transaction record formed by the loan amount at the same time becomes a distributed ledger in the blockchain account that is scattered across the computing nodes on the blockchain. Each computing node also calculates the hash value through its own key and stores it in the node's memory . When the loan user generates the next transaction record, it also calculates a corresponding hash value with the key and stores it in the user device to form a distributed ledger in the blockchain account that is distributed among the computing nodes on the blockchain.

進一步地,由於上述機制下有調整貸款額度的彈性,金融機構可根據從貸款管理系統得到影響貸款額度的信用資料,自動或通過申請調整貸款額度。Furthermore, due to the flexibility of adjusting the loan limit under the aforementioned mechanism, financial institutions can adjust the loan limit automatically or through application based on the credit information that affects the loan limit obtained from the loan management system.

在另一實施例中,貸款用戶可以設定可查詢其帳戶的其他用戶,區塊鏈上的全部或部分用戶經過認證與授權後可查詢區塊鏈總帳下分散式帳本的交易記錄。In another embodiment, loan users can set other users who can query their accounts. All or part of the users on the blockchain can query the transaction records of the distributed ledger under the blockchain general ledger after being authenticated and authorized.

在區塊鏈下的貸款管理系統的實施例中,系統包括一用戶管理模組,用以管理於貸款管理系統中註冊的用戶;一認證模組,記載登入貸款管理系統的認證資料,並管理各用戶申請一區塊鏈帳本的認證資料,執行區塊鏈身份認證;一總帳管理模組,用以管理貸款用戶的各種交易記錄;一金融帳戶管理模組,連結總帳管理模組,可將貸款用戶的區塊鏈帳戶與金融帳戶產生關聯。系統即能執行所述的貸款管理方法。In the embodiment of the loan management system under the blockchain, the system includes a user management module for managing users registered in the loan management system; an authentication module, which records the authentication data for logging into the loan management system and manages Each user applies for authentication data of a blockchain ledger to perform blockchain identity authentication; a general ledger management module to manage various transaction records of loan users; a financial account management module to link the general ledger management module , Can associate the blockchain account of the loan user with the financial account. The system can execute the described loan management method.

進一步地,當貸款用戶於貸款額度中動支一筆額度時,通過貸款管理系統記錄貸款用戶的需求,如營業實際費用支出,因此動支額度將對應這個需求,並產生一筆交易記錄。Further, when a loan user spends a certain amount in the loan line, the loan management system records the loan user's needs, such as actual operating expenses, so the move line will correspond to this demand and generate a transaction record.

為了能更進一步瞭解本發明為達成既定目的所採取之技術、方法及功效,請參閱以下有關本發明之詳細說明、圖式,相信本發明之目的、特徵與特點,當可由此得以深入且具體之瞭解,然而所附圖式僅提供參考與說明用,並非用來對本發明加以限制者。In order to further understand the technology, methods and effects of the present invention to achieve the established objectives, please refer to the following detailed descriptions and drawings about the present invention. I believe that the objectives, features and characteristics of the present invention can be thoroughly and concretely obtained. It is understood that, however, the accompanying drawings are only provided for reference and illustration, and are not intended to limit the present invention.

101‧‧‧貸款管理系統101‧‧‧Loan Management System

103‧‧‧金融機構103‧‧‧Financial Institution

105、106、107‧‧‧用戶105, 106, 107‧‧‧users

10‧‧‧網路10‧‧‧Internet

32‧‧‧用戶裝置32‧‧‧User Device

30‧‧‧貸款管理系統30‧‧‧Loan Management System

34‧‧‧金融機構主機34‧‧‧Financial Institution Host

325‧‧‧帳本325‧‧‧Ledger

321‧‧‧軟體程式321‧‧‧Software Program

327‧‧‧帳戶327‧‧‧Account

323‧‧‧金鑰323‧‧‧Key

303‧‧‧認證模組303‧‧‧Authentication Module

30‧‧‧貸款管理系統30‧‧‧Loan Management System

305‧‧‧總帳管理模組305‧‧‧General Ledger Management Module

307‧‧‧金融帳戶管理模組307‧‧‧Financial Account Management Module

301‧‧‧用戶管理模組301‧‧‧User Management Module

步驟S201~S209‧‧‧設定帳戶的流程Steps S201~S209‧‧‧Flow of account setting

步驟S401~S415‧‧‧貸款管理方法流程Steps S401~S415‧‧‧The process of loan management method

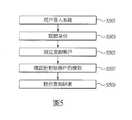

步驟S501~S509‧‧‧貸款管理方法流程Steps S501~S509‧‧‧The process of loan management method

圖1顯示區塊鏈下的貸款管理系統的架構實施例示意圖;圖2所示為區塊鏈下的貸款管理方法中設定帳戶的實施例流程;圖3顯示貸款管理系統的實施例功能方塊圖;圖4描述區塊鏈下的貸款管理方法實施例流程圖;圖5描述區塊鏈下的貸款管理方法實施例流程圖。Figure 1 shows a schematic diagram of an embodiment of a loan management system under the blockchain; Figure 2 shows an embodiment process of setting an account in a loan management method under the blockchain; Figure 3 shows a functional block diagram of an embodiment of the loan management system Figure 4 describes a flowchart of an embodiment of a loan management method under the blockchain; Figure 5 describes a flowchart of an embodiment of the loan management method under the blockchain.

揭露書提出一種區塊鏈下的貸款管理方法與系統,其中區塊鏈下的貸款管理系統實現一個界接金融機構(放貸方,如銀行)與用戶(借貸方)的平台,平台通過區塊鏈(Blockchain)技術認證借貸雙方,以及利用分散式帳本的機制記錄貸款用戶與金融機構之間的交易資訊,利用區塊鏈技術的認證方式可以提供高安全性交易與分級授權的優點,而利用區塊鏈記帳的方式則達到去中心化而獲得公信力的好處。The disclosure book proposes a loan management method and system under the blockchain. The loan management system under the blockchain realizes a platform that connects financial institutions (lenders, such as banks) and users (lenders). Blockchain technology authenticates both borrowers and lenders, and uses a distributed ledger mechanism to record transaction information between loan users and financial institutions. The authentication method using blockchain technology can provide the advantages of high-security transactions and hierarchical authorization. The use of blockchain for accounting will achieve decentralization and gain the benefits of credibility.

所述區塊鏈(Blockchain)是指通過去中心化(如去除伺服中心)和去信任方式(如第三方認證)的一種分散式管理的技術,以一種分散式拓樸(Distributed topology)運作,讓參與其中的各個節點(如實現區塊鏈下的貸款管理方法的金融機構、平台與用戶裝置)將一段時間產生的資料通過密碼學演算法加密後產生雜湊值(hash),記錄到一個分散式的數據塊(block),其中記錄鏈結下一個數據塊,如此,區塊鏈把資料庫分別放在不同的節點裡保存,並且互相支持數據查詢(查帳),資料更動需要經過其餘節點的共識同意。因此,這種分散式管理的機制形成去中心化的公開帳本(ledger),相關應用平台(如揭露書提出的區塊鏈下的貸款管理系統)可以通過所有參與節點共同檢驗記錄真偽,並且每個數據塊的內容都由後續子鏈上的區塊來保證其內容不可被篡改。The Blockchain refers to a decentralized management technology through decentralization (such as removing the server center) and trustless methods (such as third-party authentication), operating in a distributed topology, Let the participating nodes (such as financial institutions, platforms and user devices that implement loan management methods under the blockchain) encrypt the data generated for a period of time through a cryptographic algorithm to generate a hash value and record it in a decentralized A type of data block (block), in which the record is linked to the next data block. In this way, the block chain stores the database in different nodes and supports each other for data query (accounting), and data changes need to go through the remaining nodes The consensus agrees. Therefore, this decentralized management mechanism forms a decentralized public ledger, and related application platforms (such as the loan management system under the blockchain proposed in the disclosure book) can jointly verify the authenticity of records through all participating nodes. And the content of each data block is guaranteed by the block on the subsequent sub-chain that its content cannot be tampered with.

根據揭露書提出的區塊鏈下的貸款管理方法與系統實施例,應用區塊鏈的技術,在區塊鏈上的每個數據塊記錄的資訊如貸款用戶在貸款應用上的貸款額度、動支額度與變動額度等交易資訊,交易資訊由多個獨立的節點(用戶裝置、系統伺服器、金融機構的主機等)維護、更新和核查,可確保記帳結果的公平、公正和公開透明,並無需任何中心化機構的審核和維護。According to the embodiment of the loan management method and system under the blockchain proposed in the disclosure, the blockchain technology is applied, and the information recorded in each data block on the blockchain, such as the loan amount and movement of the loan user in the loan application Transaction information such as the payment limit and change limit. The transaction information is maintained, updated, and verified by multiple independent nodes (user devices, system servers, hosts of financial institutions, etc.) to ensure the fairness, impartiality, and transparency of the accounting results, and No need for review and maintenance by any centralized organization.

在區塊鏈下的貸款管理方法與系統的應用中,執行一筆交易時,可使用設立帳戶時申請的公私鑰(public-private key)的公鑰加密交易內容,傳遞到另一方(如平台)時,只有配有對應私鑰的對象才能解密而取得交易內容;反之,若以私鑰加密交易內容,擁有公鑰的對象就可以配對的公鑰解密而取得交易內容。如此,在區塊鏈下的貸款管理方法應用區塊鏈分散式帳本的實施例中,貸款用戶在借貸上的變動,如動支額度,可以他的私鑰加密動支額度的信息,並以私鑰產生數位簽章(digital signature),用以確認轉帳資料發送來源的真偽,之後廣播到區塊鏈上,每個接收到此筆轉帳資料的節點可以使用配對的公鑰解密轉帳資料,如此可以確保傳送訊息的人的身份,也將轉帳資料利用加密技術儲存在各節點中。因此,每個節點都保有一份帳本,紀錄了在網路上所有使用某個區塊鏈技術的每筆交易紀錄。In the application of the loan management method and system under the blockchain, when a transaction is executed, the public key of the public-private key (public-private key) applied for when setting up the account can be used to encrypt the transaction content and pass it to the other party (such as the platform) At this time, only the object with the corresponding private key can decrypt and obtain the transaction content; on the contrary, if the transaction content is encrypted with the private key, the object with the public key can decrypt the paired public key to obtain the transaction content. In this way, in the embodiment where the loan management method under the blockchain applies the blockchain distributed ledger, the loan user's changes in the loan, such as the amount of money, can encrypt the information of the amount of money with his private key, and Generate a digital signature with the private key to confirm the authenticity of the source of the transfer data, and then broadcast it to the blockchain. Each node that receives the transfer data can use the paired public key to decrypt the transfer data In this way, the identity of the person sending the message can be ensured, and the transfer data can be stored in each node using encryption technology. Therefore, each node maintains a ledger that records all transactions on the Internet that use a certain blockchain technology.

圖1顯示揭露書提出的區塊鏈下的貸款管理系統的架構實施例示意圖。Figure 1 shows a schematic diagram of an embodiment of the architecture of the loan management system under the blockchain proposed in the disclosure.

在此架構實施例圖中,設有區塊鏈下的貸款管理系統101,貸款管理系統101實現一個平台,為提供金融機構(如銀行)103服務其用戶105、106與107的平台,主要是應用了區塊鏈的技術執行信貸管理,將用戶105、106與107申請貸款、動支金額、查詢記錄、調整貸款額度等記錄都通過區塊鏈分散式帳本的機制記錄起來,並提供各用戶105、106或107(成為貸款用戶時)設定存取貸款內容的權限,特別是可以針對每一個其他用戶設定存取 帳戶內容的不同權限,包括時限。In this architecture embodiment diagram, there is a

再者,用戶105、106與107通過貸款管理系統101實現的平台可以設定動支金額,反映到自己的實際帳戶上,並可進一步申請調整貸款金額,然而,通過實際帳戶記錄了金融機構核撥的一個貸款額度的金額,卻不是讓貸款用戶直接取得全部貸款額度的金額。例如通過用戶105、106與107的電腦裝置執行的軟體程式連線貸款管理系統101或是金融機構103之後,上傳自己的收入、設定資產變動,使得金融機構103可以根據這些資訊調整貸款金額。Furthermore,

在一實施例中,當貸款用戶動支總額度的一部分時,需要在貸款管理系統101上記錄實際費用支出,才能動支對應的金額。舉例來說,當貸款用戶是經營事業的用途,相關費用支出如人事費用、水費、電費等,系統將根據這些需求核定可動支金額,並產生一筆交易記錄,通過區塊鏈記載。如此,說明書所公開的區塊鏈下的貸款管理方法與系統將有效降低金融機構103提供貸款的風險,並且給予貸款用戶方便與調整額度的彈性。特別地,不同於傳統金融貸款時需要查核貸款用戶的資產負債、信用評等、歷史記錄等資訊,此區塊鏈下的貸款管理方法與系統可以適用沒有資產以及沒有足夠信用記錄的貸款用戶一定額度的貸款(可能是小額),而動支金額視實際支出而定,並非直接將貸款總額撥入貸款用戶的實際帳戶中,有效降低金融機構103風險。In one embodiment, when the loan user moves a part of the total expenditure, the actual expenditure needs to be recorded on the

欲運行區塊鏈下的貸款管理方法,用戶105、106與107需要在自己的裝置中安裝特定軟體程式,如行動裝置中的APP,操作軟體程式啟始的使用者介面(user interface),通過網路10建立與系統的連線,通過網路10亦可連線金融機構103等,並通過網路10實現區塊鏈建立分散式帳本的目的。To run the loan management method under the blockchain,

開始時,需要執行如圖2所示實施區塊鏈下的貸款管理方法中設定帳戶的實施例流程。At the beginning, it is necessary to perform the embodiment process of setting an account in the implementation of the loan management method under the blockchain as shown in FIG.

在步驟S201中,通過執行於用戶端電腦裝置中的軟體程式與貸款管理系統連線,註冊帳戶,設定安全認證的資料,如密碼或各種認證方式。註冊完成後,如步驟S203,後台貸款管理系統啟動區塊鏈機制,用戶通過執行於用戶裝置(運算節點)中的軟體程式演算產生金鑰對(Key pair),包括私鑰(Private key)與公鑰(Public key),加密與解密使用不同的金鑰,私鑰將安全地儲存在用戶裝置中。參與區塊鏈的每個節點都將產生各自的金鑰對,將私鑰儲存在各節點記憶體中,公鑰則可在網路上公開,用來加密與驗證資料之用。In step S201, a software program running on the client computer device is connected to the loan management system, an account is registered, and security authentication data, such as a password or various authentication methods, is set. After the registration is completed, in step S203, the back-end loan management system activates the blockchain mechanism, and the user generates a key pair, including a private key and a private key, through a software program running on the user device (computing node). Public key, encryption and decryption use different keys, and the private key will be stored safely in the user's device. Each node participating in the blockchain will generate its own key pair, and store the private key in the memory of each node, and the public key can be published on the Internet for encryption and verification of data.

如此,如步驟S205,完成建立貸款用戶的個人專屬總帳,也就是一個專屬區塊鏈。此總帳將關聯提供貸款服務的金融機構的一個實體的金融帳戶,此金融帳戶可以為貸款用戶原本在金融機構註冊的帳戶,亦可為在貸款管理系統建立區塊鏈總帳時,立即讓貸款用戶申請程序而建立的金融帳戶。In this way, in step S205, the establishment of the personal private ledger of the loan user is completed, that is, a private blockchain. This general ledger will be associated with an entity's financial account of a financial institution that provides loan services. This financial account can be the account that the loan user originally registered with the financial institution, or it can be used immediately when the blockchain general ledger is established in the loan management system. A financial account established by the loan user application procedure.

此區塊鏈總帳在區塊鏈的機制下形成一個共享的分散式總帳,由多個參與的運算節點來共同維護,每個節點也各自擁有一份完整的帳本備份,在此區塊鏈下的貸款管理方法實施例中,可由金融機構、實現平台的貸款管理系統以及參與服務的多個用戶形成區塊鏈運算節點,各節點中都具備完整區塊鏈資料,資料包括的區塊記錄每次交易產生的資訊,在區塊鏈機制下,這些記錄無法被竄改。This blockchain general ledger forms a shared decentralized general ledger under the blockchain mechanism, which is jointly maintained by multiple participating computing nodes. Each node also has a complete copy of the ledger. In this area In the embodiment of the loan management method under the block chain, the financial institution, the loan management system of the realization platform, and multiple users participating in the service can form a block chain operation node. Each node has complete block chain data, and the data includes the area The block records the information generated by each transaction. Under the blockchain mechanism, these records cannot be tampered with.

建立區塊鏈總帳的用戶即為此帳戶的擁有者與管理者,接著,如步驟S207,用戶可以設定存取總帳下貸款記錄的其他平台用戶與對應的權限,主要是查詢權限,並設定記錄於貸款管理系統中,戶查詢特定總帳或特定交易資料的權限。再如步驟S209,這貸款管理系統中將以資料庫記載某個總帳的用戶、帳戶資料、貸款金融機構與用戶權限,用以管理用戶權限,並確認用些用戶同樣為貸款管理系統的用戶,參與此區塊鏈的用戶需在各自的電 腦裝置中安裝對應的軟體程式,成為區塊鏈的運算節點,取得各自的金鑰對,在每筆交易記錄上以雜湊(Hash)函數運算雜湊值,記錄在區塊標頭(header),用以驗證每筆交易記錄的正確性。The user who created the blockchain general ledger is the owner and manager of this account. Then, in step S207, the user can set other platform users and corresponding permissions to access loan records under the general ledger, mainly query permissions, and Set the authority to record in the loan management system, and the user can query specific general ledger or specific transaction data. In step S209, the loan management system will record the user, account information, loan financial institution and user authority of a general ledger in the database to manage the user authority and confirm that the users are also users of the loan management system , Users participating in this blockchain need to install the corresponding software programs in their respective computer devices to become the computing nodes of the blockchain, obtain their respective key pairs, and use the Hash function to compute the hash on each transaction record The value is recorded in the block header to verify the correctness of each transaction record.

在區塊鏈上產生多筆交易記錄,都以分散式演算法散布在各運算節點中,形成區塊,每個區塊的標頭都包含前一個區塊雜湊值,這是將前一個區塊的標頭以雜湊函數運算得到的值,因此每個區塊之間,都會藉由這條鏈與先前的區塊鏈結。當用戶想要查詢某個貸款用戶的交易資料,通過用戶裝置的軟體程式與貸款管理系統連線後,確認該用戶存取某貸款用戶的權限,確認後,該用戶可以依照權限查詢總帳或其中特定交易資料。Multiple transaction records are generated on the blockchain, which are distributed among the computing nodes using a distributed algorithm to form blocks. The header of each block contains the hash value of the previous block. The header of the block is the value calculated by the hash function, so each block will be linked to the previous block chain by this chain. When a user wants to query the transaction data of a certain loan user, after connecting to the loan management system through the software program of the user device, confirm the user's permission to access a certain loan user. After confirmation, the user can query the general ledger or Which specific transaction information.

所述貸款管理系統的功能可參考圖3所示其中功能方塊圖,所示貸款管理系統30可以伺服器、叢集等各式電腦系統實現,通過其中處理器執行區塊鏈下的貸款管理方法,其中由各軟體模組運行的軟體程序用以服務用戶(用戶裝置32)對於貸款管理的需求,提供使用者介面設定貸款相關資訊,通過貸款管理系統30建立區塊鏈上的總帳,並與金融機構(金融機構主機34)實體金融帳戶產生關聯。所示貸款管理系統30、金融機構主機34與用戶裝置32皆為運行參與此區塊鏈的運算節點。For the functions of the loan management system, refer to the functional block diagram shown in FIG. 3. The

圖3所示功能方塊的運行可以同時參考圖4與圖5描述區塊鏈下的貸款管理方法實施例流程圖。The operation of the function block shown in FIG. 3 can be described with reference to FIGS. 4 and 5 at the same time to describe the flowchart of the embodiment of the loan management method under the blockchain.

一開始,用戶於用戶裝置32安裝相關軟體程式321,如行動裝置中的APP,通過軟體程式321,用戶可以在啟動後與貸款管理系統30連線,註冊成為貸款用戶,設定一區塊鏈帳戶327,同時在貸款管理系統30中的用戶管理模組301中建立用戶資料,包括用戶基本資料、貸款需求相關資訊,以及通過認證模組303,其中包括登入貸款管理系統30的認證資料,並用以管理用戶申請區塊鏈帳本時所需的金鑰等相關認證資料。At the beginning, the user installs the

所述用戶資料特別是包括可以影響金融機構核發貸款金額的 信用資料,例如用戶信用資訊、收入、繳稅記錄、學歷、工作、居住地、抵押品等可以綜合評斷貸款額度的資訊,而這些資訊也是提供金融機構可以隨時或定時根據用戶申請,或是自動調整貸款額度的依據。另外,當金融機構通過貸款管理系統30得到該貸款用戶的動支與還款記錄等可以影響貸款額度的信用資料時,亦能自動調整記載於金融帳戶中的貸款額度。The user information especially includes credit information that can affect the amount of loans issued by financial institutions, such as user credit information, income, tax payment records, education, work, residence, collateral, and other information that can comprehensively determine the loan amount. It also provides a basis for financial institutions to automatically adjust loan quotas based on user applications at any time or regularly. In addition, when the financial institution obtains the credit information of the loan user through the

在完成初始設定後,用戶可通過軟體程式所啟始的使用者介面提出貸款申請,貸款管理系統30接收用戶端的貸款請求(步驟S401,圖4),用戶可在此時提交申請資料,如貸款金額以及上述可以影響金融機構核發貸款的資料。這部分可以通過貸款管理系統30申請,由其中金融帳戶管理模組307處理,並與金融機構主機34傳遞資料後,該用戶的區塊鏈帳戶與金融機構的實體金融帳戶產生關聯;另外,不排除用戶通過軟體程式321或特定軟體直接向金融機構提出申請。After completing the initial settings, the user can submit a loan application through the user interface initiated by the software program, and the

當貸款管理系統30將用戶的貸款申請等相關資料傳遞給金融機構主機34後,金融機構根據申請資料設定貸款額度(步驟S403,圖4),貸款管理系統30同時通過區塊鏈技術建立此貸款用戶的專屬區塊鏈,在貸款用戶的區塊鏈帳戶中設定一專屬貸款用戶的區塊鏈總帳(步驟S405,圖4)。After the

貸款用戶在申請區塊鏈總帳時,同時通過金鑰演算法取得金鑰323,儲存於用戶裝置32中,參與區塊鏈的所有用戶都取得屬於自己的金鑰,用以演算雜湊值、加密與數位簽章之用。因此,當金融機構核發貸款額度時,此筆交易記錄即通過金鑰演算對應的雜湊值後,形成儲存於區塊鏈上各節點中的分散式帳本,成為總帳的一部分。所述總帳是一個散布於參與區塊鏈的運算節點的共享式總帳,在各節點建立分散式帳本325,同時記錄於用戶裝置23中,以及受到貸款管理系統30中總帳管理模組305管理,其中管理貸款用戶的各種交易記錄,以及記錄貸款額度。When the loan user applies for the blockchain general ledger, he also obtains the key 323 through the key algorithm and stores it in the

在圖4步驟S407中,通過貸款管理系統30的金融帳戶管理模組307功能,與總帳管理模組305連結,可以將貸款用戶設定好的區塊鏈帳戶與金融機構設定的金融帳戶產生關聯,金融帳戶由金融機構主機32管理,金融機構核撥的貸款金額即由金融帳戶管理,形成一筆交易記錄(步驟S409,圖4),通過貸款管理系統30的認證模組303執行區塊鏈身份認證後(步驟S411,圖4),此筆撥款總額即成為區塊鏈上的記錄,形成分散式帳本(步驟S413,圖4),並播送至其他運算節點上(步驟S415,圖4)。In step S407 in Figure 4, through the function of the financial

經貸款額度設定完成,之後,當貸款用戶根據實際需求動支貸款的一部分,通過貸款管理系統30的總帳管理模組305記錄下一筆交易記錄,例如動支貸款形成的交易記錄(步驟S409,圖4),在區塊鏈下,執行身份認證後(步驟S411,圖4),在用戶裝置中,以金鑰形成對應的雜湊值儲存在用戶帳戶中的區塊鏈帳戶中,並播送至區塊鏈各節點(步驟S413,圖4),形成散布於區塊鏈上各運算節點的分散式帳本(步驟S415,圖4)。After the loan limit setting is completed, after the loan user spends part of the loan according to actual needs, a transaction record is recorded through the general

在一實施例中,在揭露書所提出區塊鏈下的貸款管理方法中,可讓金融機構提供一種動態貸款機制。由於最初核發貸款金額僅為一筆記錄在區塊鏈總帳內的記錄,而非直接撥款至實際金融帳戶中,因此所提供的彈性是,貸款額度的可變動性。In one embodiment, in the loan management method under the blockchain proposed in the disclosure, financial institutions can provide a dynamic loan mechanism. Since the initial loan amount is only a record recorded in the blockchain general ledger, rather than directly allocated to the actual financial account, the flexibility provided is the variability of the loan amount.

當貸款管理方法配合區塊鏈分散式帳本的認證與記帳機制,而不直接讓貸款用戶取得或可動支全部貸款額度的金額,除了可以免除傳統需要撥款到真實帳戶產生的風險,更因為僅是根據實際需求處理動支的部分,系統也僅針對貸款人動支的部分收取利息;更因此產生的彈性是讓貸款用戶可以在貸款期間通過還款、記錄收入、資產等可能影響貸款額度的方式,讓金融機構調整貸款額度,改變額度的記錄同樣形成分散式帳本,並記載於區塊鏈上的各運算節點中。When the loan management method cooperates with the authentication and accounting mechanism of the blockchain decentralized ledger, and does not directly allow the loan user to obtain or mobilize the full loan amount, in addition to avoiding the risk of the traditional need to allocate funds to the real account, it is only It is the part that handles the moving expenses according to actual needs, and the system only charges interest for the part of the lender's moving expenses; the flexibility generated by this is that the loan user can repay, record income, assets, etc. that may affect the loan limit during the loan period In this way, financial institutions are allowed to adjust the loan limit, and the records of the changed limit also form a distributed ledger, which is recorded in each computing node on the blockchain.

特別的是,區塊鏈具有所有參與某個專屬區塊鏈的人都可以 查詢帳戶的特性,每個人根據系統提供的權限可通過網路查詢經過授權可查詢的區塊的資訊,也就是各節點中具有分散式帳本,因此區塊鏈上全部或部分用戶通過授權可以查詢某個區塊鏈總帳下分散式帳本的交易記錄。如此,當貸款管理方法配合區塊鏈公開與透明的機制,可以讓參與區塊鏈的其他用戶查詢儲存在各運算節點的分散式帳本記載的交易記錄,所述貸款管理系統通過區塊鏈的認證機制,通過用戶管理模組301與總帳管理模組305,可以設定其他參與區塊鏈的其他用戶查詢貸款用戶的總帳(如動支記錄、還款記錄、貸款變更記錄、餘額等),先由總帳的用戶通過系統設定可以存取分散式帳本的其他用戶,以及這些用戶的權限,流程可參考圖5所示區塊鏈下的貸款管理方法實施例流程圖。In particular, the blockchain has the feature that all people participating in an exclusive blockchain can query the account. Everyone can query the information of the authorized and queryable block through the Internet according to the permissions provided by the system, that is, each The node has a distributed ledger, so all or part of the users on the blockchain can query the transaction records of the distributed ledger under a certain blockchain general ledger through authorization. In this way, when the loan management method cooperates with the open and transparent mechanism of the blockchain, other users participating in the blockchain can query the transaction records recorded in the distributed ledger stored in each computing node. The loan management system uses the blockchain Through the

開始如步驟S501,用戶通過用戶裝置上的軟體程序登入貸款管理系統,並進行身份認證,如步驟S503,認證身份的程序可包括登入系統的認證,以及設定區塊鏈總帳存取權限的認證。接著如步驟S505,通過貸款管理系統提供的使用者介面(如網頁、軟體程式啟始的介面)設定要查詢的帳戶,並選擇其他可查詢此總帳的用戶與設定查詢權限。Initially, as in step S501, the user logs in to the loan management system through the software program on the user device and performs identity authentication. As in step S503, the identity authentication procedure can include authentication for logging in to the system and authentication for setting blockchain general ledger access rights . Then, in step S505, the account to be inquired is set through the user interface provided by the loan management system (such as the interface for starting a webpage, software program), and other users who can inquire about this general ledger are selected and the inquiry authority is set.

之後,當這些用戶通過貸款管理系統登入系統後,如步驟S507,系統經認證身份後,將確認針對所要查詢帳戶的用戶是否經過貸款用戶授權,判斷權限後,通過區塊鏈的演算方式,如步驟S509,系統將通過使用者介面提供查詢結果。After these users log in to the system through the loan management system, as in step S507, after the system is authenticated, it will confirm whether the user whose account is to be queried is authorized by the loan user, and after determining the authority, the calculation method of the blockchain is used, such as In step S509, the system will provide the query result through the user interface.

綜上所述,以上實施例所揭露的區塊鏈下的貸款管理方法與系統,貸款管理系統實現一個區塊鏈貸款服務平台,所提出的方法可提供金融機構針對平台用戶核撥貸款,金融機構先撥款至一實體帳戶中,而貸款用戶在平台上建立一區塊鏈總帳,兩者關聯,當貸款用戶產生交易記錄,即以區塊鏈的分散式帳本技術記載交易記錄,記錄各種貸款異動、動支、還款等事件,同時,其他被授權用戶可以查詢交易記錄,不同於一般將貸款全額匯入用戶實 體帳戶的方法,此區塊鏈下的貸款管理方法僅記載經動支的部分,還可以在擔負較小風險的情況下針對沒有信用記錄的人,或是信用資料不足以在傳統金融服務中取得貸款的人,並讓貸款人可以隨時通過提出的資料要求調整貸款額度。In summary, the loan management method and system under the blockchain disclosed in the above embodiments, the loan management system implements a blockchain loan service platform, and the proposed method can provide financial institutions for appropriating loans for platform users. The institution first allocates funds to a physical account, and the loan user establishes a blockchain ledger on the platform, and the two are related. When the loan user generates transaction records, the transaction records are recorded by the blockchain's distributed ledger technology. Various loan transactions, payments, repayments and other events. At the same time, other authorized users can query transaction records. Unlike the general method of remitting the loan in full to the user's physical account, the loan management method under this blockchain only records the transaction. The part of the payment can also be targeted at people with no credit history or people whose credit information is not sufficient to obtain a loan in traditional financial services while taking a small risk, and the lender can adjust the loan at any time through the information requested. Quota.

事實上,在一實施方式中,區塊鏈下的貸款管理方法與系統提供的貸款方式除了適用傳統根據資產負債表提供的貸款以外,實際上還可以是一種小額貸款的概念,因為系統僅對動支部分計算利息,可以降低貸款用戶的成本負擔。就貸款管理系統而言,當貸款用戶要動支總額度的一部分時,其中提供貸款用戶可以通過使用者介面提出實際費用支出來動支對應的貸款額度,其他系統服務還有查詢貸款額度、支領貸款、執行還款、請求調整貸款金額(如執行於用戶端電腦裝置的網頁或特定軟體介面)等動作,所述貸款額度並非固定,而是可以根據貸款用戶信用記錄調整,並即時計算更新利息。更者,由於系統應用了區塊鏈的技術,使得貸款管理系統能查核貸款用戶,並能對已核發貸款進行風險評估。In fact, in one embodiment, the loan management method under the blockchain and the loan method provided by the system are not only suitable for traditional loans provided based on the balance sheet, but actually can also be a concept of small loans, because the system only supports The calculation of interest for the expenditure part can reduce the cost burden of loan users. As far as the loan management system is concerned, when a loan user wants to use a part of the total expenditure, the user who provides the loan can propose the actual expenses through the user interface to move the corresponding loan limit. Other system services include querying the loan limit and expenditure. Take loan, perform repayment, request adjustment of loan amount (such as running on the webpage of the client computer device or specific software interface), etc. The loan limit is not fixed, but can be adjusted according to the credit history of the loan user, and calculated and updated in real time interest. What's more, because the system uses blockchain technology, the loan management system can check loan users and perform risk assessments on approved loans.

以上所述僅為本發明之較佳可行實施例,凡依本發明申請專利範圍所做之均等變化與修飾,皆應屬本發明之涵蓋範圍。The foregoing descriptions are only preferred and feasible embodiments of the present invention, and all equivalent changes and modifications made in accordance with the scope of the patent application of the present invention should fall within the scope of the present invention.

S401‧‧‧接收貸款請求S401‧‧‧Receive loan request

S403‧‧‧設定貸款額度S403‧‧‧Set loan limit

S405‧‧‧設定區塊鏈總帳S405‧‧‧Set Blockchain General Ledger

S407‧‧‧關聯區塊鏈帳戶與金融帳戶S407‧‧‧Associate blockchain account with financial account

S409‧‧‧執行交易產生交易記錄S409‧‧‧Execute transaction to generate transaction record

S411‧‧‧身份認證S411‧‧‧Identity Authentication

S413‧‧‧播送至區塊鏈各節點S413‧‧‧Broadcast to each node of the blockchain

S415‧‧‧形成分散式帳本S415‧‧‧Form a distributed ledger

Claims (8)

Translated fromChinesePriority Applications (1)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| TW107114694ATWI699724B (en) | 2018-04-30 | 2018-04-30 | Method and system for loan management under a blockchain |

Applications Claiming Priority (1)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| TW107114694ATWI699724B (en) | 2018-04-30 | 2018-04-30 | Method and system for loan management under a blockchain |

Publications (2)

| Publication Number | Publication Date |

|---|---|

| TW201946014A TW201946014A (en) | 2019-12-01 |

| TWI699724Btrue TWI699724B (en) | 2020-07-21 |

Family

ID=69582887

Family Applications (1)

| Application Number | Title | Priority Date | Filing Date |

|---|---|---|---|

| TW107114694ATWI699724B (en) | 2018-04-30 | 2018-04-30 | Method and system for loan management under a blockchain |

Country Status (1)

| Country | Link |

|---|---|

| TW (1) | TWI699724B (en) |

Citations (5)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| CN105761143A (en)* | 2016-02-01 | 2016-07-13 | 上海凭安网络科技有限公司 | Multi-party co-construction credit record method based on block chains |

| CN106484836A (en)* | 2016-09-30 | 2017-03-08 | 深圳市华傲数据技术有限公司 | Data processing method based on block chain technology and system |

| CN106651346A (en)* | 2016-11-28 | 2017-05-10 | 上海凯岸信息科技有限公司 | Block chain-based credit investigation data sharing and trading system |

| CN107077675A (en)* | 2016-12-30 | 2017-08-18 | 深圳前海达闼云端智能科技有限公司 | Block chain based currency management method and system |

| CN107274184A (en)* | 2017-05-11 | 2017-10-20 | 上海点融信息科技有限责任公司 | block chain data processing based on zero-knowledge proof |

- 2018

- 2018-04-30TWTW107114694Apatent/TWI699724B/ennot_activeIP Right Cessation

Patent Citations (5)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| CN105761143A (en)* | 2016-02-01 | 2016-07-13 | 上海凭安网络科技有限公司 | Multi-party co-construction credit record method based on block chains |

| CN106484836A (en)* | 2016-09-30 | 2017-03-08 | 深圳市华傲数据技术有限公司 | Data processing method based on block chain technology and system |

| CN106651346A (en)* | 2016-11-28 | 2017-05-10 | 上海凯岸信息科技有限公司 | Block chain-based credit investigation data sharing and trading system |

| CN107077675A (en)* | 2016-12-30 | 2017-08-18 | 深圳前海达闼云端智能科技有限公司 | Block chain based currency management method and system |

| CN107274184A (en)* | 2017-05-11 | 2017-10-20 | 上海点融信息科技有限责任公司 | block chain data processing based on zero-knowledge proof |

Also Published As

| Publication number | Publication date |

|---|---|

| TW201946014A (en) | 2019-12-01 |

Similar Documents

| Publication | Publication Date | Title |

|---|---|---|

| US12248985B2 (en) | Investment fund token ownership | |

| CN110490723A (en) | Loan administration method and system under block chain | |

| US11792017B2 (en) | Systems and methods of secure provenance for distributed transaction databases | |

| US20200211099A1 (en) | Decentralized Customer-Controlled Credit Verification | |

| US10607285B2 (en) | System for managing serializability of resource transfers in a process data network | |

| US10387878B2 (en) | System for tracking transfer of resources in a process data network | |

| US10142312B2 (en) | System for establishing secure access for users in a process data network | |

| US20190147431A1 (en) | Credit Protocol | |

| US20170243222A1 (en) | System for use of secure data from a process data network as secured access by users | |

| US20170243286A1 (en) | System for allowing external validation of data in a process data network | |

| KR102324155B1 (en) | Method and apparatus for autonomous guarantee verification for p2p loan service based on blockchain | |

| CN114549194A (en) | A blockchain-based rights asset management service platform and its implementation method | |

| KR102279342B1 (en) | Banking service providing system and method using cryptocurrency | |

| KR20240086698A (en) | Digital asset management system using blockchain and NFT technologies | |

| Arantes et al. | Improving the process of lending, monitoring and evaluating through Blockchain Technologies: an application of Blockchain in the Brazilian Development Bank (BNDES) | |

| US20230298117A1 (en) | Automated Tokenization Of Property Rights | |

| JP2020046975A (en) | Fund transfer system and method for virtual currency | |

| CN111242785A (en) | Bill processing method and device, electronic equipment and storage medium | |

| US20140149314A1 (en) | System and Method for Monitoring Compliance Regarding Investment Thresholds and Accredited/Non-Accredited Status of Investors | |

| CN114003879A (en) | Asset proxy method, device, electronic equipment and storage medium | |

| TWI699724B (en) | Method and system for loan management under a blockchain | |

| US20200234288A1 (en) | Systems and methods of securing sensitive data | |

| CN110910252A (en) | System and method for managing security units associated with intellectual property assets | |

| CN116049869A (en) | Transaction method of multi-layer digital wallet based on blockchain | |

| CN116340985A (en) | Ledger system of multi-layer digital wallet based on blockchain |

Legal Events

| Date | Code | Title | Description |

|---|---|---|---|

| MM4A | Annulment or lapse of patent due to non-payment of fees |