CN115221212A - Fund investment data management system and method - Google Patents

Fund investment data management system and methodDownload PDFInfo

- Publication number

- CN115221212A CN115221212ACN202110406256.2ACN202110406256ACN115221212ACN 115221212 ACN115221212 ACN 115221212ACN 202110406256 ACN202110406256 ACN 202110406256ACN 115221212 ACN115221212 ACN 115221212A

- Authority

- CN

- China

- Prior art keywords

- investment

- information

- fund

- data

- analysis

- Prior art date

- Legal status (The legal status is an assumption and is not a legal conclusion. Google has not performed a legal analysis and makes no representation as to the accuracy of the status listed.)

- Pending

Links

Images

Classifications

- G—PHYSICS

- G06—COMPUTING OR CALCULATING; COUNTING

- G06F—ELECTRIC DIGITAL DATA PROCESSING

- G06F16/00—Information retrieval; Database structures therefor; File system structures therefor

- G06F16/20—Information retrieval; Database structures therefor; File system structures therefor of structured data, e.g. relational data

- G06F16/24—Querying

- G06F16/245—Query processing

- G06F16/2458—Special types of queries, e.g. statistical queries, fuzzy queries or distributed queries

- G06F16/2462—Approximate or statistical queries

- G—PHYSICS

- G06—COMPUTING OR CALCULATING; COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q40/00—Finance; Insurance; Tax strategies; Processing of corporate or income taxes

- G06Q40/06—Asset management; Financial planning or analysis

Landscapes

- Engineering & Computer Science (AREA)

- Physics & Mathematics (AREA)

- Business, Economics & Management (AREA)

- Theoretical Computer Science (AREA)

- Accounting & Taxation (AREA)

- Development Economics (AREA)

- Probability & Statistics with Applications (AREA)

- Finance (AREA)

- General Physics & Mathematics (AREA)

- Technology Law (AREA)

- Fuzzy Systems (AREA)

- Strategic Management (AREA)

- Economics (AREA)

- Operations Research (AREA)

- General Business, Economics & Management (AREA)

- Human Resources & Organizations (AREA)

- Game Theory and Decision Science (AREA)

- Entrepreneurship & Innovation (AREA)

- Marketing (AREA)

- Mathematical Physics (AREA)

- Software Systems (AREA)

- Computational Linguistics (AREA)

- Data Mining & Analysis (AREA)

- Databases & Information Systems (AREA)

- General Engineering & Computer Science (AREA)

- Financial Or Insurance-Related Operations Such As Payment And Settlement (AREA)

Abstract

Translated fromChineseDescription

Translated fromChinese技术领域technical field

本发明涉及计算机技术领域,尤其涉及一种基金投资数据管理系 统及方法。The invention relates to the field of computer technology, in particular to a fund investment data management system and method.

背景技术Background technique

随着经济的发展,投资理财也越来越受到重视,股票、基金、证 券等的交易也越来越频繁。用户的理财意识的增强,随着也对优质的 投资策略的需求和系统性投资的需求越来越高。With the development of the economy, more and more attention has been paid to investment and wealth management, and the transactions of stocks, funds, securities, etc. have become more and more frequent. With the enhancement of users' financial awareness, the demand for high-quality investment strategies and systematic investment is also increasing.

现有技术中,很多投资系统只是简单地完成股票、基金的买卖以 及信息的提供,然而大多数投资者并不具备专业的理财能力,不具有 对这些信息的分析处理能力。In the existing technology, many investment systems simply complete the trading of stocks and funds and provide information. However, most investors do not have professional financial management capabilities, nor do they have the ability to analyze and process such information.

因此,如何提供一种基金投资数据的管理方案,能够方便用户对 信息和数据获取的同时,协助用户进行投资数据分析管理是本领域技 术人员亟待解决的技术问题。Therefore, how to provide a management scheme for fund investment data, which can facilitate users to obtain information and data, and assist users in analyzing and managing investment data is a technical problem to be solved urgently by those skilled in the art.

发明内容SUMMARY OF THE INVENTION

本发明提供一种基金投资数据管理系统及方法,能够方便用户对 信息和数据获取的同时,协助用户进行投资数据分析管理。The present invention provides a fund investment data management system and method, which can facilitate users to acquire information and data and assist users in analyzing and managing investment data.

本发明提供一种基金投资数据管理系统,包括:The present invention provides a fund investment data management system, comprising:

投前研究模块,用于基于投资数据对基金进行分析得到投资参考 结果;The pre-investment research module is used to analyze the fund based on investment data to obtain investment reference results;

投中执行模块,用于基于所述投资参考结果以及用户的投资选择 进行基金的投资交易;The investment execution module is used to carry out the investment transaction of the fund based on the investment reference result and the user's investment choice;

投后分析模块,用于获取用户当前投资交易的基金信息并生成对 应的投后分析报告。The post-investment analysis module is used to obtain the fund information of the user's current investment transactions and generate the corresponding post-investment analysis report.

进一步地,还包括:数据整合模块、金工模型;Further, it also includes: a data integration module and a metalworking model;

所述数据整合模块,用于整合目标基金的多种数据来源或类型的 投资数据成预设结构;所述投资数据包括客户数据中心的投前数据、 外部供应商的采购数据以及人工导入的数据;The data integration module is used to integrate multiple data sources or types of investment data of the target fund into a preset structure; the investment data includes the pre-investment data of the customer data center, the procurement data of external suppliers and the manually imported data ;

所述金工模型,用于基于所述预设结构的投资数据生成所述目标 基金的因子库。The metalworking model is used to generate the factor library of the target fund based on the investment data of the preset structure.

进一步地,所述投前研究模块,包括:模拟组合单元,用于将所 述因子库中的目标基金的数据提取到关注池,生成模拟基金的模拟组 合,并根据所述模拟组合以及因子库确定收益指标,基于所述收益指 标筛选基金。Further, the pre-investment research module includes: a simulated combination unit for extracting the data of the target fund in the factor library into the attention pool, generating a simulated combination of simulated funds, and according to the simulated combination and the factor library A return index is determined, and funds are screened based on the return index.

进一步地,所述投前研究模块,还包括:大类资产配置单元,用 于根据宏观经济数据确定当前经济基本面和金融市场状态,在预设大 类资产的配置设置信息和约束下确定大类资产或策略配置建议信息;Further, the pre-investment research module further includes: a large-class asset allocation unit, which is used to determine the current economic fundamentals and financial market status according to macroeconomic data, and determine large-scale assets under the preset configuration setting information and constraints of large-class assets. Class asset or strategy configuration recommendation information;

所述大类资产或策略配置建议信息包括风险评价信息、马克维茨 资产配置模型以及BL资产配置模型。The information on asset allocation or strategy allocation advice of the major categories includes risk assessment information, Markowitz asset allocation model and BL asset allocation model.

进一步地,所述投前研究模块,还包括以下至少一个:净值分析 单元、持仓分析单元以及定性分析单元;Further, the pre-investment research module also includes at least one of the following: an equity analysis unit, a position analysis unit, and a qualitative analysis unit;

所述净值分析单元,用于根据至少一个以下信息调用客户自主开 发的模型进行净值分析:基金净值进行风险收益特征的评价信息,常 见风险收益指标的计算信息,基于净值数据风险暴露信息,多基金的 横向对比分析信息,同类基金业绩排名信息;The net worth analysis unit is used to call a model independently developed by the client to carry out net worth analysis according to at least one of the following information: evaluation information of risk-return characteristics of fund net worth, calculation information of common risk-return indicators, risk exposure information based on net worth data, multi-fund The horizontal comparative analysis information and the performance ranking information of similar funds;

所述持仓分析单元,用于根据至少一个以下信息通过多基金横向 对比或调用客户自主开发的模型进行持仓分析:基金持仓信息对目标 基金进行分析评价信息、行业分布信息、策略分布信息、风险暴露等 计算信息、业绩归因信息、风格分析信息以及持仓债券信用分析信息;The position analysis unit is used to perform position analysis through horizontal comparison of multiple funds or invoking a model independently developed by the client according to at least one of the following information: fund position information to analyze and evaluate the target fund, industry distribution information, strategy distribution information, risk exposure and other calculation information, performance attribution information, style analysis information, and bond position credit analysis information;

所述定性分析单元,用于基于目标基金的管理人基本信息,旗下 产品整体,策略描述和分类,尽调打分表以及管理人核心人员变动和 舆情监控进行定性分析。The qualitative analysis unit is used for qualitative analysis based on the basic information of the manager of the target fund, the overall product portfolio, the description and classification of strategies, the due diligence scoring table, and the changes of the manager’s core personnel and public opinion monitoring.

进一步地,所述投中执行模块包括以下至少一个:投顾池管理单 元,投中决策审批单元,投资执行单元以及投中风控单元;Further, the investment execution module includes at least one of the following: an investment advisory pool management unit, an investment decision approval unit, an investment execution unit and an investment risk control unit;

所述投顾池管理单元,用于基于至少一个以下信息管理投顾池: 基金绩效评价信息、客户投顾池管理办法信息、投顾分析评价报告信 息、线上表决以及定级信息、策略标签的分类管理信息、定级后的对 于单一基金和单一投顾投资限制设置信息以及投资限制信息与投中、 投后的风控联动信息;The investment advisory pool management unit is configured to manage the investment advisory pool based on at least one of the following information: fund performance evaluation information, client investment advisory pool management method information, investment advisory analysis and evaluation report information, online voting and grading information, and strategy tags classified management information, information on the setting of investment restrictions for a single fund and a single investment advisor after grading, and the linkage information between investment restriction information and risk control during and after investment;

所述投中决策审批单元,用于将当前线下执行的投资指令审批决 策流程线上化;The investment decision approval unit is used to onlineize the investment order approval decision process currently executed offline;

所述投资执行单元,用于将决策审批后确定执行的交易推送至软 通或恒生等系统,有运营和交易相关部门执行;The investment execution unit is used to push the transactions determined to be executed after the decision is approved to iSoftStone or Hang Seng and other systems, and is executed by the operation and transaction-related departments;

所述投中风控单元,用于在投资决策审批流发起后,根据产品合 同、内部控制要求、投顾池定级对应的投资限制,债券评级限制等约 束条件,并结合FOF母基金最新持仓情况,校验当前投资的可行性。The investment risk control unit is used for, after the initiation of the investment decision approval process, according to the product contract, internal control requirements, investment restrictions corresponding to the rating of the investment advisory pool, bond rating restrictions and other constraints, combined with the latest position of the FOF parent fund. , to verify the feasibility of the current investment.

进一步地,further,

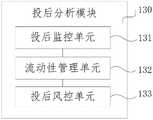

所述投后分析模块包括以下至少一个:投后监控单元、流动性管 理单元、投后风控单元;The post-investment analysis module includes at least one of the following: a post-investment monitoring unit, a liquidity management unit, and a post-investment risk control unit;

所述投后监控单元,用于根据母基金和子基金的净值和持仓信息, 进行多维度统计,得到投后监控数据;The post-investment monitoring unit is used to perform multi-dimensional statistics according to the net worth and position information of the parent fund and the sub-fund to obtain post-investment monitoring data;

所述流动性管理单元,用于根据固收和产品对于资产和负债两端 的规模,收益,期限信息进行统计,得到流动性管理数据;The liquidity management unit is used to perform statistics on the scale, income, and term information of both ends of assets and liabilities according to fixed income and products to obtain liquidity management data;

所述投后风控单元,用于根据最新估值表信息,结合产品投资限 制、投顾池限制信息进行投后风控;对于有投后跟踪要求的子基金的 投后收益和回撤指标进行持续跟踪和报警。The post-investment risk control unit is used for post-investment risk control based on the latest valuation table information and in combination with product investment restrictions and investment advisory pool restrictions; post-investment returns and drawdown indicators for sub-funds that have post-investment tracking requirements Continuous tracking and alarming.

进一步地,还包括:报表管理模块,用于为所述投前研究模块、 投中执行模块和投后分析模块提供报表;所述报表包括投顾尽调报告 模板、定期报告模板、投研信息展示报告以及基于所述投前研究模块、 所述投中执行模块以及所述投后分析模块的灵活报告模板。Further, it also includes: a report management module, which is used to provide a report for the pre-investment research module, the investment execution module and the post-investment analysis module; the report includes an investment due diligence report template, a regular report template, and investment research information. Display reports and flexible report templates based on the pre-money research module, the mid-money execution module, and the post-money analysis module.

进一步地,还包括:系统管理模块,用于项目设置管理、账户结 构管理、资金号设置管理、部门设置管理、人员设置管理,权限管理。Further, it also includes: a system management module, which is used for project setting management, account structure management, fund number setting management, department setting management, personnel setting management, and authority management.

另一方面,本发明提供一种基金投资数据管理方法,应用于上述 的基金投资数据管理系统,包括:On the other hand, the present invention provides a kind of fund investment data management method, which is applied to the above-mentioned fund investment data management system, including:

基于投资数据对基金进行分析得到投资参考结果;Analyze the fund based on investment data to obtain investment reference results;

基于所述投资参考结果以及用户的投资选择进行基金的投资交 易;Based on the investment reference results and the user's investment choice, the investment transaction of the fund is carried out;

获取用户当前投资交易的基金信息并生成对应的投后分析报告。Obtain the fund information of the user's current investment transactions and generate the corresponding post-investment analysis report.

进一步地,所述基于投资数据对基金进行分析得到投资参考结果 包括:Further, the fund is analyzed based on the investment data to obtain the investment reference result including:

将所述因子库中的目标基金的数据提取到关注池,生成模拟基金 的模拟组合;Extract the data of the target fund in the factor library into the attention pool to generate a simulated portfolio of simulated funds;

根据所述模拟组合以及因子库确定收益指标;Determine the return index according to the simulated combination and the factor library;

基于所述收益指标筛选基金;Screening funds based on said return metrics;

其中,所述因子库是在整合目标基金的多种数据来源或类型的投 资数据成预设结构后;所述投资数据包括客户数据中心的投前数据、 外部供应商的采购数据以及人工导入的数据;金工模型基于所述预设 结构的投资数据生成的。Wherein, the factor database is after integrating various data sources or types of investment data of the target fund into a preset structure; the investment data includes the pre-investment data of the customer data center, the procurement data of external suppliers, and the manually imported data. data; the metalworking model is generated based on the investment data of the preset structure.

进一步地,所述基于投资数据对基金进行分析得到投资参考结果 包括:Further, the fund is analyzed based on the investment data to obtain the investment reference result including:

根据宏观经济数据确定当前经济基本面和金融市场状态;Determine current economic fundamentals and financial market conditions based on macroeconomic data;

在预设大类资产的配置设置信息和约束下确定大类资产或策略 配置建议信息;Determine the asset class or strategy configuration suggestion information under the preset configuration setting information and constraints of the asset class;

所述大类资产或策略配置建议信息包括风险评价信息、马克维茨 资产配置模型以及BL资产配置模型。The information on asset allocation or strategy allocation advice of the major categories includes risk assessment information, Markowitz asset allocation model and BL asset allocation model.

进一步地,所述基于投资数据对基金进行分析得到投资参考结果 包括:Further, the fund is analyzed based on the investment data to obtain the investment reference result including:

根据至少一个以下信息调用客户自主开发的模型进行净值分析: 基金净值进行风险收益特征的评价信息,常见风险收益指标的计算信 息,基于净值数据风险暴露信息,多基金的横向对比分析信息,同类 基金业绩排名信息;或Call the client's self-developed model for net worth analysis based on at least one of the following information: Fund net worth evaluation information about risk-return characteristics, calculation information of common risk-return indicators, risk exposure information based on net worth data, horizontal comparative analysis information of multiple funds, similar funds performance ranking information; or

根据至少一个以下信息通过多基金横向对比或调用客户自主开 发的模型进行持仓分析:基金持仓信息对目标基金进行分析评价信息、 行业分布信息、策略分布信息、风险暴露等计算信息、业绩归因信息、 风格分析信息以及持仓债券信用分析信息;或Carry out position analysis through horizontal comparison of multiple funds or invoking models independently developed by clients according to at least one of the following information: fund position information to analyze and evaluate target funds, industry distribution information, strategy distribution information, risk exposure and other calculation information, performance attribution information , style analysis information, and position bond credit analysis information; or

根据至少一个以下信息进行定性分析:目标基金的管理人基本信 息、旗下产品整体信息、策略描述和分类信息、尽调打分表信息以及 管理人核心人员变动信息和舆情监控信息。进一步地,所述基于所述 投资参考结果以及用户的投资选择进行基金的投资交易包括:Qualitative analysis is carried out based on at least one of the following information: the basic information of the manager of the target fund, the overall information of its products, strategy description and classification information, due diligence scoring table information, and information on changes in core managers and public opinion monitoring information. Further, the investment transaction of the fund based on the investment reference result and the user's investment selection includes:

基于至少一个以下信息管理投顾池:基金绩效评价信息、客户投 顾池管理办法信息、投顾分析评价报告信息、线上表决以及定级信息、 策略标签的分类管理信息、定级后的对于单一基金和单一投顾投资限 制设置信息以及投资限制信息与投中、投后的风控联动信息;Manage investment advisory pools based on at least one of the following information: fund performance evaluation information, client investment advisory pool management method information, investment advisory analysis and evaluation report information, online voting and rating information, classified management information of strategy tags, Information on the setting of investment restrictions for a single fund and a single investment advisor, and the linkage information between investment restriction information and risk control during and after investment;

所述投中决策审批单元,用于线上执行投资指令审批决策流程;The investment decision approval unit is used for online execution of the investment order approval decision process;

所述投资执行单元,用于将决策审批后确定执行的交易推送至交 易执行部门;The investment execution unit is used to push the transaction determined to be executed after the decision is approved to the transaction execution department;

所述投中风控单元,用于在投资决策审批流发起后,根据预设约 束条件,结合FOF母基金最新持仓情况,校验当前投资的可行性; 所述预设约束条件包括以下一种或多种:产品合同、内部控制要求、 投顾池定级对应的投资限制信息、债券评级限制。The investment risk control unit is used to verify the feasibility of the current investment according to the preset constraints and the latest position of the FOF parent fund after the investment decision approval flow is initiated; the preset constraints include one of the following or Various: product contracts, internal control requirements, investment restriction information corresponding to the rating of the investment advisory pool, bond rating restrictions.

进一步地,所述获取用户当前投资交易的基金信息并生成对应的 投后分析报告包括:Further, described obtaining the fund information of the user's current investment transaction and generating the corresponding post-investment analysis report includes:

根据母基金和子基金的净值和持仓信息,进行多维度统计,得到 投后监控数据;According to the net value and position information of the parent fund and sub-fund, conduct multi-dimensional statistics to obtain post-investment monitoring data;

根据固收和产品对于资产和负债两端的规模,收益,期限信息进 行统计,得到流动性管理数据;According to the fixed income and products, the scale, income and term information of both assets and liabilities are counted to obtain liquidity management data;

根据最新估值表信息,结合产品投资限制、投顾池限制信息进行 投后风控;对于有投后跟踪要求的子基金的投后收益和回撤指标进行 持续跟踪和报警。According to the latest valuation table information, combined with product investment restrictions and investment advisory pool restrictions, post-investment risk control is carried out; the post-investment returns and drawdown indicators of sub-funds with post-investment tracking requirements are continuously tracked and alarmed.

本发明提供的一种基金投资数据管理系统及方法,通过设置投前 研究模块、投中执行模块以及投后分析模块,投前研究模块基于投资 数据对基金进行分析得到投资参考结果;投中执行模块基于所述投资 参考结果以及用户的投资选择进行基金的投资交易;投后分析模块获 取用户当前投资交易的基金信息并生成对应的投后分析报告,能够对 投前、投中、投后进行全面的集成管理,方便用户对信息的获取的同 时,协助用户进行投资分析管理。The invention provides a fund investment data management system and method. By setting a pre-investment research module, a mid-investment execution module and a post-investment analysis module, the pre-investment research module analyzes the fund based on the investment data to obtain investment reference results; The module conducts fund investment transactions based on the investment reference results and the user's investment choices; the post-investment analysis module obtains the fund information of the user's current investment transactions and generates a corresponding post-investment analysis report, which can conduct pre-investment, mid-investment and post-investment analysis. Comprehensive integrated management facilitates users to obtain information while assisting users in investment analysis and management.

附图说明Description of drawings

为了更清楚地说明本发明或现有技术中的技术方案,下面将对实 施例或现有技术描述中所需要使用的附图作一简单地介绍,显而易见 地,下面描述中的附图是本发明的一些实施例,对于本领域普通技术 人员来讲,在不付出创造性劳动的前提下,还可以根据这些附图获得 其他的附图。In order to explain the present invention or the technical solutions in the prior art more clearly, the following will briefly introduce the accompanying drawings that need to be used in the description of the embodiments or the prior art. Obviously, the accompanying drawings in the following description are the For some embodiments of the invention, for those of ordinary skill in the art, other drawings can also be obtained according to these drawings without any creative effort.

图1为本发明实施例提供一种基金投资数据管理系统的组成结 构示意图;1 is a schematic diagram of the composition of a fund investment data management system according to an embodiment of the present invention;

图2为本发明实施例提供一种基金投资数据管理系统的拓展组 成结构示意图;2 is a schematic diagram of an expanded composition structure of a fund investment data management system according to an embodiment of the present invention;

图3为本发明实施例提供一种基金投资数据管理系统的投前研 究模块组成结构示意图;3 is a schematic structural diagram of a pre-investment research module of a fund investment data management system according to an embodiment of the present invention;

图4为本发明实施例提供一种基金投资数据管理系统的投中执 行模块组成结构示意图;4 is a schematic diagram of the composition structure of the investment execution module of a fund investment data management system according to an embodiment of the present invention;

图5为本发明实施例提供一种基金投资数据管理系统的投中执 行模块组成结构示意图;5 is a schematic diagram of the composition structure of the investment execution module of a fund investment data management system according to an embodiment of the present invention;

图6为本发明实施例提供一种基金投资数据管理系统的又一拓 展组成结构示意图;6 is a schematic structural diagram of another expansion of a fund investment data management system provided by an embodiment of the present invention;

图7为本发明实施例提供的一种基金投资数据管理系统的实践 示意图之一;Fig. 7 is one of the practice schematic diagrams of a kind of fund investment data management system provided by the embodiment of the present invention;

图8为本发明实施例提供的一种基金投资数据管理系统的实践 示意图之二;Fig. 8 is the second practical schematic diagram of a fund investment data management system provided by an embodiment of the present invention;

图9为本发明实施例提供的一种基金投资数据管理方法的流程 图。FIG. 9 is a flowchart of a method for managing fund investment data according to an embodiment of the present invention.

具体实施方式Detailed ways

为使本发明的目的、技术方案和优点更加清楚,下面将结合本发 明中的附图,对本发明中的技术方案进行清楚、完整地描述,显然, 所描述的实施例是本发明一部分实施例,而不是全部的实施例。基于 本发明中的实施例,本领域普通技术人员在没有作出创造性劳动前提 下所获得的所有其他实施例,都属于本发明保护的范围。In order to make the objectives, technical solutions and advantages of the present invention clearer, the technical solutions in the present invention will be clearly and completely described below with reference to the accompanying drawings. Obviously, the described embodiments are part of the embodiments of the present invention. , not all examples. Based on the embodiments of the present invention, all other embodiments obtained by those of ordinary skill in the art without creative efforts shall fall within the protection scope of the present invention.

下面结合图1-图6描述本发明的基金投资数据管理系统。The following describes the fund investment data management system of the present invention with reference to FIG. 1 to FIG. 6 .

图1为本发明实施例提供一种基金投资数据管理系统的组成结 构示意图;图2为本发明实施例提供一种基金投资数据管理系统的拓 展组成结构示意图;图3为本发明实施例提供一种基金投资数据管理 系统的投前研究模块组成结构示意图;图4为本发明实施例提供一种 基金投资数据管理系统的投中执行模块组成结构示意图;图5为本发 明实施例提供一种基金投资数据管理系统的投中执行模块组成结构 示意图;图6为本发明实施例提供一种基金投资数据管理系统的又一 拓展组成结构示意图。FIG. 1 is a schematic diagram of the composition structure of a fund investment data management system provided by an embodiment of the present invention; FIG. 2 is a schematic diagram of an expanded composition structure of a fund investment data management system provided by an embodiment of the present invention; FIG. 3 is an embodiment of the present invention. Fig. 4 is a schematic diagram of the composition structure of a pre-investment research module of a fund investment data management system; Fig. 4 is a schematic diagram of the composition structure of an investment execution module of a fund investment data management system according to an embodiment of the present invention; Fig. 5 is a fund investment data management system according to an embodiment of the present invention. A schematic diagram of the composition structure of the investment execution module of the investment data management system; FIG. 6 is a schematic diagram of another expanded composition structure of a fund investment data management system according to an embodiment of the present invention.

在本发明一种具体实施方式中,本发明实施例提供一种基金投资 数据管理系统100,包括:In a specific implementation of the present invention, an embodiment of the present invention provides a fund investment

投前研究模块110,用于基于投资数据对基金进行分析得到投资 参考结果;The

投中执行模块120,用于基于所述投资参考结果以及用户的投资 选择进行基金的投资交易;The

投后分析模块130,用于获取用户当前投资交易的基金信息并生 成对应的投后分析报告。The

本发明实施例中实现FOF(基金中的基金,Fund of Funds)投资 流程,也就是投前、投中、投后的完整管理和信息处理,实现对FOF 业务的过程管理,具体地:围绕FOF投资流程,构建一套科学、系 统、规范、高效的FOF业务的基金投资数据管理系统,实现FOF基 金的全周期管理,快速实现对FOF业务的支持,助力业务创新与发 展。In the embodiment of the present invention, the FOF (Fund of Funds, Fund of Funds) investment process is realized, that is, the complete management and information processing before, during and after the investment, and the process management of the FOF business is realized, specifically: around the FOF Investment process, build a scientific, systematic, standardized and efficient fund investment data management system for FOF business, realize full-cycle management of FOF funds, quickly realize support for FOF business, and facilitate business innovation and development.

具体地,基金投资数据管理系统100还包括:数据整合模块140、 金工模型150;所述数据整合模块140,用于整合目标基金的多种数 据来源或类型的投资数据成预设结构;所述投资数据包括客户数据中 心的投前数据、外部供应商的采购数据以及人工导入的数据;所述金 工模型,用于基于所述预设结构的投资数据生成所述目标基金的因子 库。Specifically, the fund investment

实践中,数据整合模块140不仅可以使用本地的数据,也可以使 用第三方机构提供的数据,这时多种来源的数据可能存在数据结构不 相同的情况,因此,可以将这些数据进行筛选,提取出本基金投资数 据管理系统100需要的预设数据结构的数据,便于进行后续的数据使 用。并且可以使用金工模型150(也就是金融工程模型)对获取到的 数据进行加工,从而得到因子库数据,例如可以根据基金的历史数据 来计算得到红利、低波、价值、成长、质量和高贝塔等单因子,当然 也可以是多因子组合例如红利低波、质量价值等多因子组合,整合多 种数据来源和类型的数据:包括但不限于客户数据中心投前数据,外 部供应商采购数据,人工导入的数据等,将整合后的数据输入至金工 模型150中进行处理,得到因子库数据。In practice, the

进一步地,为了实现投前研究,方便用户进行投资参考,投前研 究模块110可以包括:模拟组合单元111,用于将所述因子库中的目 标基金的数据提取到关注池,生成模拟基金的模拟组合,并根据所述 模拟组合以及因子库确定收益指标,基于所述收益指标筛选基金。对 于模拟组合的基金可以有用户自主选择,也可以自动根据用户选择的 类别自动选择具体的基金组合。Further, in order to realize pre-investment research and facilitate users to make investment reference, the

例如,在一种具体实施方式中,可以使用问卷的方式对用户的投 资偏好进行测试,在得到测试结果后,可以根据用户的投资偏好生成 相应的模拟基金的组合。For example, in a specific embodiment, the user's investment preference can be tested by means of a questionnaire, and after the test result is obtained, a corresponding simulated fund combination can be generated according to the user's investment preference.

进一步地,所述投前研究模块110,还包括:大类资产配置单元 112,用于根据宏观经济数据确定当前经济基本面和金融市场状态, 在预设大类资产的配置设置信息和约束下确定大类资产或策略配置 建议信息;所述大类资产或策略配置建议信息包括风险评价信息、马 克维茨资产配置模型以及BL资产配置模型。BL资产配置模型,也 就是Black-Litterman模型,是基于MPT(Modern Portfolio Theory, 现代投资组合理论)基础上的资产配置理论。BL模型在隐含市场收 益率和分析师主观预测信息的基础上,成功解决了MPT模型中假设 条件不成立,参数敏感等问题。Further, the

大类资产配置是大格局、大方向,科学的资产配置来管理大资金, 是既稳当,回报又高的一个方法。Large-scale asset allocation is a big pattern and direction. Scientific asset allocation to manage large funds is a method that is stable and returns high.

资产配置与时机选择的关系问题,这块主要是指股票。美国和中 国几乎所有的基金投资者其资本加权收益率都低于基金的时间加权 收益率(基金净值),主要就是因为基金投资者进行择时操作,频繁 申购和赎回,不停地再给自己创造负回报。The relationship between asset allocation and timing, which mainly refers to stocks. The capital-weighted rate of return of almost all fund investors in the United States and China is lower than the time-weighted rate of return of the fund (fund net worth), mainly because fund investors conduct timing operations, frequently subscribe and redeem, and keep giving Create negative returns yourself.

长期资金的大类资产配置理念有四个,股权偏好、价值导向、实 质分散、逆向投资。股权偏好:长期看,基金投资回报最出色,长期 资金应该主要配置股权资产,这就是股权偏好。价值导向:我们做配 置就是要判断未来两三年或者三五年各类资产的价值中枢,围绕价值 中枢来动态配置资产。实质分散:实质分散主要是避开基金之间的相 关度。逆向投资:最好的投资机会来临的时候,是人们最悲观的时候, 人们对市场看空的程度达到顶峰。There are four major asset allocation concepts for long-term funds: equity preference, value orientation, substantial dispersion, and contrarian investment. Equity preference: From a long-term perspective, fund investment returns are the best, and long-term funds should mainly allocate equity assets, which is equity preference. Value orientation: Our allocation is to judge the value center of various assets in the next two to three years or three to five years, and dynamically allocate assets around the value center. Substantial diversification: Substantial diversification mainly avoids correlations between funds. Contrarian Investing: When the best investment opportunities come, people are at their most pessimistic and their bearishness on the market peaks.

马克维茨资产配置模型理论依据以下几个假设:The Markowitz asset allocation model theory is based on the following assumptions:

1、投资者在考虑每一次投资选择时,其依据是某一持仓时间内 的证券收益的概率分布;1. When investors consider each investment choice, the basis is the probability distribution of securities returns within a certain position;

2、投资者是根据证券的期望收益率估测证券组合的风险;2. Investors estimate the risk of a portfolio of securities based on the expected rate of return of the securities;

3、投资者的决定仅仅是依据证券的风险和收益;3. Investors' decisions are based solely on the risks and benefits of securities;

4、在一定的风险水平上,投资者期望收益最大;相对应的是在 一定的收益水平上,投资者希望风险最小。4. At a certain level of risk, investors expect the maximum return; correspondingly, at a certain level of return, investors want the least risk.

根据以上假设,马科维茨资产配置确立了证券组合预期收益、风 险的计算方法和有效边界理论。建立了资产优化配置的均值-方差模 型:目标函数:minб2(rp)=∑∑xixjCov(ri-rj);Based on the above assumptions, Markowitz's asset allocation establishes the calculation method and efficient frontier theory for the expected return and risk of the portfolio. The mean-variance model of optimal asset allocation is established: objective function: minб2(rp)=∑∑xixjCov(ri-rj);

rp=∑xiri;rp=∑xiri;

限制条件:1=∑Xi(允许卖空);Constraints: 1=∑Xi (short selling allowed);

或1=∑Xi xi>≥0(不允许卖空);Or 1=∑Xi xi>≥0 (short selling is not allowed);

其中,rp为组合收益,ri为第i只股票的收益,xi、xj为证券i、j的投资比例,б2(rp)为组合投资方差(组合总风险),Cov(ri、rj)为 两个证券之间的协方差。该模型为现代证券投资理论奠定了基础。上 式表明,在限制条件下求解Xi证券收益率使组合风险б2(rp)最小, 可通过朗格朗日目标函数求得。Among them, rp is the portfolio return, ri is the return of the ith stock, xi and xj are the investment ratios of securities i and j, б2(rp) is the portfolio investment variance (total portfolio risk), and Cov(ri, rj) is the two covariance between securities. This model lays the foundation for modern portfolio investment theory. The above formula shows that the portfolio risk б2(rp) can be minimized by solving the return of Xi securities under restricted conditions, which can be obtained by the Langrangian objective function.

当然,也可以使用BL资产配置模型进行资产配置, Black-litterman模型=马可威茨均值方差模型+投资者的观点(情 绪)换一句更简单的话来说:Of course, you can also use the BL asset allocation model for asset allocation, Black-litterman model = Markowitz mean variance model + investor's point of view (sentiment) In simpler words:

Y资产的收益=(历史上它的均衡收益+投资者对它预期)的 加权平均;Return of Y asset = (historically its equilibrium return + investor's expectation of it) weighted average;

BL模型特别强调的概念是加权,如果市场飞涨,投资者狂热, 自然投资者主观的预期将占有更大的权重。那么如何衡量这个权重, 就是BL模型机智的地方了。The concept that the BL model particularly emphasizes is weighting. If the market is soaring and investors are frenzied, the subjective expectations of natural investors will have a greater weight. So how to measure this weight is where the BL model is witty.

BL模型基本框架涵盖了以下几个参数:The basic framework of the BL model covers the following parameters:

投资者的主观观点P+初始市值权重W+市场均衡收益N= 投资者期望收益E(r);Investor's subjective opinion P+ initial market value weight W+ market equilibrium return N= investor's expected return E(r);

投资者期望收益E(r)+马科维兹均值方差M=BL模型;Investor's expected return E(r) + Markowitz mean variance M = BL model;

以及:计算最优权重的公式W1=风险厌恶系数+资产的协方 差矩阵+期望收益率;(以上的+不是加减乘除的+,是参数叠加, 仅提供直观感受)。And: the formula for calculating the optimal weight W1 = risk aversion coefficient + covariance matrix of assets + expected return; (the above + is not the + of addition, subtraction, multiplication and division, but the superposition of parameters, which only provides an intuitive feeling).

进一步地,所述投前研究模块110,还包括以下至少一个:净值 分析单元113、持仓分析单元114以及定性分析单元115;Further, the

所述净值分析单元113,用于根据至少一个以下信息调用客户自 主开发的模型进行净值分析:基金净值进行风险收益特征的评价信息, 常见风险收益指标的计算信息,基于净值数据风险暴露信息,多基金 的横向对比分析信息,同类基金业绩排名信息;The net

所述持仓分析单元114,用于根据至少一个以下信息通过多基金 横向对比或调用客户自主开发的模型进行持仓分析:基金持仓信息对 目标基金进行分析评价信息、行业分布信息、策略分布信息、风险暴 露等计算信息、业绩归因信息、风格分析信息以及持仓债券信用分析 信息;The

所述定性分析单元115,用于基于目标基金的管理人基本信息, 旗下产品整体,策略描述和分类,尽调打分表以及管理人核心人员变 动和舆情监控进行定性分析。The

具体地,净值分析单元113根据基金净值进行风险收益特征的评 价,常见风险收益指标的计算,基于净值数据风险暴露,多基金的横 向对比分析,同类基金业绩排名,调用客户自主开发的模型进行净值 分析。例如,可以对目标基金的盘中成交及日清算结果计算及展示、 实时行情推送,并且将基金净值实时计算并且显示;Specifically, the net

而持仓分析单元114,根据基金持仓进行分析评价,行业分布、 策略分布、风险暴露等计算,业绩归因,风格分析,持仓债券信用分 析,多基金横向对比,调用客户自主开发的模型进行持仓分析。例如, 在一种实施例中可以使用目标基金在不同模型上的持仓分析结果,得 到不同风格上的暴露,以及不用风格因子对于基金的收益、风险贡献 情况,以下举例。具体可以使用以下模型:The

夏普模型:夏普风格因子模型是通过净值模拟处基金的投资风格, 基金投资风格是指基金资产在不同标的资产间进行配置的投资策略 或者计划。它本质上是一种有约束的线性模型,通过相关市场指数(代 表各类投资风格)的加权组合来复制出投资组合历史收益的基本模式 (模拟仓位)。模型中的加权系数被称为“夏普风格权重”,它的大小 在一定程度上表示不同风格因子对资产组合收益的解释程度。Sharpe model: The Sharpe style factor model simulates the investment style of the fund through net worth. The fund investment style refers to the investment strategy or plan in which the fund assets are allocated among different underlying assets. It is essentially a constrained linear model that replicates the basic pattern (simulated positions) of historical portfolio returns through weighted combinations of relevant market indices (representing various investment styles). The weighting coefficients in the model are called "Sharpe style weights", and their magnitudes represent, to a certain extent, the extent to which different style factors explain the returns of the portfolio.

Chart四因子模型:多因子模型并不是一个因果关系的模型,所 谓的因子只是在统计上和收益率存在相关关系,是试图解释收益风险 的维度。由于基金持仓信息无法实时获取,通过该模型仅通过基于收 益的方法就能够对可获知净值变动的股票型基金进行较为及时的分 析,即求其对每个因子的平均风险暴露,将基金收益和风险分解为来 源于市场因子的收益、规模因子的收益、价值因子的收益、动量因子 的收益和特异因子(Alpha)的收益。Chart four-factor model: The multi-factor model is not a causal model. The so-called factors are only statistically correlated with returns, and are dimensions that try to explain return risks. Since the fund position information cannot be obtained in real time, this model can analyze the stock funds whose net value changes can be known in a timely manner only through the method based on income, that is, to find the average risk exposure of each factor, and compare the fund income and Risk is decomposed into returns from market factors, returns from scale factors, returns from value factors, returns from momentum factors and returns from specific factors (Alpha).

Fama五因子模型:多因子模型并不是一个因果关系的模型,所 谓的因子只是在统计上和收益率存在相关关系,是试图解释收益风险 的维度。由于基金持仓信息无法实时获取,通过该模型仅通过基于收 益的方法就能够对可获知净值变动的股票型基金进行较为及时的分 析,即求其对每个因子的平均风险暴露,将收益和风险分解为来源于 市场因子的收益、规模因子的收益、价值因子的收益、盈利因子的收 益、投资因子的收益和特异因子(Alpha)的收益。Fama five-factor model: The multi-factor model is not a causal model. The so-called factors are only statistically correlated with returns, and are dimensions that try to explain return risks. Since the fund position information cannot be obtained in real time, this model can analyze the stock funds whose net value changes can be known in a timely manner only through the method based on income, that is, to find the average risk exposure of each factor, and combine the return and risk. It is decomposed into returns from market factors, returns from scale factors, returns from value factors, returns from profitability factors, returns from investment factors and returns from specific factors (Alpha).

定性分析单元115可以根据基金管理人基本信息,基金管理人的 旗下产品整体、策略描述和分类,尽调打分表线上化,管理人核心人 员变动和舆情监控等信息进行基金管理人的定性分析评价。可以从基 本信息、业绩表现、综合评价三个维度对基金管理人给出总体评价的 结论,基金管理人在全市场及同策略分类下不同能力的排名,通过基 金管理人管理过的基金产品拟合基金经理综合业绩指数及分策略业 绩指数,对基金管理人过往的业绩可以进行追溯及擅长策略进行分析 比较。The

在本发明的又一具体实施方式中,所述投中执行模块120包括以 下至少一个:投顾池管理单元121,投中决策审批单元122,投资执 行单元123以及投中风控单元124。In yet another specific embodiment of the present invention, the

所述投顾池管理单元121,用于基于至少一个以下信息管理投顾 池:基金绩效评价信息、客户投顾池管理办法信息、投顾分析评价报 告信息、线上表决以及定级信息、策略标签的分类管理信息、定级后 的对于单一基金和单一投顾投资限制设置信息以及投资限制信息与 投中、投后的风控联动信息;The investment advisory

投顾,投资顾问是指专门从事于提供投资建议而获薪酬的人士, 它是投资服务中非常重要的角色。投资顾问,有广义和狭义之分。广 义的投资顾问,可以是指为金融投资、房地产投资、商品投资等各类 投资领域提供专业建议的专业人士。狭义的投资顾问,特指在证券行 业(如证券公司或专业证券投资咨询机构)为证券投资者(通常为股 民)提供专业证券投资咨询服务的人员。Investment advisor, an investment advisor is a person who specializes in providing investment advice and gets paid, and it is a very important role in investment services. There are broad and narrow senses for investment advisors. Investment consultants in a broad sense can refer to professionals who provide professional advice in various investment fields such as financial investment, real estate investment, and commodity investment. Investment consultants in a narrow sense refer to those who provide professional securities investment consulting services for securities investors (usually shareholders) in the securities industry (such as securities companies or professional securities investment consulting agencies).

所述投中决策审批单元122,用于线上执行投资指令审批决策流 程;The investment

所述投资执行单元123,用于将决策审批后确定执行的交易推送 至交易执行部门;The

所述投中风控单元124,用于在投资决策审批流发起后,根据预 设约束条件,结合FOF母基金最新持仓情况,校验当前投资的可行 性;所述预设约束条件包括以下一种或多种:产品合同、内部控制要 求、投顾池定级对应的投资限制信息、债券评级限制。The investment

具体地,投顾池管理是FOF产品管理的前提,良好、细致的投 顾池管理将为后续的资金分配打下良好的基础。投顾池可以分为三级: 跟踪级投顾池、关注级投顾池和投资级投顾池。不同级别的投顾池在 信息的粗略、优秀程度和数量等方面存在显著的不同。目前有第三方 机构提供的部分期货类私募的公开资料和业绩信息,其中信息较为完 整的部分可以纳入跟踪级投顾池。另外,期货公司现有经纪业务客户 和资产管理通道业务客户也可纳入到跟踪级投顾池的选择范围中来。Specifically, the management of the investment advisory pool is the premise of FOF product management, and good and meticulous management of the investment advisory pool will lay a good foundation for the subsequent allocation of funds. Investment advisory pools can be divided into three levels: tracking-level investment advisory pools, concern-level investment advisory pools, and investment-grade investment advisory pools. There are significant differences in the roughness, excellence and quantity of information among different levels of investment advisory pools. At present, there are some public information and performance information of futures private placements provided by third-party institutions, and the part with relatively complete information can be included in the tracking-level investment advisory pool. In addition, the existing brokerage business customers and asset management channel business customers of futures companies can also be included in the selection scope of the tracking-level investment advisory pool.

FOF产品管理人可从跟踪级投顾池中,按照较为宽松的条件,进 行初步筛选,并与筛选出的投顾联系,进行关注级尽调。通过对尽调 结果打分的方式,从中选择出100—200家投顾纳入关注级投顾池。 关注级投顾池的数据,可以用来计算分策略的策略指数,供资金的策 略配置时使用。FOF product managers can conduct preliminary screening from the tracking-level investment advisor pool according to relatively loose conditions, and contact the selected investment advisors for attention-level due diligence. By scoring the results of due diligence, 100-200 investment advisors were selected to be included in the attention-level investment advisor pool. The data of the attention-level investment advisory pool can be used to calculate the strategy index of the sub-strategy, which is used for the strategy allocation of funds.

投中决策审批单元122将当前线下执行的投资指令审批决策流 程线上化。解决投中决策线上化,提高投中执行的效率,具体地,可 以将当要投资的基金组合推送到审批决策者,待审批决策者查看各种 相关文件,确定可以进行投资后,发出投资确认指令。The investment decision-

投资执行单元123在接收到投资确认指令后,进行具体的基金的 买卖交易,具体地,可以与资管产品流程等交易系统进行对接。将决 策审批后确定执行的交易推送至软通或恒生等系统,由运营和交易相 关部门执行,解决投资研究决策的结果与交易打通,形成业务闭环。After receiving the investment confirmation instruction, the

投中风控单元124在投资决策审批流发起后,根据产品合同,内 部控制要求,投顾池定级对应的投资限制,债券评级限制等约束条件, 结合FOF母基金最新持仓情况,自动校验该笔投资的可行性。解决 交易下单和存续过程中的风险控制,提前预知风险,及时处置。具体 地,风控尽调的事前筛选是有必要和有效的。毕竟子基金风控预案的 执行者还是要由投顾来具体执行。通过在尽调环境就排除掉这些高风 险的投顾和产品,可以在很大程度上降低监督的难度和提高风控预案 的执行能力,达成以现有技术条件为基础,内容包括清盘线和预警线、 杠杆控制和品种控制等风控手段的风控预案,以大概率保证产品的正 常运作。After the investment decision approval flow is initiated, the investment

在上述实施例的基础上,本实施例中投后分析模块130包括以下 至少一个:投后监控单元131、流动性管理单元132、投后风控单元 133;On the basis of the above-mentioned embodiment, in this embodiment, the

所述投后监控单元131,用于根据母基金和子基金的净值和持仓 信息,进行多维度统计,为投后业绩分析,风险评估提供支持;The

所述流动性管理单元132,用于根据固收和产品对于资产和负债 两端的规模,收益,期限等信息进行统计,为营销和投资决策提供数 据支持;The

所述投后风控单元133,用于根据最新估值表信息,结合产品投 资限制;投顾池限制等约束进行事后风控;对于部分有投后跟踪要求 的子基金的投后收益和回撤等指标进行持续跟踪和报警。The post-investment

在交易后,可以对交易的目标基金进行投后监控,具体地,投后 监控单元131根据母基金和子基金的净值和持仓信息,进行多维度统 计,为投后业绩分析,风险评估提供支持。具体地,可以进行业绩预 警:涵盖业绩大幅下跌、业绩连续下跌、净值跌破预警线、净值跌破 平仓线等风险事件;还可以进行持仓股票预警:涵盖股票ST、股票 退市、业绩预警、股权质押、股权冻结、股东减持、连续下跌、剔除 指数、分析师评级下调等风险事件;或者进行持仓债券预警:涵盖债 券兑付风险警示、主体评级下调、债项评价下调、评级展望下调、担保人评级下调、估值收益率大幅上行、成交价大幅偏离估值、债券违 约等风险事件;当然,还可以进行其他的预警,例如异常机构、失联 机构等私募机构预警、基金经理发生变动、黑名单、组合中子基金权 重超过阈值等风险事件;对于预警的提醒方式,可以支持系统消息、短信、邮件等多种多样的提醒方式提醒,具体可以根据预警的等级的 不同而设置相应的提醒方式。针对组合或产品进行风险监控,支持风 控指标设置、阈值设置、自定义风控指标,支持穿透式风险监控,涵 盖组合或产品持仓股票、债券、期货等大类资产风险监控。支持系统 消息、短信、邮件等多种方式预警提醒。After the transaction, post-investment monitoring can be performed on the target fund of the transaction. Specifically, the

流动性管理单元132根据固收和产品对于资产和负债两端的规 模,收益,期限等信息进行统计,为营销和投资决策提供数据支持, 解决投资与负债两端资产约束情况,便于后续的风险控制与投资决策。The

投后风控单元133根据最新估值表信息,结合产品投资限制。投 顾池限制等约束进行事后风控。对于部分有投后跟踪要求的子基金的 投后收益和回撤等指标进行持续跟踪和报警,解决投后风险实时跟踪。The post-investment

具体地,为了进行风险控制,可以设定相应的风险制度,检测投 资风险,监管交易员严格止损执行交易计划。Specifically, in order to carry out risk control, a corresponding risk system can be set to detect investment risks and supervise traders to strictly stop losses and execute trading plans.

具体的基金风控的措施如下:The specific fund risk control measures are as follows:

1、机制风控。参与新基投资,往往会有三个月的封闭期,这样, 也就为开放式基金的净值增长提供了一定的封闭运行周期,也为投资 者获得净值增长的机会,创造了条件;1. Mechanism of risk control. Participating in Celgene investment, there is often a three-month closed period, which provides a certain closed operation cycle for the net value growth of open-end funds, and also creates conditions for investors to obtain opportunities for net value growth;

2、目标风控。即投资者选择基金产品,要坚持不达目标不罢休 的投资思想。尤其是要按照自身设定的投资目标,选择合适的基金产 品类型;2. Target risk control. That is, when investors choose fund products, they must adhere to the investment philosophy of never giving up until their goals are achieved. In particular, it is necessary to select the appropriate fund product type according to the investment objectives set by oneself;

3、补仓风控。对于基本面良好的基金产品,投资者可以利用震 荡行情下,基金产品净值下跌的有利时机,选择低成本补仓的机会, 从而起到摊低购基成本的作用;3. Replenishment risk control. For fund products with good fundamentals, investors can take advantage of the favorable opportunity when the net value of fund products falls under volatile market conditions, and choose the opportunity to cover short positions at low cost, thus playing a role in amortizing the cost of purchasing the fund;

4、理念风控。即投资者投资基金产品,需要坚持长期投资、分 散投资、价值投资和理性投资,贯彻“不把鸡蛋放在同一个篮子里” 的理财思想,将闲置资金在银行(行情专区)存款、保险(行情专 区)及资本市场之间进行分配,控制股票型基金产品投资比例,选择 属于自己的激进型、稳健型及保守型基金产品组合;4. Conceptual risk control. That is, investors investing in fund products need to adhere to long-term investment, diversified investment, value investment and rational investment, implement the financial management idea of "don't put eggs in the same basket", and deposit idle funds in banks (markets area), insurance ( Allocation between the market area) and the capital market, control the investment ratio of stock fund products, and choose their own aggressive, stable and conservative fund product portfolios;

5、定投风控。即通过采取运用固定渠道、运用固定资金、选择 固定时间,进行固定基金产品的投资模式,起到熨平证券市场波动, 降低基金产品投资风险的作用;5. Set investment risk control. That is, by using fixed channels, using fixed funds, and choosing a fixed time to invest in fixed fund products, it plays a role in smoothing the volatility of the securities market and reducing the investment risk of fund products;

6、周期风控。即投资者遵循不同类型基金产品投资运作规律基 础上进行风控:货币市场基金主要投资于一年期货币市场工具,免申 购赎回费,具有较强的流动性;债券型基金与货币政策调整有一定的 关系;股票型基金与经济周期密不可分;QDII基金产品需要考虑投 资国经济,尤其是汇率波动;分级基金产品需要把握基金产品的净值 与价格波动价差套利。6. Periodic risk control. That is, investors follow the investment operation rules of different types of fund products to carry out risk control: money market funds mainly invest in one-year money market instruments, free of subscription and redemption fees, and have strong liquidity; bond funds and monetary policy adjustments There is a certain relationship; stock funds are inseparable from the economic cycle; QDII fund products need to consider the investment country's economy, especially exchange rate fluctuations; tiered fund products need to grasp the net value of fund products and price fluctuations and spread arbitrage.

在上述实施例的基础上,本实施例中,基金投资数据管理系统 100包括:报表管理模块160,用于为所述投前研究模块110、投中 执行模块120和投后分析模块130提供报表;所述报表包括投顾尽调 报告模板、定期报告模板、投研信息展示报告以及基于所述投前研究 模块、所述投中执行模块以及所述投后分析模块的灵活报告模板。也 就是说以上的各个单元、模块中的数据分析结果都可以通过报告的形 式供用户进行下载和阅读,从而方便进行数据管理和存档。On the basis of the above embodiment, in this embodiment, the fund investment

另外,还可以在基金投资数据管理系统100中设置系统管理模块 170,用于项目设置管理、账户结构、资金号设置管理、部门设置管 理、人员设置管理,权限管理。也就是说,还可以对基金投资数据管 理系统100中的用户、项目进行管理,例如,可以新建项目、可以设 置项目的参数,并且设置账户结构,例如账户是可以父子结构的,父 账户可以查看和调用子账户,可以设置付款的银行卡号,添加资金账 号的付款顺序等,当然后也可以以部门为单位进行人员的管理,对部 门做设置,对具体的人也可以设置权限,例如,还可以设置各种主题 样式供用户选择。In addition, a

请参考图7、图8,图7为本发明实施例提供的一种基金投资数 据管理系统的实践示意图之一;图8为本发明实施例提供的一种基金 投资数据管理系统的实践示意图之二。Please refer to FIG. 7 and FIG. 8 . FIG. 7 is a schematic diagram of a practice of a fund investment data management system provided by an embodiment of the present invention; FIG. 8 is a schematic diagram of a practice of a fund investment data management system provided by an embodiment of the present invention. two.

如图7所示,在本发明实施例中,具体地,该基金投资数据管理 系统为投资管理-FoF平台,在该平台上,可以使用本地数据也可以 使用第三方数据,第三方数据可以来自于第三方投研机构的投研报告, 也可以来自于外部的交易渠道,还可以来自于基金委托机构,由于这 些不同来源的数据的结构不尽相同,因此可以使用数据模型将这些数 据结构统一为本平台可以使用的预设数据结构,然后使用金工模型 (也就是金融工程模型)对这些数据进行处理,得到各种后续使用到 的因子库。As shown in FIG. 7 , in the embodiment of the present invention, specifically, the fund investment data management system is an investment management-FoF platform, on which local data or third-party data can be used, and the third-party data can be obtained from Investment research reports for third-party investment and research institutions can also come from external trading channels or fund entrusting institutions. Since the data structures of these different sources are different, data models can be used to unify these data structures. The preset data structure that can be used by this platform is used, and then the metalworking model (that is, the financial engineering model) is used to process these data to obtain various factor libraries for subsequent use.

具体地,投前可以进行产品服务、策略管理、组合管理,投中可 以进行交易服务、头寸管理、风险管理,而投后可以进行当前已经购 置的基金的投后分析和各种报告的管理,并且本地的数据还可以在客 户端进行本地应用的扩展。Specifically, product services, strategy management, and portfolio management can be carried out before investment, transaction services, position management, and risk management can be carried out during investment, and post-investment analysis of currently purchased funds and management of various reports can be carried out after investment. And local data can also be extended to local applications on the client side.

如图8所示,还可以利用估值系统中的净值信息和持仓信息对目 标基金进行数据分析,并且数据建模后进行投前研究、组合管理、投 中执行、投后分析等。而且用户还可以利用本平台得到关于投资的咨 询信息、FICC信用评价信息、以及报告工厂产生的各种基金的报告。 当然,这些是在计算引擎、流程引擎以及IMS(投资管理系统, Investmentmanagement)的硬件和软件基础上运行的。As shown in Figure 8, it is also possible to use the net worth information and position information in the valuation system to conduct data analysis on the target fund, and conduct pre-investment research, portfolio management, investment execution, and post-investment analysis after data modeling. Moreover, users can also use this platform to obtain consulting information about investment, FICC credit evaluation information, and reports on various funds generated by the reporting factory. Of course, these run on the hardware and software basis of the computing engine, the process engine and the IMS (Investment Management System).

下面对本发明提供的基金投资数据管理方法进行描述,下文描述 的基金投资数据管理方法与上文描述的基金投资数据管理系统可相 互对应参照。The fund investment data management method provided by the present invention is described below, and the fund investment data management method described below and the fund investment data management system described above can be referred to each other correspondingly.

请参考图9,图9为本发明实施例提供的一种基金投资数据管理 方法的流程图。Please refer to FIG. 9, which is a flowchart of a method for managing fund investment data according to an embodiment of the present invention.

在本发明又一实施例中,本发明提供一种基金投资数据管理方法, 应用于上述的基金投资数据管理系统,包括:In another embodiment of the present invention, the present invention provides a fund investment data management method, which is applied to the above-mentioned fund investment data management system, including:

步骤910:基于投资数据对基金进行分析得到投资参考结果;Step 910: analyze the fund based on the investment data to obtain an investment reference result;

步骤920:基于所述投资参考结果以及用户的投资选择进行基金 的投资交易;Step 920: carry out the investment transaction of the fund based on the investment reference result and the user's investment selection;

步骤930:获取用户当前投资交易的基金信息并生成对应的投后 分析报告。Step 930: Obtain the fund information of the user's current investment transaction and generate a corresponding post-investment analysis report.

进一步地,所述基于投资数据对基金进行分析得到投资参考结果 包括:Further, the fund is analyzed based on the investment data to obtain the investment reference result including:

将所述因子库中的目标基金的数据提取到关注池,生成模拟基金 的模拟组合;Extract the data of the target fund in the factor library into the attention pool to generate a simulated portfolio of simulated funds;

根据所述模拟组合以及因子库确定收益指标;Determine the return index according to the simulated combination and the factor library;

基于所述收益指标筛选基金;Screening funds based on said return metrics;

其中,所述因子库是在整合目标基金的多种数据来源或类型的投 资数据成预设结构后;所述投资数据包括客户数据中心的投前数据、 外部供应商的采购数据以及人工导入的数据;金工模型基于所述预设 结构的投资数据生成的。Wherein, the factor database is after integrating various data sources or types of investment data of the target fund into a preset structure; the investment data includes the pre-investment data of the customer data center, the procurement data of external suppliers, and the manually imported data. data; the metalworking model is generated based on the investment data of the preset structure.

进一步地,所述基于投资数据对基金进行分析得到投资参考结果 包括:Further, the fund is analyzed based on the investment data to obtain the investment reference result including:

根据宏观经济数据确定当前经济基本面和金融市场状态;Determine current economic fundamentals and financial market conditions based on macroeconomic data;

在预设大类资产的配置设置信息和约束下确定大类资产或策略 配置建议信息;Determine the asset class or strategy configuration suggestion information under the preset configuration setting information and constraints of the asset class;

所述大类资产或策略配置建议信息包括风险评价信息、马克维茨 资产配置模型以及BL资产配置模型。The information on asset allocation or strategy allocation advice of the major categories includes risk assessment information, Markowitz asset allocation model and BL asset allocation model.

进一步地,所述基于投资数据对基金进行分析得到投资参考结果 包括:Further, the fund is analyzed based on the investment data to obtain the investment reference result including:

根据至少一个以下信息调用客户自主开发的模型进行净值分析: 基金净值进行风险收益特征的评价信息,常见风险收益指标的计算信 息,基于净值数据风险暴露信息,多基金的横向对比分析信息,同类 基金业绩排名信息;或Call the client's self-developed model for net worth analysis based on at least one of the following information: Fund net worth evaluation information about risk-return characteristics, calculation information of common risk-return indicators, risk exposure information based on net worth data, horizontal comparative analysis information of multiple funds, similar funds performance ranking information; or

根据至少一个以下信息通过多基金横向对比或调用客户自主开 发的模型进行持仓分析:基金持仓信息对目标基金进行分析评价信息、 行业分布信息、策略分布信息、风险暴露等计算信息、业绩归因信息、 风格分析信息以及持仓债券信用分析信息;或Carry out position analysis through horizontal comparison of multiple funds or invoking models independently developed by clients according to at least one of the following information: fund position information to analyze and evaluate target funds, industry distribution information, strategy distribution information, risk exposure and other calculation information, performance attribution information , style analysis information, and position bond credit analysis information; or

根据至少一个以下信息进行定性分析:目标基金的管理人基本信 息、旗下产品整体信息、策略描述和分类信息、尽调打分表信息以及 管理人核心人员变动信息和舆情监控信息。进一步地,所述基于所述 投资参考结果以及用户的投资选择进行基金的投资交易包括:Qualitative analysis is carried out based on at least one of the following information: the basic information of the manager of the target fund, the overall information of its products, strategy description and classification information, due diligence scoring table information, and information on changes in core managers and public opinion monitoring information. Further, the investment transaction of the fund based on the investment reference result and the user's investment selection includes:

基于至少一个以下信息管理投顾池:基金绩效评价信息、客户投 顾池管理办法信息、投顾分析评价报告信息、线上表决以及定级信息、 策略标签的分类管理信息、定级后的对于单一基金和单一投顾投资限 制设置信息以及投资限制信息与投中、投后的风控联动信息;Manage investment advisory pools based on at least one of the following information: fund performance evaluation information, client investment advisory pool management method information, investment advisory analysis and evaluation report information, online voting and rating information, classified management information of strategy tags, Information on the setting of investment restrictions for a single fund and a single investment advisor, and the linkage information between investment restriction information and risk control during and after investment;

所述投中决策审批单元,用于线上执行投资指令审批决策流程;The investment decision approval unit is used for online execution of the investment order approval decision process;

所述投资执行单元,用于将决策审批后确定执行的交易推送至交 易执行部门;The investment execution unit is used to push the transaction determined to be executed after the decision is approved to the transaction execution department;

所述投中风控单元,用于在投资决策审批流发起后,根据预设约 束条件,结合FOF母基金最新持仓情况,校验当前投资的可行性; 所述预设约束条件包括以下一种或多种:产品合同、内部控制要求、 投顾池定级对应的投资限制信息、债券评级限制。The investment risk control unit is used to verify the feasibility of the current investment according to the preset constraints and the latest position of the FOF parent fund after the investment decision approval flow is initiated; the preset constraints include one of the following or Various: product contracts, internal control requirements, investment restriction information corresponding to the rating of the investment advisory pool, bond rating restrictions.

进一步地,所述获取用户当前投资交易的基金信息并生成对应的 投后分析报告包括:Further, described obtaining the fund information of the user's current investment transaction and generating the corresponding post-investment analysis report includes:

根据母基金和子基金的净值和持仓信息,进行多维度统计,得到 投后监控数据;According to the net value and position information of the parent fund and sub-fund, conduct multi-dimensional statistics to obtain post-investment monitoring data;

根据固收和产品对于资产和负债两端的规模,收益,期限信息进 行统计,得到流动性管理数据;According to the fixed income and products, the scale, income and term information of both assets and liabilities are counted to obtain liquidity management data;

根据最新估值表信息,结合产品投资限制、投顾池限制信息进行 投后风控;对于有投后跟踪要求的子基金的投后收益和回撤指标进行 持续跟踪和报警。According to the latest valuation table information, combined with product investment restrictions and investment advisory pool restrictions, post-investment risk control is carried out; the post-investment returns and drawdown indicators of sub-funds with post-investment tracking requirements are continuously tracked and alarmed.

以上所描述的装置实施例仅仅是示意性的,其中所述作为分离部 件说明的单元可以是或者也可以不是物理上分开的,作为单元显示的 部件可以是或者也可以不是物理单元,即可以位于一个地方,或者也 可以分布到多个网络单元上。可以根据实际的需要选择其中的部分或 者全部模块来实现本实施例方案的目的。本领域普通技术人员在不付 出创造性的劳动的情况下,即可以理解并实施。The device embodiments described above are only illustrative, wherein the units described as separate components may or may not be physically separated, and the components shown as units may or may not be physical units, that is, they may be located in One place, or it can be distributed over multiple network elements. Some or all of the modules may be selected according to actual needs to achieve the purpose of the solution in this embodiment. Those of ordinary skill in the art can understand and implement it without creative effort.

通过以上的实施方式的描述,本领域的技术人员可以清楚地了解 到各实施方式可借助软件加必需的通用硬件平台的方式来实现,当然 也可以通过硬件。基于这样的理解,上述技术方案本质上或者说对现 有技术做出贡献的部分可以以软件产品的形式体现出来,该计算机软 件产品可以存储在计算机可读存储介质中,如ROM/RAM、磁碟、光 盘等,包括若干指令用以使得一台计算机设备(可以是个人计算机, 服务器,或者网络设备等)执行各个实施例或者实施例的某些部分所 述的方法。From the description of the above embodiments, those skilled in the art can clearly understand that each embodiment can be implemented by means of software plus a necessary general hardware platform, and certainly can also be implemented by hardware. Based on this understanding, the above-mentioned technical solutions can be embodied in the form of software products in essence or the parts that make contributions to the prior art, and the computer software products can be stored in computer-readable storage media, such as ROM/RAM, magnetic A disc, an optical disc, etc., including several instructions for causing a computer device (which may be a personal computer, a server, or a network device, etc.) to perform the methods described in various embodiments or parts of the embodiments.

最后应说明的是:以上实施例仅用以说明本发明的技术方案,而 非对其限制;尽管参照前述实施例对本发明进行了详细的说明,本领 域的普通技术人员应当理解:其依然可以对前述各实施例所记载的技 术方案进行修改,或者对其中部分技术特征进行等同替换;而这些修 改或者替换,并不使相应技术方案的本质脱离本发明各实施例技术方 案的精神和范围。Finally, it should be noted that the above embodiments are only used to illustrate the technical solutions of the present invention, but not to limit them; although the present invention has been described in detail with reference to the foregoing embodiments, those of ordinary skill in the art should understand that it can still be The technical solutions described in the foregoing embodiments are modified, or some technical features thereof are equivalently replaced; and these modifications or replacements do not make the essence of the corresponding technical solutions deviate from the spirit and scope of the technical solutions of the embodiments of the present invention.

Claims (14)

Priority Applications (1)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| CN202110406256.2ACN115221212A (en) | 2021-04-15 | 2021-04-15 | Fund investment data management system and method |

Applications Claiming Priority (1)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| CN202110406256.2ACN115221212A (en) | 2021-04-15 | 2021-04-15 | Fund investment data management system and method |

Publications (1)

| Publication Number | Publication Date |

|---|---|

| CN115221212Atrue CN115221212A (en) | 2022-10-21 |

Family

ID=83604708

Family Applications (1)

| Application Number | Title | Priority Date | Filing Date |

|---|---|---|---|

| CN202110406256.2APendingCN115221212A (en) | 2021-04-15 | 2021-04-15 | Fund investment data management system and method |

Country Status (1)

| Country | Link |

|---|---|

| CN (1) | CN115221212A (en) |

Cited By (1)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| CN116703606A (en)* | 2023-06-09 | 2023-09-05 | 五矿国际信托有限公司 | Fine fixed resource management and research integrated method based on real-time warehouse-holding analysis |

Citations (5)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| KR101708834B1 (en)* | 2015-08-21 | 2017-03-08 | 주식회사 케이지제로인 | Server for providing monitoring services for fund investor and computer readable recording medium using the same |

| CN106991611A (en)* | 2017-03-27 | 2017-07-28 | 北京贝塔智投科技有限公司 | A kind of intelligence financing investment consultant's robot system and its method of work |

| CN108805718A (en)* | 2018-05-24 | 2018-11-13 | 广州实盈网络科技有限公司 | A kind of performance attribution analysis and FOF MOM Asset Allocation systems |

| CN112465647A (en)* | 2019-09-06 | 2021-03-09 | 北京财蕴天下信息技术有限责任公司 | Intelligent investment management system |

| CN112598511A (en)* | 2020-11-19 | 2021-04-02 | 厦门小蚜虫量化软件开发有限公司 | Stock quantitative trading system based on AI wind control |

- 2021

- 2021-04-15CNCN202110406256.2Apatent/CN115221212A/enactivePending

Patent Citations (5)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| KR101708834B1 (en)* | 2015-08-21 | 2017-03-08 | 주식회사 케이지제로인 | Server for providing monitoring services for fund investor and computer readable recording medium using the same |

| CN106991611A (en)* | 2017-03-27 | 2017-07-28 | 北京贝塔智投科技有限公司 | A kind of intelligence financing investment consultant's robot system and its method of work |

| CN108805718A (en)* | 2018-05-24 | 2018-11-13 | 广州实盈网络科技有限公司 | A kind of performance attribution analysis and FOF MOM Asset Allocation systems |

| CN112465647A (en)* | 2019-09-06 | 2021-03-09 | 北京财蕴天下信息技术有限责任公司 | Intelligent investment management system |

| CN112598511A (en)* | 2020-11-19 | 2021-04-02 | 厦门小蚜虫量化软件开发有限公司 | Stock quantitative trading system based on AI wind control |

Cited By (2)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| CN116703606A (en)* | 2023-06-09 | 2023-09-05 | 五矿国际信托有限公司 | Fine fixed resource management and research integrated method based on real-time warehouse-holding analysis |

| CN116703606B (en)* | 2023-06-09 | 2024-05-17 | 五矿国际信托有限公司 | Fine fixed resource management and research integrated method based on real-time warehouse-holding analysis |

Similar Documents

| Publication | Publication Date | Title |

|---|---|---|

| Alexander | Bayesian methods for measuring operational risk | |

| US7904368B2 (en) | Portfolio confirmation and certification platform | |

| Saitri et al. | How Firm Characteristics Affect the Dividend Policy of Listed Banking Companies on The Indonesian Stock Exchange in 2019-2021 | |

| Hernando | The effect of information asimmetry on earnings management in companies that conduct an initial public offering (IPO) on the Indonesia Stock Exchange (IDX) | |

| Birol | Corporate governance and fraud detection: A study from Borsa Istanbul | |

| CN115221212A (en) | Fund investment data management system and method | |

| Osewe | Effect of external debt and inflation on economic growth in Kenya | |

| Al-Hawatmah et al. | The Effect of lending policy on the profitability of commercial banks: Evidence from Jordan | |

| Wanyoike et al. | Working Capital Management and Profitability of Tea Processing Firms in Aberdare Ranges Region, Kenya | |

| Pourgadimi et al. | Presenting the development of the Beneish model with emphasis on economic features using Neural Network, Vector Machine, and Random Forest | |

| Pokhrel | Financial Performance Analysis of Joint Venture Commercial Banks of Nepal in the Framework of CAMEL | |

| Too et al. | Effects of Credit Risk Management on Performance of Banks in Nairobi, Kenya | |

| Katwal | Stock Price Behavior of Nepalese Commercial Banks (With Reference to Everest Bank Limited, Nepal Bank Limited Nabil Bank Limited, and Nepal Investment Bank Limited) | |

| KR100574790B1 (en) | Exchange risk management system | |

| Mustafa et al. | The Influence of Net Profit Margin, Dividend Payout Ratio, and Total Asset Turnover on Sharia Share Prices in Jakarta Islamic Index | |

| Dixit | Basics Of Financial Management | |

| Danuz et al. | The Effect Of Profitability, Liquidity, Activity, and Leverage on Stock Prices to Independent Commissioners As Moderating Variables | |

| Minh et al. | Impact of financial decisions on business performance of pharmaceutical companies listed on the Vietnamese stock market | |

| Opondo | Determinants of financial self-sufficiency of Deposit-Taking SACCOs in Kenya. | |

| RAJESHWARI | STOCK MARKET ANALYSIS AND PREDICTION | |

| Silva et al. | System architecture | |

| Min | EFFECIVENESS OF LOANS PORTFOLIO MANAGEMENT PRACTICES IN MYANMAR MICROFINANCE BANK (Khin Thandar Myo Min, 2019) | |

| Bhujel | STOCK PRICE BEHAVIOUR OF INSURANCE COMPANIES IN NEPAL | |

| Mwanyemba | A Comparative Study of Financial Performance of CRDB and NBC Banks an Application of Camels Model | |

| Haider | Exploring the relationship between changes in accounting policies and valuation of Australian banking firms |

Legal Events

| Date | Code | Title | Description |

|---|---|---|---|

| PB01 | Publication | ||

| PB01 | Publication | ||

| SE01 | Entry into force of request for substantive examination | ||

| SE01 | Entry into force of request for substantive examination |