CN114693409A - Product matching method, device, computer equipment, storage medium and program product - Google Patents

Product matching method, device, computer equipment, storage medium and program productDownload PDFInfo

- Publication number

- CN114693409A CN114693409ACN202210445601.8ACN202210445601ACN114693409ACN 114693409 ACN114693409 ACN 114693409ACN 202210445601 ACN202210445601 ACN 202210445601ACN 114693409 ACN114693409 ACN 114693409A

- Authority

- CN

- China

- Prior art keywords

- user

- product

- financial

- level

- historical

- Prior art date

- Legal status (The legal status is an assumption and is not a legal conclusion. Google has not performed a legal analysis and makes no representation as to the accuracy of the status listed.)

- Pending

Links

Images

Classifications

- G—PHYSICS

- G06—COMPUTING OR CALCULATING; COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q30/00—Commerce

- G06Q30/06—Buying, selling or leasing transactions

- G06Q30/0601—Electronic shopping [e-shopping]

- G06Q30/0623—Electronic shopping [e-shopping] by investigating goods or services

- G06Q30/0625—Electronic shopping [e-shopping] by investigating goods or services by formulating product or service queries, e.g. using keywords or predefined options

- G—PHYSICS

- G06—COMPUTING OR CALCULATING; COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q30/00—Commerce

- G06Q30/06—Buying, selling or leasing transactions

- G06Q30/0601—Electronic shopping [e-shopping]

- G06Q30/0631—Recommending goods or services

- G—PHYSICS

- G06—COMPUTING OR CALCULATING; COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q40/00—Finance; Insurance; Tax strategies; Processing of corporate or income taxes

- G06Q40/02—Banking, e.g. interest calculation or account maintenance

- G—PHYSICS

- G06—COMPUTING OR CALCULATING; COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q40/00—Finance; Insurance; Tax strategies; Processing of corporate or income taxes

- G06Q40/06—Asset management; Financial planning or analysis

Landscapes

- Business, Economics & Management (AREA)

- Accounting & Taxation (AREA)

- Finance (AREA)

- Engineering & Computer Science (AREA)

- Development Economics (AREA)

- General Business, Economics & Management (AREA)

- Strategic Management (AREA)

- Physics & Mathematics (AREA)

- Marketing (AREA)

- General Physics & Mathematics (AREA)

- Economics (AREA)

- Theoretical Computer Science (AREA)

- Technology Law (AREA)

- Entrepreneurship & Innovation (AREA)

- Game Theory and Decision Science (AREA)

- Human Resources & Organizations (AREA)

- Operations Research (AREA)

- Financial Or Insurance-Related Operations Such As Payment And Settlement (AREA)

Abstract

Description

Translated fromChinese技术领域technical field

本申请涉及计算机技术领域,特别是涉及一种产品匹配方法、装置、计算机设备、存储介质和计算机程序产品。The present application relates to the field of computer technology, and in particular, to a product matching method, apparatus, computer equipment, storage medium and computer program product.

背景技术Background technique

在金融行业,为了满足用户多样性的理财需求,不同类型的金融产品越来越多,比如银行根据用户的不同需求设定的不同类型的金融理财产品以及不同类型的存款产品等,对于银行来说,如何高效地将金融产品推销至客户是当下亟待解决的重要问题。In the financial industry, in order to meet the diverse financial needs of users, there are more and more different types of financial products, such as different types of financial wealth management products and different types of deposit products set by banks according to the different needs of users. It is said that how to effectively promote financial products to customers is an important problem that needs to be solved urgently.

传统技术中,在进行金融产品推销时,通常是当用户走进银行营业网点时,通过银行的柜面营销人员为用户推销不同的金融产品;或者,通过银行的客户端(即用户终端上的银行客户端)向用户推送不同的金融产品。In the traditional technology, when selling financial products, when the user walks into the bank's business outlet, the salesperson at the bank's counter sells different financial products for the user; Bank client) pushes different financial products to users.

然而,现有金融产品的推销方式针对性不强,存在向用户推销的金融产品与用户的匹配程度较低的问题。However, the marketing methods of existing financial products are not highly targeted, and there is a problem that the financial products promoted to users have a low degree of matching with users.

发明内容SUMMARY OF THE INVENTION

基于此,有必要针对上述技术问题,提供一种能够提高产品与用户的匹配程度的产品匹配方法、装置、计算机设备、计算机可读存储介质和计算机程序产品。Based on this, it is necessary to provide a product matching method, apparatus, computer equipment, computer-readable storage medium and computer program product that can improve the matching degree between products and users in response to the above technical problems.

第一方面,本申请提供了一种产品匹配方法。该方法包括:In a first aspect, the present application provides a product matching method. The method includes:

获取用户的历史行为数据和账户收支数据;该历史行为数据包括用户对于金融产品的历史搜索记录以及历史浏览记录;Obtain the user's historical behavior data and account income and expenditure data; the historical behavior data includes the user's historical search records and historical browsing records for financial products;

将历史行为数据和账户收支数据输入预设分类模型,获得用户的用户等级;该用户等级用于表征用户的抗金融风险能力;Input historical behavior data and account income and expenditure data into the preset classification model to obtain the user's user level; the user level is used to characterize the user's ability to resist financial risks;

根据用户等级,从产品数据库中确定与用户匹配的第一目标产品;其中,产品数据库中包括多个具有标签信息的金融产品。According to the user level, the first target product matching the user is determined from the product database; wherein the product database includes a plurality of financial products with label information.

在其中一个实施例中,将历史行为数据和账户收支数据输入预设分类模型,获得用户的用户等级,包括:In one embodiment, historical behavior data and account income and expenditure data are input into a preset classification model to obtain the user level of the user, including:

获取用户的特征向量;该用户的特征向量包括基于历史行为数据生成的第一特征向量和基于账户收支数据形成的第二特征向量;Obtain the feature vector of the user; the feature vector of the user includes a first feature vector generated based on historical behavior data and a second feature vector formed based on account balance data;

将该特征向量输入至预设分类模型,获得用户的用户等级;其中,该预设分类模型为采用多个样本特征向量及其对应的等级标签对初始分类模型进行训练获得的。The feature vector is input into the preset classification model to obtain the user level of the user; wherein, the preset classification model is obtained by training the initial classification model by using multiple sample feature vectors and their corresponding level labels.

在其中一个实施例中,获取用户的特征向量,包括:In one of the embodiments, acquiring the feature vector of the user includes:

对历史搜索记录进行特征提取,获得第一特征子向量;该第一特征子向量中的特征值包括搜索时间、搜索设备以及搜索关键词;Perform feature extraction on historical search records to obtain a first feature sub-vector; the feature values in the first feature sub-vector include search time, search equipment and search keywords;

对历史浏览记录进行特征提取,获得第二特征子向量;该第二特征子向量中的特征值包括浏览时间、浏览设备以及历史浏览产品类型;第一特征向量包括第一特征子向量和第二特征子向量;Perform feature extraction on historical browsing records to obtain a second feature sub-vector; the feature values in the second feature sub-vector include browsing time, browsing equipment and historical browsing product types; the first feature vector includes the first feature sub-vector and the second feature sub-vector eigenvector;

基于账户收支数据,获得第二特征向量;该第二特征向量中的特征值包括收入总额、支出总额以及单月最小收入额;Based on the account balance and expenditure data, a second feature vector is obtained; the feature values in the second feature vector include total income, total expenditure and minimum monthly income;

将第一特征子向量、第二特征子向量以及第二特征向量进行特征融合,获得用户的特征向量。Feature fusion is performed on the first feature sub-vector, the second feature sub-vector and the second feature vector to obtain the feature vector of the user.

在其中一个实施例中,根据用户等级,从产品数据库中确定与用户匹配的第一目标产品,包括:In one embodiment, according to the user level, the first target product that matches the user is determined from the product database, including:

获取产品数据库中各金融产品的标签信息;该金融产品的标签信息包括产品类型、起购标准、风险等级、收益等级、年限中的至少一个;Obtain the label information of each financial product in the product database; the label information of the financial product includes at least one of product type, minimum purchase standard, risk level, income level, and age;

根据用户等级以及各金融产品的标签信息,确定与用户匹配的第一目标产品。According to the user level and the label information of each financial product, the first target product that matches the user is determined.

在其中一个实施例中,根据用户等级以及各金融产品的标签信息,确定与用户匹配的第一目标产品,包括:In one embodiment, the first target product matching the user is determined according to the user level and the label information of each financial product, including:

针对产品数据库中的各金融产品,确定金融产品的各个标签信息对应的参考等级,并根据用户等级与各个标签信息对应的参考等级确定金融产品对应的用户匹配度;For each financial product in the product database, determine the reference level corresponding to each label information of the financial product, and determine the user matching degree corresponding to the financial product according to the user level and the reference level corresponding to each label information;

根据各金融产品对应的用户匹配度,选择与用户匹配的第一目标产品。According to the user matching degree corresponding to each financial product, the first target product matching the user is selected.

在其中一个实施例中,根据用户等级与各个标签信息对应的参考等级确定金融产品对应的用户匹配度,包括:In one embodiment, the user matching degree corresponding to the financial product is determined according to the user level and the reference level corresponding to each tag information, including:

根据各个标签信息对应的参考等级,确定金融产品的各个标签信息中,与用户等级匹配的目标标签信息;According to the reference level corresponding to each tag information, determine the target tag information that matches the user level in each tag information of the financial product;

对各目标标签信息进行加权处理,确定金融产品对应的用户匹配度。Weighting processing is performed on each target tag information to determine the user matching degree corresponding to the financial product.

在其中一个实施例中,根据各金融产品对应的用户匹配度,选择与用户匹配的第一目标产品,包括:In one embodiment, according to the user matching degree corresponding to each financial product, selecting the first target product matching the user includes:

将各金融产品对应的用户匹配度,按照从大到小的顺序进行排序处理;Sort the user matching degree corresponding to each financial product in descending order;

将排序处理后的前预设数量的金融产品作为与用户匹配的第一目标产品。The first preset number of financial products after the sorting process is used as the first target product matched with the user.

在其中一个实施例中,该方法还包括:In one embodiment, the method further includes:

获取用户通过目标客户端输入的当前搜索信息;Obtain the current search information entered by the user through the target client;

根据当前搜索信息、用户等级,从产品数据库中确定与当前搜索信息及用户等级匹配的第二目标产品;According to the current search information and user level, determine the second target product that matches the current search information and user level from the product database;

将第二目标产品发送至目标客户端。The second target product is sent to the target client.

第二方面,本申请还提供了一种产品匹配装置。该装置包括:In a second aspect, the present application also provides a product matching device. The device includes:

第一获取模块,用于获取用户的历史行为数据和账户收支数据;该历史行为数据包括用户对于金融产品的历史搜索记录以及历史浏览记录;The first acquisition module is used to acquire the user's historical behavior data and account income and expenditure data; the historical behavior data includes the user's historical search records and historical browsing records for financial products;

第二获取模块,用于将历史行为数据和账户收支数据输入预设分类模型,获得用户的用户等级;该用户等级用于表征用户的抗金融风险能力;The second acquisition module is used to input historical behavior data and account income and expenditure data into the preset classification model to obtain the user level of the user; the user level is used to characterize the user's ability to resist financial risks;

确定模块,用于根据用户等级,从产品数据库中确定与用户匹配的第一目标产品;其中,该产品数据库中包括多个具有标签信息的金融产品。The determining module is used for determining the first target product matching the user from the product database according to the user level; wherein the product database includes a plurality of financial products with tag information.

第三方面,本申请还提供了一种计算机设备。该计算机设备包括存储器和处理器,该存储器存储有计算机程序,该处理器执行所述计算机程序时实现以下步骤:In a third aspect, the present application also provides a computer device. The computer device includes a memory and a processor, the memory stores a computer program, and the processor implements the following steps when executing the computer program:

获取用户的历史行为数据和账户收支数据;该历史行为数据包括用户对于金融产品的历史搜索记录以及历史浏览记录;Obtain the user's historical behavior data and account income and expenditure data; the historical behavior data includes the user's historical search records and historical browsing records for financial products;

将历史行为数据和账户收支数据输入预设分类模型,获得用户的用户等级;该用户等级用于表征用户的抗金融风险能力;Input historical behavior data and account income and expenditure data into the preset classification model to obtain the user's user level; the user level is used to characterize the user's ability to resist financial risks;

根据用户等级,从产品数据库中确定与用户匹配的第一目标产品;其中,产品数据库中包括多个具有标签信息的金融产品。According to the user level, the first target product matching the user is determined from the product database; wherein the product database includes a plurality of financial products with label information.

第四方面,本申请还提供了一种计算机可读存储介质。该计算机可读存储介质,其上存储有计算机程序,该计算机程序被处理器执行时实现以下步骤:In a fourth aspect, the present application also provides a computer-readable storage medium. The computer-readable storage medium has a computer program stored thereon, and when the computer program is executed by the processor, the following steps are implemented:

获取用户的历史行为数据和账户收支数据;该历史行为数据包括用户对于金融产品的历史搜索记录以及历史浏览记录;Obtain the user's historical behavior data and account income and expenditure data; the historical behavior data includes the user's historical search records and historical browsing records for financial products;

将历史行为数据和账户收支数据输入预设分类模型,获得用户的用户等级;该用户等级用于表征用户的抗金融风险能力;Input historical behavior data and account income and expenditure data into the preset classification model to obtain the user's user level; the user level is used to characterize the user's ability to resist financial risks;

根据用户等级,从产品数据库中确定与用户匹配的第一目标产品;其中,产品数据库中包括多个具有标签信息的金融产品。According to the user level, the first target product matching the user is determined from the product database; wherein the product database includes a plurality of financial products with label information.

第五方面,本申请还提供了一种计算机程序产品,该计算机程序产品,包括计算机程序,该计算机程序被处理器执行时实现以下步骤:In a fifth aspect, the present application also provides a computer program product, the computer program product includes a computer program that implements the following steps when the computer program is executed by the processor:

获取用户的历史行为数据和账户收支数据;该历史行为数据包括用户对于金融产品的历史搜索记录以及历史浏览记录;Obtain the user's historical behavior data and account income and expenditure data; the historical behavior data includes the user's historical search records and historical browsing records for financial products;

将历史行为数据和账户收支数据输入预设分类模型,获得用户的用户等级;该用户等级用于表征用户的抗金融风险能力;Input historical behavior data and account income and expenditure data into the preset classification model to obtain the user's user level; the user level is used to characterize the user's ability to resist financial risks;

根据用户等级,从产品数据库中确定与用户匹配的第一目标产品;其中,产品数据库中包括多个具有标签信息的金融产品。According to the user level, the first target product matching the user is determined from the product database; wherein the product database includes a plurality of financial products with label information.

上述产品匹配方法、装置、计算机设备、存储介质和计算机程序产品,通过获取用户的历史行为数据和账户收支数据,并将该历史行为数据和账户收支数据输入预设分类模型,获得用于表征用户的抗金融风险能力的用户等级;接着,根据该用户等级,从产品数据库中确定与用户匹配的第一目标产品;其中,该历史行为数据包括用户对于金融产品的历史搜索记录以及历史浏览记录,产品数据库中包括多个具有标签信息的金融产品;也就是说,本申请实施例所提供的产品匹配方法,通过对用户所涉及的对金融产品的历史搜索记录和历史浏览记录进行分析,以及对用户的历史账户收支数据进行分析,来确定用户的抗金融风险等级,进而,根据用户的抗金融风险等级为用户匹配更合适的金融产品;即通过对用户喜好和抗金融风险能力进行综合评估,以此来匹配金融产品,能够大大提高金融产品与用户的匹配程度,实现为用户提供更精准的个性化定制理财服务,针对不同用户提供针对性更强的金融产品,还能提高用户的满意度,以及提高金融产品推荐的高效性。The above-mentioned product matching method, device, computer equipment, storage medium and computer program product, by acquiring the user's historical behavior data and account income and expenditure data, and inputting the historical behavior data and account income and expenditure data into the preset classification model, obtain the information for The user level that characterizes the user's ability to resist financial risks; then, according to the user level, the first target product that matches the user is determined from the product database; wherein the historical behavior data includes the user's historical search records and historical browsing records for financial products records, the product database includes a plurality of financial products with tag information; that is, the product matching method provided by the embodiment of the present application analyzes the historical search records and historical browsing records of the financial products involved by the user, And analyze the user's historical account income and expenditure data to determine the user's anti-financial risk level, and then match the user with more suitable financial products according to the user's anti-financial risk level; Comprehensive evaluation to match financial products can greatly improve the degree of matching between financial products and users, provide users with more accurate personalized customized financial services, provide more targeted financial products for different users, and improve the user experience. satisfaction, and improve the efficiency of financial product recommendation.

附图说明Description of drawings

图1为一个实施例中产品匹配方法的应用环境图;Fig. 1 is the application environment diagram of the product matching method in one embodiment;

图2为一个实施例中产品匹配方法的流程示意图;2 is a schematic flowchart of a product matching method in one embodiment;

图3为另一个实施例中产品匹配方法的流程示意图;3 is a schematic flowchart of a product matching method in another embodiment;

图4为另一个实施例中产品匹配方法的流程示意图;4 is a schematic flowchart of a product matching method in another embodiment;

图5为另一个实施例中产品匹配方法的流程示意图;5 is a schematic flowchart of a product matching method in another embodiment;

图6为另一个实施例中产品匹配方法的流程示意图;6 is a schematic flowchart of a product matching method in another embodiment;

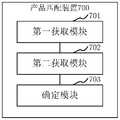

图7为一个实施例中产品匹配装置的结构框图;7 is a structural block diagram of a product matching device in one embodiment;

图8为一个实施例中计算机设备的内部结构图。FIG. 8 is a diagram of the internal structure of a computer device in one embodiment.

具体实施方式Detailed ways

为了使本申请的目的、技术方案及优点更加清楚明白,以下结合附图及实施例,对本申请进行进一步详细说明。应当理解,此处描述的具体实施例仅仅用以解释本申请,并不用于限定本申请。In order to make the purpose, technical solutions and advantages of the present application more clearly understood, the present application will be described in further detail below with reference to the accompanying drawings and embodiments. It should be understood that the specific embodiments described herein are only used to explain the present application, but not to limit the present application.

首先,在具体介绍本公开实施例的技术方案之前,先对本公开实施例基于的技术背景或者技术演进脉络进行介绍。通常情况下,在进行金融产品推销时,可以包括两种方式,其一是通过银行客户端(比如手机银行、网上银行等客户端应用程序)向用户发送推荐的金融产品;该方式下,由于抗风险能力高低以及收入差异导致不同用户对于理财产品的需求不一样,简单的随机推销或者以盈利为主的金融产品推销不仅会降低用户满意度而且会导致用户利益受损不利于长期的营销业务开展。总结来说,就是对金融产品的定位不准确,导致金融产品与用户之间的匹配程度较低。First, before introducing the technical solutions of the embodiments of the present disclosure in detail, the technical background or technical evolution context on which the embodiments of the present disclosure are based is introduced. Usually, there are two ways to sell financial products. One is to send recommended financial products to users through bank clients (such as mobile banking, online banking and other client applications); Different users have different needs for wealth management products due to the difference in anti-risk ability and income. Simple random sales or profit-oriented financial product sales will not only reduce user satisfaction, but also lead to damage to user interests, which is not conducive to long-term marketing business. carry out. To sum up, the positioning of financial products is inaccurate, resulting in a low degree of matching between financial products and users.

其二是通过营业网点的柜面营销,营业网点的产品推销往往是通过柜员或者大堂经理进行,这些金融从业者对于金融产品的认知以及风险把控是有限的,难以做到详细的为用户提供产品讲解以及整体理财方案的制定,且需要大量的人力物力来支撑金融产品营销。总结来说,就是金融理财业务人员对金融产品和用户之间的关联性较弱,导致金融产品与用户之间的匹配程度较低。The second is through over-the-counter marketing at business outlets. The product sales of business outlets are often carried out by tellers or lobby managers. These financial practitioners have limited understanding of financial products and risk control, and it is difficult to provide detailed information for users. Provide product explanations and formulation of overall financial plans, and require a lot of manpower and material resources to support financial product marketing. To sum up, financial management business personnel have a weak correlation between financial products and users, resulting in a low degree of matching between financial products and users.

基于此,本申请实施例提供了一种产品匹配方法,能够通过用户的历史行为数据和账户收支数据对用户进行深度分析和定位确定用户等级,并对金融产品进行标签细化,进而根据用户等级和金融产品的标签信息,确定与用户匹配程度较高的金融产品,以此来提高金融产品与用户之间的匹配程度。另外,通过分析用户的兴趣、风险承担能力、收支情况等进行金融产品的精准推荐,不仅能为用户提供个性化且针对性强的理财方案,减少营销人员的业务压力,提高用户的满意度,还能有效提高金融产品营销的有效性和准确性。Based on this, the embodiments of the present application provide a product matching method, which can conduct in-depth analysis and positioning of users through the user's historical behavior data and account income and expenditure data to determine the user level, and refine the labels of financial products, and then use the user's historical behavior data and account balance data. Level and label information of financial products to determine financial products with a higher degree of matching with users, so as to improve the matching degree between financial products and users. In addition, accurate recommendation of financial products by analyzing users' interests, risk tolerance, income and expenditure, etc., can not only provide users with personalized and highly targeted financial planning solutions, reduce business pressure on marketers, and improve user satisfaction. It can also effectively improve the effectiveness and accuracy of financial product marketing.

下面结合本申请实施例所应用的场景,对本申请实施例涉及的技术方案进行介绍。The technical solutions involved in the embodiments of the present application will be introduced below in combination with the scenarios applied by the embodiments of the present application.

本申请实施例提供的产品匹配方法,可以应用于如图1所示的应用环境中。其中,终端102通过网络与服务器104进行通信。数据存储系统可以存储服务器104需要处理的数据。数据存储系统可以集成在服务器104上,也可以放在云上或其他网络服务器上。其中,终端102可以但不限于是各种个人计算机、笔记本电脑、智能手机、平板电脑、物联网设备和便携式可穿戴设备,以及金融营业厅中的智能操作终端等,物联网设备可为智能音箱、智能电视、智能空调、智能车载设备等,便携式可穿戴设备可为智能手表、智能手环、头戴设备等;在该终端102中可以安装有用于进行金融操作的客户端应用程序。服务器104可以用独立的服务器或者是多个服务器组成的服务器集群来实现。用户通过终端102访问该客户端应用程序,并通过该客户端应用程序进行金融业务操作,服务器104通过用户的历史行为数据和用户的历史账户收支数据为用户匹配更合适的金融产品,并通过该客户端应用程序推送给用户。The product matching method provided in the embodiment of the present application can be applied to the application environment shown in FIG. 1 . The terminal 102 communicates with the

在一个实施例中,如图2所示,提供了一种产品匹配方法,以该方法应用于图1中的服务器为例进行说明,包括以下步骤:In one embodiment, as shown in FIG. 2 , a product matching method is provided, which is described by taking the method applied to the server in FIG. 1 as an example, including the following steps:

步骤201,获取用户的历史行为数据和账户收支数据。Step 201: Obtain the user's historical behavior data and account income and expenditure data.

其中,该历史行为数据包括用户对于金融产品的历史搜索记录以及历史浏览记录,账户收支数据可以包括但不限于是用户账户的所有收入和支出的交易数据,以及该用户的信贷交易数据。The historical behavior data includes the user's historical search records and historical browsing records for financial products, and the account income and expenditure data may include but not limited to transaction data of all income and expenditure of the user's account, as well as the user's credit transaction data.

可选地,用户通过登录账号登录客户端应用程序,在进入该客户端应用程序后,可以进行与金融业务相关的金融操作,如:浏览金融产品、搜索金融产品、分享金融产品、点击访问金融产品、以及进行金融转账操作等;通过对用户在客户端应用程序的行为操作进行监听,可以获取用户的历史搜索记录和历史浏览记录;可选地,为了进行实时数据流传输,可以利用Flume分布式日志聚合系统监控文件进行数据收集,通过对进行文件配置自动收集跟用户相关的日志文件,并将日志文件传输至Kafka中;对于用户的历史行为(包括但不限于登录、浏览、搜索、分享、点击等行为)以及系统运行日志等数据集进行访问,利用其消息队列系统进行日志分析进行数据的实时分析处理;使用Flume监控用户行为,当有行为改变时自动采集文件数据并传输到Kafka进行处理;以获取到用户对于金融产品的历史搜索记录以及历史浏览记录。可选地,为了提高数据处理效率,可以采用离线处理的方式,为了方便处理可以对收集到的文件数据进行格式统一上传至分布式文件传输系统,使用spark技术进行离线文件处理,并存储至HBase数据库。Optionally, the user logs in to the client application through the login account, and after entering the client application, he can perform financial operations related to financial services, such as: browsing financial products, searching for financial products, sharing financial products, and clicking to access financial services. products, and financial transfer operations, etc.; by monitoring the user's behavior in the client application, the user's historical search records and historical browsing records can be obtained; optionally, for real-time data streaming, Flume distribution can be used The log aggregation system monitors files for data collection, automatically collects user-related log files through file configuration, and transmits the log files to Kafka; for users’ historical behaviors (including but not limited to logging in, browsing, searching, sharing , click and other behaviors) and system operation logs and other data sets to access, use its message queue system for log analysis for real-time data analysis and processing; use Flume to monitor user behavior, and automatically collect file data when behavior changes and transmit it to Kafka for processing Processing; to obtain the user's historical search records and historical browsing records for financial products. Optionally, in order to improve the efficiency of data processing, offline processing can be adopted. In order to facilitate processing, the collected file data can be uniformly uploaded to the distributed file transmission system in a unified format, and the offline file processing can be performed using spark technology, and stored in HBase. database.

可选地,服务器可以通过获取用户账户的历史收支数据作为用户的账户收支数据,该账户收支数据可以包括用户在历史预设时间段内的收支数据,也可以是用户在历史的所有收支数据;该预设时间段可以是月、季、年等。Optionally, the server may obtain the historical revenue and expenditure data of the user account as the user's account revenue and expenditure data, and the account revenue and expenditure data may include the user's revenue and expenditure data within a historical preset time period, or may be the user's historical revenue and expenditure data. All income and expenditure data; the preset time period can be month, quarter, year, etc.

步骤202,将历史行为数据和账户收支数据输入预设分类模型,获得用户的用户等级。

其中,该用户等级用于表征用户的抗金融风险能力。可选地,该用户等级可以分为三级(如低级、中级、高级)、五级(如极低、较低、中等、中高、高)或者任意多个等级,等级越高,说明用户的抗金融风险能力越强;在实际应用中用户等级划分可以进行灵活调整和设置,本申请对此并不做限定。Among them, the user level is used to characterize the user's ability to resist financial risks. Optionally, the user level can be divided into three levels (such as low level, middle level, high level), five levels (such as very low, low, medium, medium-high, high) or any number of levels. The stronger the ability to resist financial risks; the user level division can be flexibly adjusted and set in practical applications, which is not limited in this application.

可选地,该预设分类模型可以是基于深度学习的分类模型,也可以是基于神经网络的分类模型,还可以是基于机器学习的分类模型等;例如:该预设分类模型可以利用基于前馈神经网络的多层感知机分类器对用户进行分类,中间节点使用sigmod激活函数,输出层使用softmax函数进行归一化处理,输出层节点表示分类器的种类,即用户的不同用户等级。Optionally, the preset classification model may be a deep learning-based classification model, a neural network-based classification model, or a machine learning-based classification model, etc.; The multi-layer perceptron classifier of the fed neural network classifies the user, the intermediate node uses the sigmod activation function, the output layer uses the softmax function for normalization, and the output layer node represents the type of classifier, that is, the different user levels of the user.

通过该预设分类模型,可以根据用户的历史行为数据和账户收支数据,对用户进行用户等级划分,确定与用户匹配的用户等级;可选地,可以将用户的历史行为数据和该用户的账户收支数据输入至该预设分类模型,以此得到该用户对应的用户等级。Through the preset classification model, users can be classified into user levels according to the user's historical behavior data and account income and expenditure data, and a user level that matches the user can be determined; optionally, the user's historical behavior data and the user's The account balance and expenditure data is input into the preset classification model, so as to obtain the user level corresponding to the user.

步骤203,根据用户等级,从产品数据库中确定与用户匹配的第一目标产品。

其中,产品数据库中包括多个具有标签信息的金融产品,也就是说,对于产品数据库中的每个金融产品,都具有不同的标签信息,每个金融产品可以对应至少一个标签信息,该标签信息可以包括但不限于是产品类型、金融产品的起购标准、金融产品的风险等级、金融产品的收益等级、金融产品的年限中的至少一个。Wherein, the product database includes a plurality of financial products with label information, that is, each financial product in the product database has different label information, and each financial product may correspond to at least one label information, the label information It may include, but is not limited to, at least one of the product type, the starting purchase standard of the financial product, the risk level of the financial product, the income level of the financial product, and the term of the financial product.

可选地,服务器可以根据用户等级、产品数据库中各个金融产品的标签信息、以及预设的不同标签与用户等级之间的对应关系,确定与用户等级匹配的金融产品,作为与该用户匹配的第一目标产品。可选地,与用户等级匹配的金融产品可以包括与用户等级相同的金融产品,或者比用户等级低的金融产品。另外,在金融产品包括多个标签信息的情况下,与用户等级匹配的金融产品可以是该金融产品中的至少一个标签信息与用户等级匹配的金融产品,或者,该金融产品的多个标签信息中存在预设数量的标签信息与用户等级匹配的金融产品,又或者是,该金融产品的多个标签信息中的预设标签信息与用户等级匹配的金融产品等。Optionally, the server may determine the financial product matching the user's level as the user-matched financial product according to the user's level, the label information of each financial product in the product database, and the preset correspondence between different labels and the user's level. The first target product. Optionally, the financial products matching the user level may include financial products with the same level as the user, or financial products with a lower level than the user. In addition, in the case where the financial product includes multiple tag information, the financial product matching the user level may be a financial product whose at least one tag information in the financial product matches the user level, or a plurality of tag information of the financial product. There are financial products with a preset number of tag information matching the user level in the financial product, or a financial product with the preset tag information matching the user level in the multiple tag information of the financial product, and the like.

对于上述所涉及的预设的不同标签与用户等级之间的对应关系,可以理解为每一个标签信息都可以包括多个与不同的用户等级匹配的子标签信息,如:起购标准可以包括与低抗金融风险能力的用户等级对应的起购标准、与中抗金融风险能力的用户等级对应的起购标准、以及与高抗金融风险能力的用户等级对应的起购标准。通过该对应关系,就可以判断金融产品的某一个标签信息是否与用户等级相匹配。For the above-mentioned corresponding relationship between the preset different tags and user levels, it can be understood that each tag information may include a plurality of sub-tag information matching different user levels. For example, the purchase criteria may include The minimum purchase standard corresponding to the user level with low financial risk resistance ability, the minimum purchase standard corresponding to the user level with medium financial risk resistance ability, and the minimum purchase standard corresponding to the user level with high financial risk resistance ability. Through the corresponding relationship, it can be determined whether a certain tag information of the financial product matches the user level.

另外,服务器在确定出与用户匹配的第一目标产品之后,还可以将该第一目标产品推送至用户;可选地,可以将该第一目标产品发送至用户的客户端应用程序(如个人网上银行);也可以通过业务网点进行推荐,如将该第一目标产品发送至业务网点的终端设备上,以使业务网点的工作人员可以在用户进行现场业务办理时,将该第一目标产品推荐至用户,或者,业务网点的工作人员还可以通过语音电话的方式将该第一目标产品推荐至用户。需要说明的是,本申请实施例中对产品的推荐方式并不做具体限定。In addition, after determining the first target product that matches the user, the server may push the first target product to the user; optionally, the first target product may be sent to the user's client application (such as a personal Online banking); it can also be recommended through business outlets, such as sending the first target product to the terminal equipment of the business outlet, so that the staff of the business outlet can provide the first target product when the user conducts on-site business processing. The first target product is recommended to the user, or the staff of the service outlet can also recommend the first target product to the user by means of a voice call. It should be noted that, in the embodiments of the present application, the recommended manner of the product is not specifically limited.

上述产品匹配方法中,服务器通过获取用户的历史行为数据和账户收支数据,并将该历史行为数据和账户收支数据输入预设分类模型,获得用于表征用户的抗金融风险能力的用户等级;接着,根据该用户等级,从产品数据库中确定与用户匹配的第一目标产品;其中,该历史行为数据包括用户对于金融产品的历史搜索记录以及历史浏览记录,产品数据库中包括多个具有标签信息的金融产品;也就是说,本申请实施例所提供的产品匹配方法,通过对用户所涉及的对金融产品的历史搜索记录和历史浏览记录进行分析,以及对用户的历史账户收支数据进行分析,来确定用户的抗金融风险等级,进而,根据用户的抗金融风险等级为用户匹配更合适的金融产品;即通过对用户喜好和抗金融风险能力进行综合评估,以此来匹配金融产品,能够大大提高金融产品与用户的匹配程度,实现为用户提供更精准的个性化定制理财服务,针对不同用户提供针对性更强的金融产品,还能提高用户的满意度,以及提高金融产品推荐的高效性。In the above product matching method, the server acquires the user's historical behavior data and account income and expenditure data, and inputs the historical behavior data and account income and expenditure data into a preset classification model to obtain a user level that is used to characterize the user's ability to resist financial risks. Then, according to the user level, determine the first target product that matches the user from the product database; wherein, the historical behavior data includes the user's historical search records and historical browsing records for financial products, and the product database includes a plurality of tags with tags Information financial products; that is to say, the product matching method provided by the embodiment of the present application analyzes the historical search records and historical browsing records of financial products involved by the user, and analyzes the user's historical account income and expenditure data. Analysis to determine the user's anti-financial risk level, and then, according to the user's anti-financial risk level, match the user with more suitable financial products; It can greatly improve the degree of matching between financial products and users, provide users with more accurate and customized financial services, provide more targeted financial products for different users, improve user satisfaction, and improve financial product recommendation. Efficiency.

图3为另一个实施例中产品匹配方法的流程示意图。本实施例涉及的是将历史行为数据和账户收支数据输入预设分类模型,获得用户的用户等级的一种可选的实现过程,在上述实施例的基础上,如图3所示,上述步骤202包括:FIG. 3 is a schematic flowchart of a product matching method in another embodiment. This embodiment relates to an optional implementation process of inputting historical behavior data and account income and expenditure data into a preset classification model to obtain the user level of the user. On the basis of the above embodiment, as shown in FIG. 3 , the

步骤301,获取用户的特征向量。

其中,该用户的特征向量包括基于历史行为数据生成的第一特征向量和基于账户收支数据形成的第二特征向量。Wherein, the feature vector of the user includes a first feature vector generated based on historical behavior data and a second feature vector based on account balance data.

具体地,在获取到用户的历史行为数据之后,可以对用户的历史行为数据进行分析,提取出用于表征用户历史行为特征的第一特征向量;其中,该第一特征向量可以包括第一特征子向量和第二特征子向量,第一特征子向量为基于历史搜索记录生成的用于表征用户搜索行为特征的特征向量,第二特征子向量为基于历史浏览记录生成的用于表征用户浏览行为特征的的特征向量。Specifically, after obtaining the user's historical behavior data, the user's historical behavior data can be analyzed to extract a first feature vector that is used to characterize the user's historical behavior features; wherein, the first feature vector can include the first feature sub-vector and second feature sub-vector, the first feature sub-vector is a feature vector generated based on historical search records and used to characterize user search behavior, and the second feature sub-vector is generated based on historical browsing records and used to represent user browsing behavior The eigenvector of the feature.

可选地,可以对历史行为数据中的历史搜索记录进行特性提取,得到用于表征用户搜索行为特征的第一特征子向量;其中,该第一特征子向量中的特征值可以包括但不限于搜索时间、搜索设备以及搜索关键词等;以及可以对历史行为数据中的历史浏览记录进行特征提取,得到用于表征用户浏览行为特征的第二特征子向量;其中,该第二特征子向量中的特征值包括但不限于浏览时间、浏览设备以及历史浏览产品类型。Optionally, feature extraction can be performed on the historical search records in the historical behavior data to obtain a first feature sub-vector that is used to characterize the user's search behavior features; wherein, the feature values in the first feature sub-vector may include but are not limited to Search time, search equipment, search keywords, etc.; and feature extraction can be performed on historical browsing records in historical behavior data to obtain a second feature sub-vector that is used to characterize user browsing behavior features; wherein, in the second feature sub-vector The characteristic values include but are not limited to browsing time, browsing equipment and historical browsing product types.

可选地,对于用户的多个历史搜索记录,可以采用聚类操作对多个历史搜索记录进行聚类分析,并根据聚类结果生成用于表征用户搜索行为特征的第一特征子向量;如:可以采用LDA主题聚类算法对多个历史搜索记录进行聚类分析,得到该第一特征子向量。其中,在进行聚类操作时,对于各个历史搜索记录,可以采用NLPIR汉语分词系统对各个历史搜索记录进行关键词提取和词性标注,得到各个历史搜索记录分别对应的关键词特征向量,进而对各个历史搜索记录的关键词特征向量进行聚类分析,得到用户搜索行为对应的第一特征子向量。可选地,在进行关键词提取时,对于一些特征性不足的词语还可以进行过滤,以便提取出更能体现用户个人搜索特质的关键词特征向量。Optionally, for multiple historical search records of users, clustering operations can be used to perform cluster analysis on multiple historical search records, and according to the clustering results, a first feature sub-vector for characterizing the user's search behavior characteristics is generated; such as : The LDA topic clustering algorithm can be used to perform cluster analysis on multiple historical search records to obtain the first feature sub-vector. Among them, during the clustering operation, for each historical search record, the NLPIR Chinese word segmentation system can be used to perform keyword extraction and part-of-speech tagging for each historical search record, and obtain the keyword feature vector corresponding to each historical search record, and then for each historical search record. The keyword feature vector of the historical search record is subjected to cluster analysis to obtain the first feature sub-vector corresponding to the user's search behavior. Optionally, when performing keyword extraction, some words with insufficient characteristics may also be filtered, so as to extract keyword feature vectors that better reflect the user's personal search characteristics.

同样地,对于用户的多个历史浏览记录也可以采用上述与历史搜索记录相同的分析方法得到用户浏览行为对应第二特征子向量,具体过程不再详细赘述。Similarly, for multiple historical browsing records of the user, the same analysis method as the above-mentioned historical search records can be used to obtain the second feature sub-vector corresponding to the user's browsing behavior, and the specific process will not be described in detail.

另外,服务器在获取到的用户的账户收支数据之后,可以对用户的账户收支数据进行分析,提取出用于表征用户账户收支行为特征的第二特征向量;其中,该第二特征向量中的特征值包括但不限于收入总额、支出总额、单月最小收入额、单月最小支出额、单月最大收入额、单月最大支出额等。In addition, after acquiring the user's account income and expenditure data, the server may analyze the user's account income and expenditure data, and extract a second feature vector that is used to characterize the user's account income and expenditure behavior; wherein, the second feature vector The characteristic values in include but are not limited to total income, total expenditure, minimum monthly income, minimum monthly expenditure, maximum monthly income, maximum monthly expenditure, etc.

进一步地,在得到用于表征用户搜索行为特征的第一特征子向量、用于表征用户浏览行为特征的第二特征子向量、以及用于表征用户账户收支行为特征的第二特征向量之后,可以将该第一特征子向量、第二特征子向量以及第二特征向量进行特征融合,得到用户的特征向量。可选地,可以将第一特征子向量、第二特征子向量以及第二特征向量进行线性变换到一个特定区间,得到用户的特征向量。也可以对第一特征子向量、第二特征子向量以及第二特征向量分别进行冗余度处理,例如:对各个特征向量中的一些近似的词汇进行替换更新;接着,将冗余处理后的第一特征子向量、冗余处理后的第二特征子向量、以及冗余处理后的第二特征向量进行线性变换,得到用户的特征向量;通过冗余处理后的特征向量能够有效解决因特征向量的维度过大导致模型的处理量较大以及模型输出结果的准确度下降的问题。Further, after obtaining the first feature sub-vector for characterizing the user's search behavior feature, the second feature sub-vector for characterizing the user's browsing behavior feature, and the second feature vector for characterizing the user's account income and expenditure behavior feature, Feature fusion may be performed on the first feature sub-vector, the second feature sub-vector and the second feature vector to obtain the feature vector of the user. Optionally, the first feature sub-vector, the second feature sub-vector, and the second feature vector may be linearly transformed into a specific interval to obtain the user's feature vector. Redundancy processing can also be performed on the first feature sub-vector, the second feature sub-vector and the second feature vector respectively, for example: replacing and updating some approximate words in each feature vector; The first feature sub-vector, the redundantly processed second feature sub-vector, and the redundantly processed second feature vector are linearly transformed to obtain the user's feature vector; the redundantly processed feature vector can effectively solve the problem of The dimension of the vector is too large, which leads to the problem that the processing volume of the model is large and the accuracy of the output of the model is reduced.

步骤302,将该特征向量输入至预设分类模型,获得用户的用户等级。Step 302: Input the feature vector into a preset classification model to obtain the user level of the user.

其中,该预设分类模型为采用多个样本特征向量及其对应的等级标签对初始分类模型进行训练获得的。The preset classification model is obtained by training the initial classification model by using multiple sample feature vectors and their corresponding grade labels.

可选地,服务器可以根据多个样本特征向量和各个样本特征向量对应的等级标签,采用有监督的训练方式对初始分类模型进行训练,得到该预设分类模型。当然,为了提高该分类模型的准确率,还可以基于用户的历史行为数据和/或账户收支数据,构造一些样本特征向量,以增加更多的样本数据;接着,可以基于增加的样本特征向量和预先采集的样本特征向量,采用半监督的训练方式对初始分类模型进行训练,得到该预设分类模型。Optionally, the server may use a supervised training method to train the initial classification model according to the plurality of sample feature vectors and the grade labels corresponding to each sample feature vector to obtain the preset classification model. Of course, in order to improve the accuracy of the classification model, some sample feature vectors can also be constructed based on the user's historical behavior data and/or account balance data to add more sample data; then, based on the increased sample feature vectors and the pre-collected sample feature vector, and use the semi-supervised training method to train the initial classification model to obtain the preset classification model.

进一步地,服务器可以通过该预设分类模型确定用户的用户等级,即将用户的特征向量输入至该预设分类模型,获得用户的用户等级。Further, the server may determine the user level of the user through the preset classification model, that is, input the feature vector of the user into the preset classification model to obtain the user level of the user.

本实施例中,通过获取用户的包括基于历史行为数据生成的第一特征向量和基于账户收支数据形成的第二特征向量在内的特征向量,并将该特征向量输入至预设分类模型,获得用户的用户等级;其中,该预设分类模型为采用多个样本特征向量及其对应的等级标签对初始分类模型进行训练获得的;由于第一特征向量能够表征用户的搜索行为和浏览行为,第二特征向量能够表征用户的账户收支行为,因此,基于第一特征向量和第二特征向量确定用户等级,不仅能够减少分类模型的输入数据量,提高分类模型的处理效率,还能提高分类模型的输出准确率,即能够提高用户等级的准确性。In this embodiment, by acquiring the feature vector of the user including the first feature vector generated based on historical behavior data and the second feature vector based on account balance data, and inputting the feature vector into the preset classification model, Obtain the user level of the user; wherein, the preset classification model is obtained by using multiple sample feature vectors and their corresponding level labels to train the initial classification model; since the first feature vector can represent the user's search behavior and browsing behavior, The second feature vector can represent the user's account income and expenditure behavior. Therefore, determining the user level based on the first feature vector and the second feature vector can not only reduce the input data volume of the classification model, improve the processing efficiency of the classification model, but also improve the classification The output accuracy of the model, that is, the accuracy that can improve the user level.

图4为另一个实施例中产品匹配方法的流程示意图。本实施例涉及的是根据用户等级,从产品数据库中确定与用户匹配的第一目标产品的一种可选的实现过程,在上述实施例的基础上,如图4所示,上述步骤203包括:FIG. 4 is a schematic flowchart of a product matching method in another embodiment. This embodiment relates to an optional implementation process of determining the first target product matching the user from the product database according to the user level. On the basis of the foregoing embodiment, as shown in FIG. 4 , the foregoing

步骤401,获取产品数据库中各金融产品的标签信息。Step 401: Obtain label information of each financial product in the product database.

其中,该金融产品的标签信息包括产品类型、起购标准、风险等级、收益等级、年限中的至少一个。Wherein, the label information of the financial product includes at least one of product type, starting purchase standard, risk level, income level, and age.

可选地,针对每一个金融产品的标签信息,可以通过对金融产品的相关信息进行分析来获取金融产品的标签信息;金融产品的相关信息可以包括但不限于是金融产品的名称、类型、起购范围、收益率、年化利率、风险指数、回报率等,通过对金融产品的相关信息和预设的不同标签的划分规则进行分析,来确定金融产品的每一个标签信息分别对应的标签值;例如:可以根据不同起购标准分别对应的参考起购范围和金融产品的实际起购范围,确定该金融产品对应的起购标准。Optionally, for the label information of each financial product, the label information of the financial product can be obtained by analyzing the relevant information of the financial product; Purchase range, rate of return, annualized interest rate, risk index, rate of return, etc., through the analysis of the relevant information of financial products and the preset division rules of different tags, to determine the corresponding tag value of each tag information of financial products. ; For example, the minimum purchase standard corresponding to the financial product can be determined according to the reference minimum purchase range and the actual minimum purchase range of the financial product corresponding to different minimum purchase standards.

在本实施例的其中一个可选的实现方式中,服务器可以对银行所需营销的理财产品和存款产品进行分类;通过对金融产品进行业务分类,根据风险及收益高低进行分级划分同时对不同的存款产品进行不同年限的设定分类,得到每个金融产品的至少一个标签信息,以此建立金融产品的产品数据库。In an optional implementation manner of this embodiment, the server may classify wealth management products and deposit products that the bank needs to market; by classifying financial products by business, classification is performed according to the level of risks and returns. Deposit products are classified into different years, and at least one label information of each financial product is obtained, thereby establishing a product database of financial products.

步骤402,根据用户等级以及各金融产品的标签信息,确定与用户匹配的第一目标产品。

可选地,对于金融产品的各个标签信息,由于每个标签信息可以对应不同的标签值,因此,对于一个标签信息的不同标签值可以预设不同的等级;如起购标准中可以包括第一起购标准和第二起购标准,其中,第一起购标准小于第二起购标准,对于第一起购标准可以设置第一等级,第二起购标准可以设置第二等级,第一等级可以低于第二等级。Optionally, for each tag information of a financial product, since each tag information can correspond to a different tag value, different levels can be preset for different tag values of a tag information; purchase standard and second minimum purchase standard, wherein the first minimum purchase standard is lower than the second minimum purchase standard, a first level can be set for the first minimum purchase standard, a second level can be set for the second minimum purchase standard, and the first level can be lower than second level.

那么,基于上述标签信息和标签信息对应的等级,可选地,针对产品数据库中的各金融产品,可以确定金融产品的各个标签信息分别对应的参考等级,接着,可以根据用户等级与各个标签信息对应的参考等级确定金融产品对应的用户匹配度;进而,可以根据各金融产品对应的用户匹配度,选择与用户匹配的第一目标产品。也就是说,针对每一个金融产品来说,可以分别对比用户等级和该金融产品的每一个标签信息对应的参考等级,得到该金融产品对应的用户匹配度,可选地,金融产品的各个标签信息中,与用户等级匹配的标签信息越多,金融产品对应的用户匹配度越高,即用户匹配度和与用户等级匹配的标签信息的数量正相关。Then, based on the above label information and the level corresponding to the label information, optionally, for each financial product in the product database, the reference level corresponding to each label information of the financial product may be determined, and then, according to the user level and each label information The corresponding reference level determines the user matching degree corresponding to the financial product; further, the first target product matching the user can be selected according to the user matching degree corresponding to each financial product. That is to say, for each financial product, the user level and the reference level corresponding to each label information of the financial product can be compared respectively to obtain the user matching degree corresponding to the financial product. In the information, the more tag information matching the user level, the higher the user matching degree corresponding to the financial product, that is, the user matching degree is positively correlated with the number of tag information matching the user level.

进一步地,在得到产品数据库中的各个金融产品分别对应的用户匹配度之后,可以将用户匹配度较高的金融产品确定为与用户匹配的第一目标产品。可选地,可以将用户匹配度大于等于预设匹配度阈值的金融产品确定为与用户匹配的第一目标产品;也可以将各金融产品对应的用户匹配度,按照从大到小的顺序进行排序处理,并将排序处理后的前预设数量的金融产品作为与用户匹配的第一目标产品。本实施例中对第一目标产品的确定方式并不做具体限定。Further, after obtaining the user matching degree corresponding to each financial product in the product database, a financial product with a higher user matching degree may be determined as the first target product matched with the user. Optionally, a financial product with a user matching degree greater than or equal to a preset matching degree threshold may be determined as the first target product matched with the user; the user matching degree corresponding to each financial product may also be determined in descending order. The sorting process is performed, and the first preset number of financial products after the sorting process is used as the first target product matched with the user. The manner of determining the first target product is not specifically limited in this embodiment.

本实施例中,服务器通过获取产品数据库中各金融产品的标签信息,根据用户等级以及各金融产品的标签信息,确定与用户匹配的第一目标产品;其中,该金融产品的标签信息包括产品类型、起购标准、风险等级、收益等级、年限中的至少一个;通过将用户等级和金融产品的各个标签信息一一进行匹配,得到与用户匹配程度高的第一目标产品,能够提高产品与用户之间的匹配程度,得到与用户匹配度高、针对性强的产品。In this embodiment, the server obtains the label information of each financial product in the product database, and determines the first target product that matches the user according to the user level and the label information of each financial product; wherein, the label information of the financial product includes the product type , at least one of the purchase criteria, risk level, income level, and age; by matching the user level with each label information of financial products, the first target product with a high degree of matching with the user can be obtained, which can improve the product and user relationship. The degree of matching between them can obtain products with a high degree of matching with users and a strong target.

图5为另一个实施例中产品匹配方法的流程示意图。本实施例涉及的是根据用户等级与各个标签信息对应的参考等级确定金融产品对应的用户匹配度的一种可选的实现过程,在上述实施例的基础上,如图5所示,上述方法还包括:FIG. 5 is a schematic flowchart of a product matching method in another embodiment. This embodiment relates to an optional implementation process of determining the user matching degree corresponding to the financial product according to the user level and the reference level corresponding to each tag information. On the basis of the above embodiment, as shown in FIG. 5 , the above method Also includes:

步骤501,根据各个标签信息对应的参考等级,确定金融产品的各个标签信息中,与用户等级匹配的目标标签信息。

可选地,与用户等级匹配可以是标签信息对应的参考等级与用户等级相同,也可以是标签信息对应的参考等级低于用户等级,也就是说,在标签信息对应的参考等级与用户等级相同,或者,标签信息对应的参考等级低于用户等级时,该标签信息均可以作为与用户等级匹配的目标标签信息。Optionally, matching with the user level may be that the reference level corresponding to the tag information is the same as the user level, or it may be that the reference level corresponding to the tag information is lower than the user level, that is, the reference level corresponding to the tag information is the same as the user level. , or, when the reference level corresponding to the tag information is lower than the user level, the tag information can be used as the target tag information matching the user level.

步骤502,对各目标标签信息进行加权处理,确定金融产品对应的用户匹配度。Step 502: Perform weighting processing on each target tag information to determine the user matching degree corresponding to the financial product.

可选地,对于金融产品的多个标签信息,可以预设不同的优先级别,即可以为不同的标签信息设置不同的权重系数,权重越高,表示该标签信息的重要程度越高,也可表示与用户匹配的关联程度越高;当然,对于不同的标签信息,也可以设置相同的权重系数。如:对于金融产品的标签信息中的风险等级对应的权重系数可以高于起购标准对应的权重系数,风险等级对应的权重系数和收益等级对应的权重系数也可以相同。Optionally, for multiple label information of financial products, different priority levels can be preset, that is, different weight coefficients can be set for different label information. The higher the weight, the higher the importance of the label information. Indicates that the degree of association with user matching is higher; of course, for different label information, the same weight coefficient can also be set. For example, the weight coefficient corresponding to the risk level in the label information of a financial product may be higher than the weight coefficient corresponding to the purchase standard, and the weight coefficient corresponding to the risk level and the weight coefficient corresponding to the income level may also be the same.

基于此,在确定出金融产品的目标标签信息之后,可以基于各目标标签信息和各目标标签信息分别对应的权重系数,对各目标标签信息进行加权处理,得到该金融产品对应的用户匹配度。Based on this, after the target label information of the financial product is determined, each target label information can be weighted based on the target label information and the weight coefficients corresponding to each target label information to obtain the user matching degree corresponding to the financial product.

本实施例中,服务器根据各个标签信息对应的参考等级,确定金融产品的各个标签信息中,与用户等级匹配的目标标签信息,并对各目标标签信息进行加权处理,确定金融产品对应的用户匹配度;通过为不同的标签信息设置不同的权重系数,使得金融产品对应的用户匹配度更能表征用户和产品之间的匹配程度,得到针对性更强的金融产品,提高金融产品与用户之间的匹配程度。In this embodiment, according to the reference level corresponding to each tag information, the server determines the target tag information matching the user level in each tag information of the financial product, and performs weighting processing on each target tag information to determine the user matching corresponding to the financial product. By setting different weight coefficients for different label information, the user matching degree corresponding to financial products can better represent the matching degree between users and products, and more targeted financial products can be obtained, improving the relationship between financial products and users. degree of matching.

图6为另一个实施例中产品匹配方法的流程示意图。本实施例涉及的是根据用户的搜索信息为用户匹配金融产品的一种可选的实现过程,在上述实施例的基础上,如图6所示,上述方法还包括:FIG. 6 is a schematic flowchart of a product matching method in another embodiment. This embodiment relates to an optional implementation process of matching financial products for users according to the user's search information. On the basis of the foregoing embodiment, as shown in FIG. 6 , the foregoing method further includes:

步骤601,获取用户通过目标客户端输入的当前搜索信息。Step 601: Acquire current search information input by a user through a target client.

其中,该当前搜索信息可以为与金融产品相关的搜索信息,包括但不限于是产品名称、产品类型、起购标准、风险等级、收益等级、年限等。Wherein, the current search information may be search information related to financial products, including but not limited to product name, product type, starting purchase standard, risk level, income level, age, and the like.

可选地,该目标客户端可以是用户通过该用户的登录账号登录客户端应用程序的客户端。Optionally, the target client may be a client through which the user logs in to the client application through the user's login account.

步骤602,根据当前搜索信息、用户等级,从产品数据库中确定与当前搜索信息及用户等级匹配的第二目标产品。

可选地,服务器可以先根据当前搜索信息,从产品数据库中筛选出与当前搜索信息对应的候选金融产品,接着,再根据用户等级从候选金融产品中确定与用户等级匹配的金融产品,作为与用户匹配的第二目标产品;其中,根据用户等级从候选金融产品中确定与用户等级匹配的金融产品的实现过程可以参照上述图2和图4给出的实施例中的相关描述过程,在此不再赘述。Optionally, the server can first screen out candidate financial products corresponding to the current search information from the product database according to the current search information, and then, according to the user level, determine the financial product that matches the user level from the candidate financial products, as the corresponding financial product. The second target product matched by the user; wherein, the implementation process of determining the financial product matching the user level from the candidate financial products according to the user level can refer to the relevant description process in the embodiments given in the above-mentioned FIG. 2 and FIG. 4 , here No longer.

可选地,服务器也可以先根据用户等级从产品数据库中筛选出与用户等级匹配的候选金融产品,接着,再根据当前搜索信息从候选金融产品中确定与当前搜索信息匹配的金融产品,作为与用户匹配的第二目标产品。Optionally, the server may also first screen out candidate financial products matching the user level from the product database according to the user level, and then determine the financial product matching the current search information from the candidate financial products according to the current search information, as the corresponding financial product. The second target product matched by the user.

步骤603,将第二目标产品发送至目标客户端。

本实施例中,服务器通过获取用户通过目标客户端输入的当前搜索信息,并根据当前搜索信息、用户等级,从产品数据库中确定与当前搜索信息及用户等级匹配的第二目标产品;最后,将第二目标产品发送至目标客户端;也就是说,本实施例,服务器还可以根据用户的搜索信息,结合用户的用户等级,为用户匹配更合适的金融产品,相比于现有技术中直接根据用户搜索信息确认与用户匹配的金融产品而言,本实施例中,通过结合用户的用户等级,能够提高用户和产品之间的匹配程度。In this embodiment, the server obtains the current search information input by the user through the target client, and according to the current search information and user level, determines the second target product from the product database that matches the current search information and the user level; The second target product is sent to the target client; that is to say, in this embodiment, the server can also match the user with a more suitable financial product according to the user's search information and the user's user level, which is more direct than in the prior art. As far as the financial product matching the user is confirmed according to the user search information, in this embodiment, the matching degree between the user and the product can be improved by combining the user level of the user.

应该理解的是,虽然如上所述的各实施例所涉及的流程图中的各个步骤按照箭头的指示依次显示,但是这些步骤并不是必然按照箭头指示的顺序依次执行。除非本文中有明确的说明,这些步骤的执行并没有严格的顺序限制,这些步骤可以以其它的顺序执行。而且,如上所述的各实施例所涉及的流程图中的至少一部分步骤可以包括多个步骤或者多个阶段,这些步骤或者阶段并不必然是在同一时刻执行完成,而是可以在不同的时刻执行,这些步骤或者阶段的执行顺序也不必然是依次进行,而是可以与其它步骤或者其它步骤中的步骤或者阶段的至少一部分轮流或者交替地执行。It should be understood that, although the steps in the flowcharts involved in the above embodiments are sequentially displayed according to the arrows, these steps are not necessarily executed in the order indicated by the arrows. Unless explicitly stated herein, the execution of these steps is not strictly limited to the order, and these steps may be performed in other orders. Moreover, at least a part of the steps in the flowcharts involved in the above embodiments may include multiple steps or multiple stages, and these steps or stages are not necessarily executed and completed at the same time, but may be performed at different times The execution order of these steps or phases is not necessarily sequential, but may be performed alternately or alternately with other steps or at least a part of the steps or phases in the other steps.

基于同样的发明构思,本申请实施例还提供了一种用于实现上述所涉及的产品匹配方法的产品匹配装置。该装置所提供的解决问题的实现方案与上述方法中所记载的实现方案相似,故下面所提供的一个或多个产品匹配装置实施例中的具体限定可以参见上文中对于产品匹配方法的限定,在此不再赘述。Based on the same inventive concept, an embodiment of the present application also provides a product matching device for implementing the above-mentioned product matching method. The implementation solution for solving the problem provided by the device is similar to the implementation solution described in the above method, so the specific limitations in one or more embodiments of the product matching device provided below can refer to the above limitations on the product matching method, It is not repeated here.

在一个实施例中,如图7所示,提供了一种产品匹配装置,包括:第一获取模块701、第二获取模块702和确定模块703,其中:In one embodiment, as shown in FIG. 7, a product matching apparatus is provided, including: a first obtaining

第一获取模块701,用于获取用户的历史行为数据和账户收支数据;该历史行为数据包括用户对于金融产品的历史搜索记录以及历史浏览记录;The

第二获取模块702,用于将历史行为数据和账户收支数据输入预设分类模型,获得用户的用户等级;该用户等级用于表征用户的抗金融风险能力;The second obtaining

确定模块703,用于根据用户等级,从产品数据库中确定与用户匹配的第一目标产品;其中,该产品数据库中包括多个具有标签信息的金融产品。The determining

在其中一个实施例中,上述第二获取模块702包括第一获取单元和第二获取单元;其中,第一获取单元,用于获取用户的特征向量;该用户的特征向量包括基于历史行为数据生成的第一特征向量和基于账户收支数据形成的第二特征向量;第二获取单元,用于将该特征向量输入至预设分类模型,获得用户的用户等级;其中,该预设分类模型为采用多个样本特征向量及其对应的等级标签对初始分类模型进行训练获得的。In one embodiment, the above-mentioned second obtaining

在其中一个实施例中,上述第一获取单元,具体用于对历史搜索记录进行特征提取,获得第一特征子向量;该第一特征子向量中的特征值包括搜索时间、搜索设备以及搜索关键词;以及对历史浏览记录进行特征提取,获得第二特征子向量;该第二特征子向量中的特征值包括浏览时间、浏览设备以及历史浏览产品类型;第一特征向量包括第一特征子向量和第二特征子向量;以及基于账户收支数据,获得第二特征向量;该第二特征向量中的特征值包括收入总额、支出总额以及单月最小收入额;接着,将第一特征子向量、第二特征子向量以及第二特征向量进行特征融合,获得用户的特征向量。In one embodiment, the above-mentioned first obtaining unit is specifically configured to perform feature extraction on historical search records to obtain a first feature sub-vector; the feature values in the first feature sub-vector include search time, search device, and search key and performing feature extraction on historical browsing records to obtain a second feature sub-vector; the feature values in the second feature sub-vector include browsing time, browsing equipment and historical browsing product type; the first feature vector includes the first feature sub-vector and the second eigenvector; and based on the account balance and expenditure data, obtain a second eigenvector; the eigenvalues in the second eigenvector include the total income, the total expenditure and the minimum monthly income; then, the first eigenvector , the second feature sub-vector and the second feature vector to perform feature fusion to obtain the feature vector of the user.

在其中一个实施例中,上述确定模块703包括第三获取单元和确定单元;其中,第三获取单元,用于获取产品数据库中各金融产品的标签信息;该金融产品的标签信息包括产品类型、起购标准、风险等级、收益等级、年限中的至少一个;确定单元,用于根据用户等级以及各金融产品的标签信息,确定与用户匹配的第一目标产品。In one embodiment, the

在其中一个实施例中,上述确定单元,具体用于针对产品数据库中的各金融产品,确定金融产品的各个标签信息对应的参考等级,并根据用户等级与各个标签信息对应的参考等级确定金融产品对应的用户匹配度;根据各金融产品对应的用户匹配度,选择与用户匹配的第一目标产品。In one of the embodiments, the above determining unit is specifically configured to, for each financial product in the product database, determine the reference level corresponding to each label information of the financial product, and determine the financial product according to the user level and the reference level corresponding to each label information The corresponding user matching degree; according to the user matching degree corresponding to each financial product, the first target product that matches the user is selected.

在其中一个实施例中,上述确定单元,具体用于根据各个标签信息对应的参考等级,确定金融产品的各个标签信息中,与用户等级匹配的目标标签信息;对各目标标签信息进行加权处理,确定金融产品对应的用户匹配度。In one embodiment, the above determining unit is specifically configured to determine, according to the reference level corresponding to each label information, target label information that matches the user level in each label information of the financial product; perform weighting processing on each target label information, Determine the user matching degree corresponding to the financial product.

在其中一个实施例中,上述确定单元,具体用于将各金融产品对应的用户匹配度,按照从大到小的顺序进行排序处理;将排序处理后的前预设数量的金融产品作为与用户匹配的第一目标产品。In one embodiment, the above determining unit is specifically configured to sort the user matching degree corresponding to each financial product in descending order; Match the first target product.

在其中一个实施例中,该装置还包括第三获取模块和发送模块;该第三获取模块,用于获取用户通过目标客户端输入的当前搜索信息;上述确定模块703,还用于根据当前搜索信息、用户等级,从产品数据库中确定与当前搜索信息及用户等级匹配的第二目标产品;发送模块,用于将第二目标产品发送至目标客户端。In one embodiment, the apparatus further includes a third obtaining module and a sending module; the third obtaining module is used to obtain the current search information input by the user through the target client; the above-mentioned determining

上述产品匹配装置中的各个模块可全部或部分通过软件、硬件及其组合来实现。上述各模块可以硬件形式内嵌于或独立于计算机设备中的处理器中,也可以以软件形式存储于计算机设备中的存储器中,以便于处理器调用执行以上各个模块对应的操作。Each module in the above-mentioned product matching device can be implemented in whole or in part by software, hardware and combinations thereof. The above modules can be embedded in or independent of the processor in the computer device in the form of hardware, or stored in the memory in the computer device in the form of software, so that the processor can call and execute the operations corresponding to the above modules.

在一个实施例中,提供了一种计算机设备,该计算机设备可以是服务器,其内部结构图可以如图8所示。该计算机设备包括通过系统总线连接的处理器、存储器和网络接口。其中,该计算机设备的处理器用于提供计算和控制能力。该计算机设备的存储器包括非易失性存储介质和内存储器。该非易失性存储介质存储有操作系统、计算机程序和数据库。该内存储器为非易失性存储介质中的操作系统和计算机程序的运行提供环境。该计算机设备的数据库用于存储产品数据库以及产品数据库中各个金融产品的标签信息,以及用户的历史行为数据和用户的账户收支数据。该计算机设备的网络接口用于与外部的终端通过网络连接通信。该计算机程序被处理器执行时以实现一种产品匹配方法。In one embodiment, a computer device is provided, and the computer device may be a server, and its internal structure diagram may be as shown in FIG. 8 . The computer device includes a processor, memory, and a network interface connected by a system bus. Among them, the processor of the computer device is used to provide computing and control capabilities. The memory of the computer device includes non-volatile storage media and internal memory. The nonvolatile storage medium stores an operating system, a computer program, and a database. The internal memory provides an environment for the execution of the operating system and computer programs in the non-volatile storage medium. The database of the computer device is used to store the product database and the label information of each financial product in the product database, as well as the user's historical behavior data and the user's account balance and expenditure data. The network interface of the computer device is used to communicate with an external terminal through a network connection. The computer program, when executed by a processor, implements a product matching method.

本领域技术人员可以理解,图8中示出的结构,仅仅是与本申请方案相关的部分结构的框图,并不构成对本申请方案所应用于其上的计算机设备的限定,具体的计算机设备可以包括比图中所示更多或更少的部件,或者组合某些部件,或者具有不同的部件布置。Those skilled in the art can understand that the structure shown in FIG. 8 is only a block diagram of a part of the structure related to the solution of the present application, and does not constitute a limitation on the computer equipment to which the solution of the present application is applied. Include more or fewer components than shown in the figures, or combine certain components, or have a different arrangement of components.

在一个实施例中,提供了一种计算机设备,包括存储器和处理器,存储器中存储有计算机程序,该处理器执行计算机程序时实现上述各个实施例中提供的产品匹配方法的步骤。In one embodiment, a computer device is provided, including a memory and a processor, where a computer program is stored in the memory, and when the processor executes the computer program, the processor implements the steps of the product matching method provided in each of the foregoing embodiments.

在一个实施例中,提供了一种计算机可读存储介质,其上存储有计算机程序,计算机程序被处理器执行时实现上述各个实施例中提供的产品匹配方法的步骤。In one embodiment, a computer-readable storage medium is provided, on which a computer program is stored, and when the computer program is executed by a processor, implements the steps of the product matching method provided in each of the foregoing embodiments.

在一个实施例中,提供了一种计算机程序产品,包括计算机程序,该计算机程序被处理器执行时实现上述各个实施例中提供的产品匹配方法的步骤。In one embodiment, a computer program product is provided, including a computer program that, when executed by a processor, implements the steps of the product matching method provided in each of the foregoing embodiments.

需要说明的是,本申请所涉及的用户信息(包括但不限于用户设备信息、用户个人信息等)和数据(包括但不限于用于分析的数据、存储的数据、展示的数据等),均为经用户授权或者经过各方充分授权的信息和数据。It should be noted that the user information (including but not limited to user equipment information, user personal information, etc.) and data (including but not limited to data for analysis, stored data, displayed data, etc.) involved in this application are all Information and data authorized by the user or fully authorized by the parties.

本领域普通技术人员可以理解实现上述实施例方法中的全部或部分流程,是可以通过计算机程序来指令相关的硬件来完成,所述的计算机程序可存储于一非易失性计算机可读取存储介质中,该计算机程序在执行时,可包括如上述各方法的实施例的流程。其中,本申请所提供的各实施例中所使用的对存储器、数据库或其它介质的任何引用,均可包括非易失性和易失性存储器中的至少一种。非易失性存储器可包括只读存储器(Read-OnlyMemory,ROM)、磁带、软盘、闪存、光存储器、高密度嵌入式非易失性存储器、阻变存储器(ReRAM)、磁变存储器(Magnetoresistive Random Access Memory,MRAM)、铁电存储器(Ferroelectric Random Access Memory,FRAM)、相变存储器(Phase Change Memory,PCM)、石墨烯存储器等。易失性存储器可包括随机存取存储器(Random Access Memory,RAM)或外部高速缓冲存储器等。作为说明而非局限,RAM可以是多种形式,比如静态随机存取存储器(Static Random Access Memory,SRAM)或动态随机存取存储器(Dynamic RandomAccess Memory,DRAM)等。本申请所提供的各实施例中所涉及的数据库可包括关系型数据库和非关系型数据库中至少一种。非关系型数据库可包括基于区块链的分布式数据库等,不限于此。本申请所提供的各实施例中所涉及的处理器可为通用处理器、中央处理器、图形处理器、数字信号处理器、可编程逻辑器、基于量子计算的数据处理逻辑器等,不限于此。Those of ordinary skill in the art can understand that all or part of the processes in the methods of the above embodiments can be implemented by instructing relevant hardware through a computer program, and the computer program can be stored in a non-volatile computer-readable storage In the medium, when the computer program is executed, it may include the processes of the above-mentioned method embodiments. Wherein, any reference to a memory, a database or other media used in the various embodiments provided in this application may include at least one of a non-volatile memory and a volatile memory. Non-volatile memory may include Read-Only Memory (ROM), magnetic tape, floppy disk, flash memory, optical memory, high-density embedded non-volatile memory, resistive memory (ReRAM), magnetic variable memory (Magnetoresistive Random Memory) Access Memory (MRAM), Ferroelectric Random Access Memory (FRAM), Phase Change Memory (PCM), graphene memory, and the like. Volatile memory may include random access memory (Random Access Memory, RAM) or external cache memory, and the like. By way of illustration and not limitation, the RAM may be in various forms, such as static random access memory (Static Random Access Memory, SRAM) or dynamic random access memory (Dynamic Random Access Memory, DRAM). The database involved in the various embodiments provided in this application may include at least one of a relational database and a non-relational database. The non-relational database may include a blockchain-based distributed database, etc., but is not limited thereto. The processors involved in the various embodiments provided in this application may be general-purpose processors, central processing units, graphics processors, digital signal processors, programmable logic devices, data processing logic devices based on quantum computing, etc., and are not limited to this.

以上实施例的各技术特征可以进行任意的组合,为使描述简洁,未对上述实施例中的各个技术特征所有可能的组合都进行描述,然而,只要这些技术特征的组合不存在矛盾,都应当认为是本说明书记载的范围。The technical features of the above embodiments can be combined arbitrarily. In order to make the description simple, all possible combinations of the technical features in the above embodiments are not described. However, as long as there is no contradiction in the combination of these technical features It is considered to be the range described in this specification.

以上所述实施例仅表达了本申请的几种实施方式,其描述较为具体和详细,但并不能因此而理解为对本申请专利范围的限制。应当指出的是,对于本领域的普通技术人员来说,在不脱离本申请构思的前提下,还可以做出若干变形和改进,这些都属于本申请的保护范围。因此,本申请的保护范围应以所附权利要求为准。The above-mentioned embodiments only represent several embodiments of the present application, and the descriptions thereof are relatively specific and detailed, but should not be construed as a limitation on the scope of the patent of the present application. It should be pointed out that for those skilled in the art, without departing from the concept of the present application, several modifications and improvements can be made, which all belong to the protection scope of the present application. Therefore, the scope of protection of the present application should be determined by the appended claims.

Claims (12)

Translated fromChinesePriority Applications (1)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| CN202210445601.8ACN114693409A (en) | 2022-04-24 | 2022-04-24 | Product matching method, device, computer equipment, storage medium and program product |

Applications Claiming Priority (1)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| CN202210445601.8ACN114693409A (en) | 2022-04-24 | 2022-04-24 | Product matching method, device, computer equipment, storage medium and program product |

Publications (1)

| Publication Number | Publication Date |

|---|---|

| CN114693409Atrue CN114693409A (en) | 2022-07-01 |

Family

ID=82144348

Family Applications (1)

| Application Number | Title | Priority Date | Filing Date |

|---|---|---|---|

| CN202210445601.8APendingCN114693409A (en) | 2022-04-24 | 2022-04-24 | Product matching method, device, computer equipment, storage medium and program product |

Country Status (1)

| Country | Link |

|---|---|

| CN (1) | CN114693409A (en) |

Cited By (3)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| CN115994821A (en)* | 2023-01-09 | 2023-04-21 | 中云融拓数据科技发展(深圳)有限公司 | Method for establishing financial wind control system based on industrial chain digital scene financial model |

| CN116226740A (en)* | 2023-02-15 | 2023-06-06 | 中国工商银行股份有限公司 | Customer maintenance method, device, processor and electronic equipment |

| CN117112628A (en)* | 2023-09-08 | 2023-11-24 | 廊坊丛林科技有限公司 | Logistics data updating method and system |

Citations (4)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| CN108665366A (en)* | 2018-04-27 | 2018-10-16 | 平安科技(深圳)有限公司 | Determine method, terminal device and the computer readable storage medium of consumer's risk grade |

| CN109447728A (en)* | 2018-09-07 | 2019-03-08 | 平安科技(深圳)有限公司 | Financial product recommended method, device, computer equipment and storage medium |

| CN111833187A (en)* | 2020-07-07 | 2020-10-27 | 北京比财数据科技有限公司 | A liquidity-based one-click financial product trading method, device and system |

| CN114119232A (en)* | 2021-12-01 | 2022-03-01 | 中国工商银行股份有限公司 | Financial product recommendation method and device, computer equipment and storage medium |

- 2022

- 2022-04-24CNCN202210445601.8Apatent/CN114693409A/enactivePending

Patent Citations (4)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| CN108665366A (en)* | 2018-04-27 | 2018-10-16 | 平安科技(深圳)有限公司 | Determine method, terminal device and the computer readable storage medium of consumer's risk grade |

| CN109447728A (en)* | 2018-09-07 | 2019-03-08 | 平安科技(深圳)有限公司 | Financial product recommended method, device, computer equipment and storage medium |

| CN111833187A (en)* | 2020-07-07 | 2020-10-27 | 北京比财数据科技有限公司 | A liquidity-based one-click financial product trading method, device and system |

| CN114119232A (en)* | 2021-12-01 | 2022-03-01 | 中国工商银行股份有限公司 | Financial product recommendation method and device, computer equipment and storage medium |

Cited By (3)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| CN115994821A (en)* | 2023-01-09 | 2023-04-21 | 中云融拓数据科技发展(深圳)有限公司 | Method for establishing financial wind control system based on industrial chain digital scene financial model |

| CN116226740A (en)* | 2023-02-15 | 2023-06-06 | 中国工商银行股份有限公司 | Customer maintenance method, device, processor and electronic equipment |

| CN117112628A (en)* | 2023-09-08 | 2023-11-24 | 廊坊丛林科技有限公司 | Logistics data updating method and system |

Similar Documents

| Publication | Publication Date | Title |

|---|---|---|

| CN112085205A (en) | Method and system for automatically training machine learning models | |

| CN114693409A (en) | Product matching method, device, computer equipment, storage medium and program product | |

| CN114819967B (en) | Data processing method, device, electronic device and computer readable storage medium | |

| CN105224699A (en) | A kind of news recommend method and device | |

| CN110880006B (en) | User classification method, device, computer equipment and storage medium | |

| CN116150663B (en) | Data classification method, device, computer equipment and storage medium | |

| CN111429161B (en) | Feature extraction method, feature extraction device, storage medium and electronic equipment | |

| CN118941365B (en) | Commodity pushing method and system based on user preference analysis | |

| US11593740B1 (en) | Computing system for automated evaluation of process workflows | |

| CN115080868A (en) | Product push method, apparatus, computer equipment, storage medium and program product | |

| CN115311042A (en) | Commodity recommendation method and device, computer equipment and storage medium | |

| CN119323452A (en) | Cloud computing-based customer data integrated management system and method | |

| CN115239355A (en) | Customer classification method, apparatus, computer device and storage medium | |

| US20250238981A1 (en) | Data interpolation platform | |

| CN118014693A (en) | Member commodity pushing method, device, system, electronic equipment and storage medium | |

| Thakur et al. | Enhancing customer experience through ai-powered personalization: A data science perspective in e-commerce | |

| Kulkarni et al. | IOT data Fusion framework for e-commerce | |

| CN115630221A (en) | Terminal application interface display data processing method and device and computer equipment | |

| CN117009575A (en) | Video recommendation method and device and electronic equipment | |

| CN114579867A (en) | Method and apparatus for resource recommendation, electronic device and storage medium | |

| CN114065042A (en) | User demand prediction method and device, electronic equipment and readable storage medium | |

| CN116308641A (en) | Product recommendation method, training device, electronic equipment and medium | |

| CN114819691A (en) | Information matching method, device, server, storage medium and program product | |

| CN116452225A (en) | Object classification method, device, computer equipment and storage medium | |

| CN112836743A (en) | User label determination method, device and server |

Legal Events

| Date | Code | Title | Description |

|---|---|---|---|

| PB01 | Publication | ||

| PB01 | Publication | ||

| SE01 | Entry into force of request for substantive examination | ||

| SE01 | Entry into force of request for substantive examination |