CN114187096A - Risk assessment method, device, equipment and storage medium based on user portrait - Google Patents

Risk assessment method, device, equipment and storage medium based on user portraitDownload PDFInfo

- Publication number

- CN114187096A CN114187096ACN202111524803.3ACN202111524803ACN114187096ACN 114187096 ACN114187096 ACN 114187096ACN 202111524803 ACN202111524803 ACN 202111524803ACN 114187096 ACN114187096 ACN 114187096A

- Authority

- CN

- China

- Prior art keywords

- user

- data

- risk

- loan

- repayment

- Prior art date

- Legal status (The legal status is an assumption and is not a legal conclusion. Google has not performed a legal analysis and makes no representation as to the accuracy of the status listed.)

- Granted

Links

Images

Classifications

- G—PHYSICS

- G06—COMPUTING OR CALCULATING; COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q40/00—Finance; Insurance; Tax strategies; Processing of corporate or income taxes

- G06Q40/03—Credit; Loans; Processing thereof

- G—PHYSICS

- G06—COMPUTING OR CALCULATING; COUNTING

- G06F—ELECTRIC DIGITAL DATA PROCESSING

- G06F16/00—Information retrieval; Database structures therefor; File system structures therefor

- G06F16/90—Details of database functions independent of the retrieved data types

- G06F16/95—Retrieval from the web

- G06F16/953—Querying, e.g. by the use of web search engines

- G06F16/9535—Search customisation based on user profiles and personalisation

Landscapes

- Engineering & Computer Science (AREA)

- Business, Economics & Management (AREA)

- Databases & Information Systems (AREA)

- Theoretical Computer Science (AREA)

- Physics & Mathematics (AREA)

- Accounting & Taxation (AREA)

- Finance (AREA)

- General Physics & Mathematics (AREA)

- Development Economics (AREA)

- Technology Law (AREA)

- General Business, Economics & Management (AREA)

- Strategic Management (AREA)

- Marketing (AREA)

- Economics (AREA)

- Data Mining & Analysis (AREA)

- General Engineering & Computer Science (AREA)

- Financial Or Insurance-Related Operations Such As Payment And Settlement (AREA)

Abstract

Translated fromChineseDescription

Translated fromChinese技术领域technical field

本发明涉及人工智能技术领域,尤其涉及一种基于用户画像的风险评估方法、装置、电子设备及计算机可读存储介质。The present invention relates to the technical field of artificial intelligence, and in particular, to a user portrait-based risk assessment method, device, electronic device and computer-readable storage medium.

背景技术Background technique

随着信用社会的到来,人们越来越常见使用信用消费(贷款)来实现未来预期的购买计划,导致市场上涌现出越来越多的贷款公司或可提供贷款业务的公司,但由于人们对于信用消费的需求也越来越大,导致各公司的贷款规模也日益庞大,当贷款数额达到一定规模后,若贷款人无法及时还款,将会造成提供贷款的公司现金流出现断裂,进而导致公司存在较大的破产倒闭风险。With the advent of the credit society, it is more and more common for people to use credit consumption (loans) to realize the expected purchase plan in the future, resulting in the emergence of more and more loan companies or companies that can provide loan business in the market. The demand for credit consumption is also increasing, which leads to the increasing scale of loans of various companies. When the loan amount reaches a certain scale, if the lender fails to repay in time, the cash flow of the company providing the loan will be broken, which will lead to The company has a greater risk of bankruptcy.

当前对于用户贷款风险的评估方法多为基于贷前用户数据分析的分线评估,即在为用户提供贷款之前,对用户的相关信息进行分析,以确定用户的贷款风险,但当用户贷款时间较长时,由于该方法的前置性,会导致预先评估出的贷款风险随着时间推移,变得越来越不精确。At present, most of the evaluation methods for user loan risk are line-based evaluation based on pre-loan user data analysis, that is, before providing loans to users, the relevant information of the user is analyzed to determine the user's loan risk, but when the user's loan time is relatively short In the long run, due to the pre-emptive nature of this method, the pre-assessed loan risk will become increasingly inaccurate over time.

发明内容SUMMARY OF THE INVENTION

本发明提供一种基于用户画像的风险评估方法、装置及计算机可读存储介质,其主要目的在于解决进行风险评估时的精确度较低的问题。The present invention provides a user portrait-based risk assessment method, device and computer-readable storage medium, the main purpose of which is to solve the problem of low accuracy in risk assessment.

为实现上述目的,本发明提供的一种基于用户画像的风险评估方法,包括:In order to achieve the above purpose, a user portrait-based risk assessment method provided by the present invention includes:

获取用户的贷前数据,根据所述贷前数据生成所述用户的基础风险画像,根据所述基础风险画像计算所述用户的初始风险值;Obtaining the user's pre-loan data, generating the user's basic risk profile according to the pre-loan data, and calculating the user's initial risk value according to the basic risk profile;

获取所述用户的贷后还款数据,根据所述贷后还款数据计算所述用户的还款意向值;Acquiring the post-loan repayment data of the user, and calculating the repayment intention value of the user according to the post-loan repayment data;

获取所述用户的贷后相关产品逾期数据,根据所述贷后相关产品逾期数据计算所述用户的风险调整系数;Obtain the overdue data of the post-loan related products of the user, and calculate the risk adjustment coefficient of the user according to the overdue data of the post-loan related products;

查询所述用户的关联用户,获取所述关联用户的历史还款数据,根据所述历史还款数据计算所述用户的潜在风险系数;query the associated users of the user, obtain historical repayment data of the associated user, and calculate the potential risk coefficient of the user according to the historical repayment data;

利用所述还款意向值、所述风险调整系数和所述潜在风险系数对所述初始风险值进行数值调整,得到所述用户的实际风险值。The initial risk value is numerically adjusted by using the repayment intention value, the risk adjustment coefficient and the potential risk coefficient to obtain the actual risk value of the user.

可选地,所述根据所述贷前数据生成所述用户的基础风险画像,包括:Optionally, generating the user's basic risk profile according to the pre-loan data includes:

逐个从所述贷前数据中选取其中一个数据为目标数据;Selecting one of the data from the pre-loan data one by one as the target data;

对所述目标数据进行语义提取,得到数据语义;performing semantic extraction on the target data to obtain data semantics;

将每个所述目标数据的数据语义转换为语义向量;converting the data semantics of each of the target data into semantic vectors;

将所有语义向量拼接为所述用户的基础风险画像。All semantic vectors are spliced into the basic risk profile of the user.

可选地,所述对所述目标数据进行语义提取,得到数据语义,包括:Optionally, performing semantic extraction on the target data to obtain data semantics, including:

对所述目标数据进行卷积、池化处理,得到所述目标数据的低维特征语义;Performing convolution and pooling processing on the target data to obtain low-dimensional feature semantics of the target data;

将所述低维特征语义映射至预先构建的高维空间,得到高维特征语义;mapping the low-dimensional feature semantics to a pre-built high-dimensional space to obtain high-dimensional feature semantics;

利用预设的激活函数对所述高维特征语义进行筛选,得到数据语义。The high-dimensional feature semantics are screened using a preset activation function to obtain data semantics.

可选地,所述将所有语义向量拼接为所述用户的基础风险画像,包括:Optionally, the splicing of all semantic vectors into the user's basic risk profile includes:

统计每一个所述语义向量的向量长度;Count the vector length of each of the semantic vectors;

选取所述向量长度最大的语义向量为目标向量,确定所述目标向量的向量长度为目标长度;Select the semantic vector with the maximum length of the vector as the target vector, and determine that the vector length of the target vector is the target length;

将每个语义向量的长度延长至所述目标长度,并将每个延长后的语义向量作为行向量进行拼接,得到用户的基础风险画像。The length of each semantic vector is extended to the target length, and each extended semantic vector is spliced as a row vector to obtain the user's basic risk profile.

可选地,所述根据所述贷后还款数据计算所述用户的还款意向值,包括:Optionally, calculating the repayment intention value of the user according to the post-loan repayment data includes:

获取所述用户的还款期数和贷款总额;Obtain the repayment period and the total loan amount of the user;

根据所述贷后还款数据统计所述用户的按时还款次数,以及根据所述贷后还款数据统计所述用户的已还款项数额;Count the number of on-time repayments of the user according to the post-loan repayment data, and count the repayment amount of the user according to the post-loan repayment data;

利用所述已还款项数额除以所述贷款总额,得到第一意向度;The first intention degree is obtained by dividing the repaid amount by the total loan amount;

利用所述按时还款次数除以所述还款期数,得到第二意向度;The second intention degree is obtained by dividing the number of repayments on time by the number of repayment periods;

利用预设权重系数将所述第一意向度和所述第二意向度进行加权求和,得到还款意向值。The first intention degree and the second intention degree are weighted and summed by using a preset weight coefficient to obtain a repayment intention value.

可选地,所述根据所述贷后相关产品逾期数据计算所述用户的风险调整系数,包括:Optionally, calculating the risk adjustment coefficient of the user according to the overdue data of the post-loan related products, including:

统计所述贷后相关产品逾期数据中产品总数量和逾期产品数量;Count the total number of products and the number of overdue products in the overdue data of the post-loan related products;

利用所述逾期产品数量除以所述产品总数量,得到所述用户的风险调整系数。The user's risk adjustment coefficient is obtained by dividing the number of overdue products by the total number of products.

可选地,所述根据所述历史还款数据计算所述用户的潜在风险系数,包括:Optionally, the calculating the potential risk coefficient of the user according to the historical repayment data includes:

统计所述关联用户的用户总数量,以及统计所述历史还款数据中存在逾期还款的逾期用户数量;Count the total number of users of the associated users, and count the number of overdue users with overdue repayments in the historical repayment data;

计算所述用户总数量与所述逾期用户数量的差值,利用所述差值除以所述用户总数量,并计算除法得到的结果的平方根,得到所述潜在风险系数。Calculate the difference between the total number of users and the number of overdue users, divide the difference by the total number of users, and calculate the square root of the result of the division to obtain the potential risk coefficient.

为了解决上述问题,本发明还提供一种基于用户画像的风险评估装置,所述装置包括:In order to solve the above problems, the present invention also provides a user portrait-based risk assessment device, the device includes:

画像生成模块,用于获取用户的贷前数据,根据所述贷前数据生成所述用户的基础风险画像,根据所述基础风险画像计算所述用户的初始风险值;a profile generation module, configured to acquire the pre-loan data of the user, generate the basic risk profile of the user according to the pre-loan data, and calculate the initial risk value of the user according to the basic risk profile;

意向值分析模块,用于获取所述用户的贷后还款数据,根据所述贷后还款数据计算所述用户的还款意向值;an intention value analysis module, configured to obtain the post-loan repayment data of the user, and calculate the user's repayment intention value according to the post-loan repayment data;

调整系数计算模块,用于获取所述用户的贷后相关产品逾期数据,根据所述贷后相关产品逾期数据计算所述用户的风险调整系数;an adjustment coefficient calculation module, configured to obtain the overdue data of the post-loan related products of the user, and calculate the risk adjustment coefficient of the user according to the overdue data of the post-loan related products;

潜在系数分析模块,用于查询所述用户的关联用户,获取所述关联用户的历史还款数据,根据所述历史还款数据计算所述用户的潜在风险系数;a potential coefficient analysis module, configured to query the associated users of the user, obtain historical repayment data of the associated user, and calculate the potential risk coefficient of the user according to the historical repayment data;

风险评估模块,用于利用所述还款意向值、所述风险调整系数和所述潜在风险系数对所述初始风险值进行数值调整,得到所述用户的实际风险值。A risk assessment module, configured to perform numerical adjustment on the initial risk value by using the repayment intention value, the risk adjustment coefficient and the potential risk coefficient to obtain the actual risk value of the user.

为了解决上述问题,本发明还提供一种电子设备,所述电子设备包括:In order to solve the above problems, the present invention also provides an electronic device, the electronic device includes:

至少一个处理器;以及,at least one processor; and,

与所述至少一个处理器通信连接的存储器;其中,a memory communicatively coupled to the at least one processor; wherein,

所述存储器存储有可被所述至少一个处理器执行的计算机程序,所述计算机程序被所述至少一个处理器执行,以使所述至少一个处理器能够执行上述所述的基于用户画像的风险评估方法。The memory stores a computer program executable by the at least one processor, the computer program being executed by the at least one processor to enable the at least one processor to perform the user profile-based risk described above assessment method.

为了解决上述问题,本发明还提供一种计算机可读存储介质,所述计算机可读存储介质中存储有至少一个计算机程序,所述至少一个计算机程序被电子设备中的处理器执行以实现上述所述的基于用户画像的风险评估方法。In order to solve the above problems, the present invention also provides a computer-readable storage medium, where at least one computer program is stored in the computer-readable storage medium, and the at least one computer program is executed by a processor in an electronic device to realize the above-mentioned The described risk assessment method based on user portrait.

本发明实施例能够利用用户的贷前数据生成基础风险画像,并根据该画像计算用户的初始风险值,同时,根据用户贷后的多方面数据,计算还款意向值、风险调整系数和潜在风险系数等贷后风险指标,并根据计算得到的贷后风险指标对初始风险值进行数值调整,提升了对所述用户进行风险评估的精确度。因此本发明提出的基于用户画像的风险评估方法、装置、电子设备及计算机可读存储介质,可以解决进行风险评估时的精确度较低的问题。The embodiment of the present invention can generate a basic risk portrait by using the pre-loan data of the user, calculate the initial risk value of the user according to the portrait, and at the same time, calculate the repayment intention value, the risk adjustment coefficient and the potential risk according to the multi-faceted data of the user after the loan coefficients and other post-loan risk indicators, and numerically adjust the initial risk value according to the calculated post-loan risk indicators, thereby improving the accuracy of risk assessment for the user. Therefore, the user portrait-based risk assessment method, device, electronic device and computer-readable storage medium proposed by the present invention can solve the problem of low accuracy in risk assessment.

附图说明Description of drawings

图1为本发明一实施例提供的基于用户画像的风险评估方法的流程示意图;1 is a schematic flowchart of a user portrait-based risk assessment method according to an embodiment of the present invention;

图2为本发明一实施例提供的生成用户的基础风险画像的流程示意图;FIG. 2 is a schematic flowchart of generating a basic risk profile of a user according to an embodiment of the present invention;

图3为本发明一实施例提供的计算用户的还款意向值的流程示意图;3 is a schematic flowchart of calculating a repayment intention value of a user according to an embodiment of the present invention;

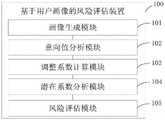

图4为本发明一实施例提供的基于用户画像的风险评估装置的功能模块图;4 is a functional block diagram of a user portrait-based risk assessment device provided by an embodiment of the present invention;

图5为本发明一实施例提供的实现所述基于用户画像的风险评估方法的电子设备的结构示意图。FIG. 5 is a schematic structural diagram of an electronic device for implementing the user portrait-based risk assessment method according to an embodiment of the present invention.

本发明目的的实现、功能特点及优点将结合实施例,参照附图做进一步说明。The realization, functional characteristics and advantages of the present invention will be further described with reference to the accompanying drawings in conjunction with the embodiments.

具体实施方式Detailed ways

应当理解,此处所描述的具体实施例仅仅用以解释本发明,并不用于限定本发明。It should be understood that the specific embodiments described herein are only used to explain the present invention, but not to limit the present invention.

本申请实施例提供一种基于用户画像的风险评估方法。所述基于用户画像的风险评估方法的执行主体包括但不限于服务端、终端等能够被配置为执行本申请实施例提供的该方法的电子设备中的至少一种。换言之,所述基于用户画像的风险评估方法可以由安装在终端设备或服务端设备的软件或硬件来执行,所述软件可以是区块链平台。所述服务端包括但不限于:单台服务器、服务器集群、云端服务器或云端服务器集群等。所述服务器可以是独立的服务器,也可以是提供云服务、云数据库、云计算、云函数、云存储、网络服务、云通信、中间件服务、域名服务、安全服务、内容分发网络(Content Delivery Network,CDN)、以及大数据和人工智能平台等基础云计算服务的云服务器。The embodiment of the present application provides a user portrait-based risk assessment method. The execution subject of the user portrait-based risk assessment method includes, but is not limited to, at least one of electronic devices that can be configured to execute the method provided by the embodiments of the present application, such as a server and a terminal. In other words, the risk assessment method based on the user portrait can be executed by software or hardware installed on the terminal device or the server device, and the software can be a blockchain platform. The server includes but is not limited to: a single server, a server cluster, a cloud server or a cloud server cluster, and the like. The server can be an independent server, or can provide cloud services, cloud databases, cloud computing, cloud functions, cloud storage, network services, cloud communications, middleware services, domain name services, security services, content delivery network (Content Delivery Network) Network, CDN), and cloud servers for basic cloud computing services such as big data and artificial intelligence platforms.

参照图1所示,为本发明一实施例提供的基于用户画像的风险评估方法的流程示意图。在本实施例中,所述基于用户画像的风险评估方法包括:Referring to FIG. 1 , it is a schematic flowchart of a user portrait-based risk assessment method according to an embodiment of the present invention. In this embodiment, the user portrait-based risk assessment method includes:

S1、获取用户的贷前数据,根据所述贷前数据生成所述用户的基础风险画像,根据所述基础风险画像计算所述用户的初始风险值。S1. Acquire pre-loan data of the user, generate a basic risk profile of the user according to the pre-loan data, and calculate the initial risk value of the user according to the basic risk profile.

本发明实施例中,所述贷前数据为贷款公司在向所述用户提供贷款之前,该用户的年龄、职业、收入状况、历史贷款次数、历史贷款金额、历史逾期次数等数据。In the embodiment of the present invention, the pre-loan data is data such as the age, occupation, income status, historical loan times, historical loan amount, and historical overdue times of the user before the loan company provides the user with a loan.

详细地,可利用具有数据抓取功能的计算机语句(如java语句、python语句等)从预先确定的存储区域抓取用户授权可被获取的贷前数据,其中,所述存储区域包括但不限于数据库、区块链节点、网络缓存。In detail, the pre-loan data that can be obtained by user authorization can be captured from a predetermined storage area by using a computer sentence (such as a java sentence, python sentence, etc.) with a data capture function, wherein the storage area includes but is not limited to Database, blockchain node, network cache.

具体地,所述贷前数据包括该用户的多方面数据,表现了该用户在贷款前的各种行为表现,因此,可利用所述贷前数据生成所述用户的基础风险画像,并根据所述基础风险画像计算所述用户的初始风险值,以便于后续对该用户的风险进行评估。Specifically, the pre-loan data includes various data of the user, showing various behaviors of the user before the loan. Therefore, the pre-loan data can be used to generate the basic risk profile of the user, and according to the The basic risk profile is used to calculate the initial risk value of the user, so as to facilitate the subsequent risk assessment of the user.

本发明实施例中,参图2所示,所述根据所述贷前数据生成所述用户的基础风险画像,包括:In the embodiment of the present invention, as shown in FIG. 2 , the generation of the basic risk profile of the user according to the pre-loan data includes:

S21、逐个从所述贷前数据中选取其中一个数据为目标数据;S21, select one of the data from the pre-loan data one by one as the target data;

S22、对所述目标数据进行语义提取,得到数据语义;S22, performing semantic extraction on the target data to obtain data semantics;

S23、将每个所述目标数据的数据语义转换为语义向量;S23, converting the data semantics of each described target data into a semantic vector;

S24、将所有语义向量拼接为所述用户的基础风险画像。S24, splicing all the semantic vectors into a basic risk portrait of the user.

本发明实施例中,可依次从所述贷前数据中选取目标数据,或者,随机且不放回地从所述贷前数据中选取目标数据。In the embodiment of the present invention, the target data may be selected from the pre-loan data in sequence, or the target data may be selected from the pre-loan data randomly and without replacement.

本发明实施例中,可预先构建的语义分析模型对所述目标数据进行语义提取,得到数据语义。In this embodiment of the present invention, a pre-built semantic analysis model can perform semantic extraction on the target data to obtain data semantics.

详细地,所述语义分析模型包括但不限于NLP(Natural Language Processing,自然语言处理)模型、HMM(Hidden Markov Model,隐马尔科夫模型)。In detail, the semantic analysis model includes, but is not limited to, an NLP (Natural Language Processing, natural language processing) model and an HMM (Hidden Markov Model, hidden Markov model).

例如,利用预先构建的语义分析模型对所述目标数据进行卷积、池化等操作,以提取该目标数据的低维特征表达,再将提取到的低维特征表达映射至预先构建的高维空间,得到该低维特征的高维特征表达,利用预设的激活函数对所述高维特征表达进行选择性地输出,得到数据语义。For example, using a pre-built semantic analysis model to perform operations such as convolution and pooling on the target data to extract low-dimensional feature expressions of the target data, and then map the extracted low-dimensional feature expressions to pre-built high-dimensional feature expressions space, obtain a high-dimensional feature expression of the low-dimensional feature, and use a preset activation function to selectively output the high-dimensional feature expression to obtain data semantics.

本发明实施例中,所述对所述目标数据进行语义提取,得到数据语义,包括:In the embodiment of the present invention, the semantic extraction of the target data to obtain the data semantics includes:

对所述目标数据进行卷积、池化处理,得到所述目标数据的低维特征语义;Performing convolution and pooling processing on the target data to obtain low-dimensional feature semantics of the target data;

将所述低维特征语义映射至预先构建的高维空间,得到高维特征语义;mapping the low-dimensional feature semantics to a pre-built high-dimensional space to obtain high-dimensional feature semantics;

利用预设的激活函数对所述高维特征语义进行筛选,得到数据语义。The high-dimensional feature semantics are screened using a preset activation function to obtain data semantics.

详细地,可通过语义分析模型对所述目标数据进行卷积、池化处理,以降低所述目标数据的数据维度,进而减少对所述目标数据进行分析时计算资源的占用,提高进行语义提取的效率。In detail, the target data can be convoluted and pooled through a semantic analysis model to reduce the data dimension of the target data, thereby reducing the occupation of computing resources when analyzing the target data, and improving semantic extraction. s efficiency.

具体地,可利用预设的映射函数将低维特征语义映射至预先构建的高维空间,所述映射函数包括MATLAB库中的Gaussian Radial Basis Function函数、高斯函数等。Specifically, a preset mapping function can be used to semantically map a low-dimensional feature to a pre-built high-dimensional space, and the mapping function includes a Gaussian Radial Basis Function, a Gaussian function, and the like in the MATLAB library.

例如,所述低维特征语义为二维平面中的点,则可利用映射函数对该二维平面中的点的二维坐标进行计算,以将二维坐标转换为三维坐标,并利用计算得到的三维坐标将点映射至预先构建的三维空间,得到该低维特征语义的高维特征语义。For example, if the low-dimensional feature is semantically a point in a two-dimensional plane, the two-dimensional coordinates of the point in the two-dimensional plane can be calculated by using a mapping function, so as to convert the two-dimensional coordinates into three-dimensional coordinates, and use the calculation to obtain The three-dimensional coordinates of the point are mapped to the pre-built three-dimensional space, and the high-dimensional feature semantics of the low-dimensional feature semantics are obtained.

将所述低维特征语义映射至预先构建的高维空间,可提高该低维特征的可分类性,进而提高从得到的高维特征语义中对特征进行筛选,得到数据语义的精确度。Mapping the low-dimensional feature semantics to a pre-built high-dimensional space can improve the classifyability of the low-dimensional features, thereby improving the accuracy of data semantics by filtering features from the obtained high-dimensional feature semantics.

本发明实施例中,可利用预设的激活函数计算所述高维特征语义中每个特征语义的输出值,并选取所述输出值大于预设的输出阈值的特征语义为数据语义,所述激活函数包括但不限于sigmoid激活函数、tanh激活函数、relu激活函数。In the embodiment of the present invention, a preset activation function may be used to calculate the output value of each feature semantics in the high-dimensional feature semantics, and the feature semantics whose output value is greater than a preset output threshold value is selected as the data semantics, and the Activation functions include but are not limited to sigmoid activation functions, tanh activation functions, and relu activation functions.

例如,高维特征语义中存在特征语义A、特征语义B和特征语义C,分别利用激活函数对特征语义A、特征语义B和特征语义C进行计算,得到特征语义A的输出值为80,特征语义B的输出值为30,特征语义C的输出值为70,当输出阈值为50时,则将特征语义A与特征语义C输出为所述目标产品的数据语义。For example, there are feature semantics A, feature semantics B and feature semantics C in high-dimensional feature semantics. The activation function is used to calculate feature semantics A, feature semantics B and feature semantics C respectively, and the output value of feature semantics A is 80. The output value of semantic B is 30, and the output value of feature semantic C is 70. When the output threshold is 50, feature semantic A and feature semantic C are output as the data semantics of the target product.

本发明实施例中,可通过预设的向量转换模型对所述数据语义进行向量转换,得到语义向量,所述向量转换模型包括但不限于word2vec模型、Bert模型。In the embodiment of the present invention, the data semantics can be vector-transformed by using a preset vector transformation model, and a semantic vector can be obtained, and the vector transformation model includes but is not limited to a word2vec model and a Bert model.

本发明实施例中,获取所述语义向量后,可将所有的语义向量进行向量拼接,以生成基础风险画像。In the embodiment of the present invention, after obtaining the semantic vector, all the semantic vectors can be vector-spliced to generate a basic risk profile.

本发明实施例中,所述将所有语义向量拼接为所述用户的基础风险画像,包括:In the embodiment of the present invention, the splicing of all semantic vectors into the basic risk portrait of the user includes:

统计每一个所述语义向量的向量长度;Count the vector length of each of the semantic vectors;

选取所述向量长度最大的语义向量为目标向量,确定所述目标向量的向量长度为目标长度;Select the semantic vector with the maximum length of the vector as the target vector, and determine that the vector length of the target vector is the target length;

将每个语义向量的长度延长至所述目标长度,并将每个延长后的语义向量作为行向量进行拼接,得到用户的基础风险画像。The length of each semantic vector is extended to the target length, and each extended semantic vector is spliced as a row vector to obtain the user's basic risk profile.

详细地,由于每个所述语义向量的长度可能不相同,因此,为了将所述语义向量进行向量拼接,需要将所述语义向量的向量长度进行统一化。In detail, since the length of each of the semantic vectors may be different, in order to perform vector splicing of the semantic vectors, the vector lengths of the semantic vectors need to be unified.

本发明实施例中,统计每个所述语义向量的长度,并对向量长度较短的向量进行向量延长,以使得所有语义向量的长度相同。In the embodiment of the present invention, the length of each of the semantic vectors is counted, and a vector with a shorter vector length is vector-extended, so that all the semantic vectors have the same length.

例如,语义向量中存在第一语义向量为[11,36,22],存在第二语义向量为[14,25,31,27],经过统计可知,第一语义向量的第一向量长度为3,第二语义向量的第二向量长度为4,第二向量长度大于第一向量长度,则可利用预设参数(如0)对所述第一语义向量进行向量延长,直至所述第一向量长度与所述第二向量长度相等,得到延长后的第一语义向量[11,36,22,0]。For example, the first semantic vector in the semantic vector is [11, 36, 22], and the second semantic vector is [14, 25, 31, 27]. Statistics show that the length of the first vector of the first semantic vector is 3 , the second vector length of the second semantic vector is 4, and the length of the second vector is greater than the length of the first vector, then a preset parameter (such as 0) can be used to extend the vector of the first semantic vector until the first vector The length is equal to the length of the second vector to obtain the extended first semantic vector [11, 36, 22, 0].

本发明实施例中,可通过将两个向量中对应列元素相加的形式将所述两个向量进行列维度合并。In this embodiment of the present invention, the two vectors may be combined in column dimension by adding corresponding column elements in the two vectors.

例如,存在第一语义向量为[11,36,22,0],存在第二语义向量为[14,25,31,27],则可将所述第一语义向量与所述第二语义向量中对应列的元素进行相加,得到基础风险画像[25,61,53,27]。For example, if the first semantic vector is [11, 36, 22, 0] and the second semantic vector is [14, 25, 31, 27], the first semantic vector and the second semantic vector can be compared Add the elements of the corresponding columns in , to get the basic risk profile [25, 61, 53, 27].

本发明另一实施例中,还可通过将两个向量中对应列元素进行并行展示的方式,利用两个向量生成矩阵,进而实现向量间的列维度合并。In another embodiment of the present invention, two vectors can be used to generate a matrix by displaying corresponding column elements in the two vectors in parallel, so as to realize the column dimension combination between the vectors.

例如,第一语义向量为[11,36,22,0],第二语义向量为[14,25,31,27],则可将所述第一语义向量与所述第二语义向量中对应列的元素进行并行展示,得到矩阵并将该矩阵作为所述用户的基础风险画像。For example, if the first semantic vector is [11, 36, 22, 0] and the second semantic vector is [14, 25, 31, 27], the first semantic vector can be corresponding to the second semantic vector The elements of the columns are displayed in parallel to obtain a matrix And use this matrix as the basic risk profile of the user.

进一步地,所述基础风险画像是通过多个向量拼接得到的矩阵,因此可直接求取所述基础风险画像的数值,得到所述用户的初始风险值。Further, the basic risk profile is a matrix obtained by splicing multiple vectors, so the value of the basic risk profile can be directly obtained to obtain the initial risk value of the user.

S2、获取所述用户的贷后还款数据,根据所述贷后还款数据计算所述用户的还款意向值。S2. Acquire post-loan repayment data of the user, and calculate the user's repayment intention value according to the post-loan repayment data.

本发明其中一个实际应用场景中,由于所述初始风险值是根据该用户的贷前数据生成的,因此,该初始风险值仅可表示该用户贷前的风险,却无法精确地表示该用户贷后对款项偿还的风险,因此,可获取所述用户的贷后还款数据,以根据所述用户的还款数据,对用户的还款行为进行分析,实现对贷后风险的评估,以提升后续对用户风险值进行评估的时效性和精确度。In one of the practical application scenarios of the present invention, since the initial risk value is generated according to the user's pre-loan data, the initial risk value can only represent the user's pre-loan risk, but cannot accurately represent the user's loan risk. Therefore, the post-loan repayment data of the user can be obtained, so as to analyze the repayment behavior of the user according to the repayment data of the user, so as to realize the assessment of the post-loan risk, so as to improve the The timeliness and accuracy of subsequent user risk assessment.

本发明实施例中,所述贷后还款数据为该用户在贷款后,每个还款期限内,对款项的偿还数额、偿还时间等数据。In the embodiment of the present invention, the post-loan repayment data is data such as the repayment amount and repayment time of the user within each repayment period after the loan.

详细地,所述获取所述用户的贷后还款数据的步骤,与S1中获取用户的贷前数据的步骤一致,在此不做赘述。In detail, the step of acquiring the post-loan repayment data of the user is the same as the step of acquiring the pre-loan data of the user in S1, and will not be repeated here.

进一步地,可对所述贷后还款数据进行分析,以计算出所述用户的还款意向值,其中,所述还款意向值用于标识所述用户按时进行还款的意向度大小。Further, the post-loan repayment data may be analyzed to calculate the repayment intention value of the user, wherein the repayment intention value is used to identify the user's intention to repay on time.

本发明实施例中,参图3所示,所述根据所述贷后还款数据计算所述用户的还款意向值,包括:In the embodiment of the present invention, as shown in FIG. 3 , the calculation of the repayment intention value of the user according to the post-loan repayment data includes:

S31、获取所述用户的还款期数和贷款总额;S31. Obtain the repayment period and the total loan amount of the user;

S32、根据所述贷后还款数据统计所述用户的按时还款次数,以及根据所述贷后还款数据统计所述用户的已还款项数额;S32. Count the number of on-time repayments of the user according to the post-loan repayment data, and count the repayment amount of the user according to the post-loan repayment data;

S33、利用所述已还款项数额除以所述贷款总额,得到第一意向度;S33. Divide the repaid amount by the total loan amount to obtain a first intention degree;

S34、利用所述按时还款次数除以所述还款期数,得到第二意向度;S34, dividing the number of repayments on time by the number of repayment periods to obtain a second degree of intention;

S35、利用预设权重系数将所述第一意向度和所述第二意向度进行加权求和,得到还款意向值。S35. Use a preset weight coefficient to perform a weighted sum of the first intention degree and the second intention degree to obtain a repayment intention value.

详细地,所述还款期数是指所述用户贷款分期还款的期数,所述贷款总额是指所述用户贷款的总金额。Specifically, the number of repayment periods refers to the number of instalments for the user's loan repayment, and the total loan amount refers to the total amount of the user's loan.

具体地,可对所述贷后还款数据进行统计,以确定该用户在已经偿还的期数内,未逾期的按时还款次数,以及所述用户已经清还的款项的总数额。Specifically, the post-loan repayment data may be counted to determine the number of on-time repayments that the user has not overdue within the number of periods already repaid, and the total amount of money that the user has repaid.

本发明实施例中,所述根据所述还款期数、所述贷款总额、所述按时还款次数和所述已还款项数额计算所述用户的还款意向度,包括:In this embodiment of the present invention, calculating the repayment intention of the user according to the repayment period, the total loan amount, the number of on-time repayments, and the repaid amount includes:

利用如下权重算法计算所述还款意向度:The repayment intention degree is calculated using the following weighting algorithm:

其中,Y为所述还款意向度,A为所述已还款项数额,B为所述贷款总额,C为所述按时还款次数,D为所述还款期数,α、β为预设权重系数。Among them, Y is the repayment intention degree, A is the repayment amount, B is the total loan amount, C is the on-time repayment times, D is the repayment period, α, β are the expected Set the weight coefficient.

S3、获取所述用户的贷后相关产品逾期数据,根据所述贷后相关产品逾期数据计算所述用户的风险调整系数。S3. Obtain the overdue data of the post-loan related products of the user, and calculate the risk adjustment coefficient of the user according to the overdue data of the post-loan related products.

本发明实施例中,所述贷后相关产品预期数据是指所述用户在获取该贷款后,但未偿还清该贷款时,该用户持有的其他贷款产品的逾期状况数据。In the embodiment of the present invention, the post-loan related product expectation data refers to the overdue status data of other loan products held by the user after the user obtains the loan but fails to repay the loan.

详细地,当用户持有多项贷款产品时,若其他贷款产品存在逾期情况,则该用户对本贷款也会存在较大的逾期行为。In detail, when a user holds multiple loan products, if other loan products are overdue, the user will also have a large overdue behavior for this loan.

具体地,所述获取所述用户的贷后相关产品逾期数据的步骤,与S1中获取用户的贷前数据的步骤一致,在此不做赘述。Specifically, the step of acquiring the overdue data of the post-loan related products of the user is the same as the step of acquiring the pre-loan data of the user in S1, and will not be repeated here.

本发明实施例中,所述根据所述贷后相关产品逾期数据计算所述用户的风险调整系数,包括:In the embodiment of the present invention, calculating the risk adjustment coefficient of the user according to the overdue data of the post-loan related products includes:

统计所述贷后相关产品逾期数据中产品总数量和逾期产品数量;Count the total number of products and the number of overdue products in the overdue data of the post-loan related products;

利用所述逾期产品数量除以所述产品总数量,得到所述用户的风险调整系数。The user's risk adjustment coefficient is obtained by dividing the number of overdue products by the total number of products.

详细地,所述利用所述逾期产品数量除以所述产品总数量,得到所述用户的风险调整系数,包括:In detail, dividing the number of overdue products by the total number of products to obtain the risk adjustment coefficient of the user, including:

利用如下公式利用所述逾期产品数量除以所述产品总数量,得到所述用户的风险调整系数:The user's risk adjustment factor is obtained by dividing the number of overdue products by the total number of products using the following formula:

其中,X为所述风险调整系数,E为所述逾期产品数量,F为所述产品总数量。Wherein, X is the risk adjustment coefficient, E is the quantity of the overdue products, and F is the total quantity of the products.

S4、查询所述用户的关联用户,获取所述关联用户的历史还款数据,根据所述历史还款数据计算所述用户的潜在风险系数。S4. Query the associated users of the user, obtain historical repayment data of the associated user, and calculate a potential risk coefficient of the user according to the historical repayment data.

本发明其中一个实际应用场景中,可认为用户所在的群体中,每个人的习惯及款项偿还能力存在一定的潜在联系,例如,当与用户存在关联关系的多个关联用户中,存在大量的关联用户有贷款逾期记录,则该用户的贷款逾期可能性可会较高。In one of the practical application scenarios of the present invention, it can be considered that in the group where the user belongs, there is a certain potential relationship between the habits and the repayment ability of each person. If the user has a loan overdue record, the possibility of the user's loan overdue may be higher.

因此,可查询所述用户的关联用户,并获取所述关联用户的历史还款数据,进而对所述历史还款数据进行分析,以利用关联用户的历史还款数据分析得到所述用户的潜在风险系数,其中,所述历史还款数据是指与所述用户具有关联关系的关联用户中,每个关联用户的贷款记录、逾期还款记录等数据。Therefore, the related users of the user can be queried, and the historical repayment data of the related users can be obtained, and then the historical repayment data can be analyzed to obtain the potential potential of the user by analyzing the historical repayment data of the related users. Risk coefficient, wherein the historical repayment data refers to the loan records, overdue repayment records and other data of each associated user among the associated users that have an associated relationship with the user.

本发明实施例中,可获取预先构建的关联用户表,并利用SQL库中的CREATE INDEX函数创建所述关联用户表的索引,进而根据所述索引从所述关联用户表中查询到所述用户的关联用户,其中,所述关联用户表中包含多个用户,以及每个用户之间的关联关系。In this embodiment of the present invention, a pre-built associated user table may be obtained, and an index of the associated user table may be created by using the CREATE INDEX function in the SQL library, and then the user may be queried from the associated user table according to the index. The associated users, wherein the associated user table includes multiple users and the associated relationship between each user.

详细地,所述获取所述关联用户的历史还款数据的步骤,与S1中获取用户的贷前数据的步骤一致,在此不做赘述。In detail, the step of obtaining the historical repayment data of the associated user is the same as the step of obtaining the pre-loan data of the user in S1, and will not be repeated here.

本发明实施例中,所述根据所述历史还款数据计算所述用户的潜在风险系数,包括:In this embodiment of the present invention, the calculation of the potential risk coefficient of the user according to the historical repayment data includes:

统计所述关联用户的用户总数量,以及统计所述历史还款数据中存在逾期还款的逾期用户数量;Count the total number of users of the associated users, and count the number of overdue users with overdue repayments in the historical repayment data;

计算所述用户总数量与所述逾期用户数量的差值,利用所述差值除以所述用户总数量,并计算除法得到的结果的平方根,得到所述潜在风险系数。Calculate the difference between the total number of users and the number of overdue users, divide the difference by the total number of users, and calculate the square root of the result of the division to obtain the potential risk coefficient.

详细地,所述计算所述用户总数量与所述逾期用户数量的差值,利用所述差值除以所述用户总数量,并计算除法得到的结果的平方根,得到所述潜在风险系数,包括:In detail, calculating the difference between the total number of users and the number of overdue users, dividing the difference by the total number of users, and calculating the square root of the result obtained by the division to obtain the potential risk coefficient, include:

利用如下公式根据所述用户总数量和所述逾期用户数量计算所述用户的潜在风险系数:Use the following formula to calculate the potential risk factor of the user according to the total number of users and the number of overdue users:

其中,Z为所述潜在风险系数,G为所述用户总数量,H为所述逾期用户数量。Among them, Z is the potential risk coefficient, G is the total number of users, and H is the number of overdue users.

S5、利用所述还款意向值、所述风险调整系数和所述潜在风险系数对所述初始风险值进行数值调整,得到所述用户的实际风险值。S5. Use the repayment intention value, the risk adjustment coefficient and the potential risk coefficient to perform numerical adjustment on the initial risk value to obtain the actual risk value of the user.

本发明实施例中,由于所述初始风险值仅可表示该用户贷前的风险,却无法精确地表示该用户贷后对款项偿还的风险,因此,为了提升对所述用户的风险值进行分析的精确度,可利用所述还款意向值、所述风险调整系数和所述潜在风险系数等贷后数据分析得到的指标,对所述初始风险值进行数值调整,以提升对所述用户进行风险评估的精确度。In the embodiment of the present invention, since the initial risk value can only represent the risk of the user before the loan, but cannot accurately represent the risk of the user repaying the money after the loan, therefore, in order to improve the risk value of the user, the risk value of the user is analyzed. The accuracy of the initial risk value can be adjusted numerically by using the repayment intention value, the risk adjustment coefficient and the potential risk coefficient and other indicators obtained by post-loan data analysis, so as to improve the performance of the user. Accuracy of risk assessment.

本发明实施例中,所述利用所述还款意向值、所述风险调整系数和所述潜在风险系数对所述初始风险值进行数值调整,得到所述用户的实际风险值,包括:In the embodiment of the present invention, the initial risk value is numerically adjusted by using the repayment intention value, the risk adjustment coefficient and the potential risk coefficient to obtain the actual risk value of the user, including:

利用如下数值调整算法对所述初始风险值进行数值调整,得到所述用户的实际风险值:Use the following numerical adjustment algorithm to numerically adjust the initial risk value to obtain the actual risk value of the user:

S=(X+Y+Z)*QS=(X+Y+Z)*Q

其中,S为所述实际风险值,Q为所述初始风险值,X为所述风险调整系数,Y为所述还款意向度,Z为所述潜在风险系数。Wherein, S is the actual risk value, Q is the initial risk value, X is the risk adjustment coefficient, Y is the repayment intention degree, and Z is the potential risk coefficient.

本发明实施例能够利用用户的贷前数据生成基础风险画像,并根据该画像计算用户的初始风险值,同时,根据用户贷后的多方面数据,计算还款意向值、风险调整系数和潜在风险系数等贷后风险指标,并根据计算得到的贷后风险指标对初始风险值进行数值调整,提升了对所述用户进行风险评估的精确度。因此本发明提出的基于用户画像的风险评估方法,可以解决进行风险评估时的精确度较低的问题。The embodiment of the present invention can generate a basic risk portrait by using the pre-loan data of the user, calculate the initial risk value of the user according to the portrait, and at the same time, calculate the repayment intention value, the risk adjustment coefficient and the potential risk according to the multi-faceted data of the user after the loan coefficients and other post-loan risk indicators, and numerically adjust the initial risk value according to the calculated post-loan risk indicators, thereby improving the accuracy of risk assessment for the user. Therefore, the user portrait-based risk assessment method proposed by the present invention can solve the problem of low accuracy in risk assessment.

如图4所示,是本发明一实施例提供的基于用户画像的风险评估装置的功能模块图。As shown in FIG. 4 , it is a functional block diagram of a risk assessment device based on a user portrait provided by an embodiment of the present invention.

本发明所述基于用户画像的风险评估装置100可以安装于电子设备中。根据实现的功能,所述基于用户画像的风险评估装置100可以包括画像生成模块101、意向值分析模块102、调整系数计算模块103、潜在系数分析模块104及风险评估模块105。本发明所述模块也可以称之为单元,是指一种能够被电子设备处理器所执行,并且能够完成固定功能的一系列计算机程序段,其存储在电子设备的存储器中。The user portrait-based

在本实施例中,关于各模块/单元的功能如下:In this embodiment, the functions of each module/unit are as follows:

所述画像生成模块101,用于获取用户的贷前数据,根据所述贷前数据生成所述用户的基础风险画像,根据所述基础风险画像计算所述用户的初始风险值;The

所述意向值分析模块102,用于获取所述用户的贷后还款数据,根据所述贷后还款数据计算所述用户的还款意向值;The intention

所述调整系数计算模块103,用于获取所述用户的贷后相关产品逾期数据,根据所述贷后相关产品逾期数据计算所述用户的风险调整系数;The adjustment

所述潜在系数分析模块104,用于查询所述用户的关联用户,获取所述关联用户的历史还款数据,根据所述历史还款数据计算所述用户的潜在风险系数;The potential

所述风险评估模块105,用于利用所述还款意向值、所述风险调整系数和所述潜在风险系数对所述初始风险值进行数值调整,得到所述用户的实际风险值。The

详细地,本发明实施例中所述基于用户画像的风险评估装置100中所述的各模块在使用时采用与上述图1至图3中所述的基于用户画像的风险评估方法一样的技术手段,并能够产生相同的技术效果,这里不再赘述。In detail, each module described in the user portrait-based

如图5所示,是本发明一实施例提供的实现基于用户画像的风险评估方法的电子设备的结构示意图。As shown in FIG. 5 , it is a schematic structural diagram of an electronic device for implementing a user portrait-based risk assessment method according to an embodiment of the present invention.

所述电子设备1可以包括处理器10、存储器11、通信总线12以及通信接口13,还可以包括存储在所述存储器11中并可在所述处理器10上运行的计算机程序,如基于用户画像的风险评估程序。The electronic device 1 may include a

其中,所述处理器10在一些实施例中可以由集成电路组成,例如可以由单个封装的集成电路所组成,也可以是由多个相同功能或不同功能封装的集成电路所组成,包括一个或者多个中央处理器(Central Processing unit,CPU)、微处理器、数字处理芯片、图形处理器及各种控制芯片的组合等。所述处理器10是所述电子设备的控制核心(ControlUnit),利用各种接口和线路连接整个电子设备的各个部件,通过运行或执行存储在所述存储器11内的程序或者模块(例如执行基于用户画像的风险评估程序等),以及调用存储在所述存储器11内的数据,以执行电子设备的各种功能和处理数据。The

所述存储器11至少包括一种类型的可读存储介质,所述可读存储介质包括闪存、移动硬盘、多媒体卡、卡型存储器(例如:SD或DX存储器等)、磁性存储器、磁盘、光盘等。所述存储器11在一些实施例中可以是电子设备的内部存储单元,例如该电子设备的移动硬盘。所述存储器11在另一些实施例中也可以是电子设备的外部存储设备,例如电子设备上配备的插接式移动硬盘、智能存储卡(Smart Media Card,SMC)、安全数字(Secure Digital,SD)卡、闪存卡(Flash Card)等。进一步地,所述存储器11还可以既包括电子设备的内部存储单元也包括外部存储设备。所述存储器11不仅可以用于存储安装于电子设备的应用软件及各类数据,例如基于用户画像的风险评估程序的代码等,还可以用于暂时地存储已经输出或者将要输出的数据。The

所述通信总线12可以是外设部件互连标准(peripheral componentinterconnect,简称PCI)总线或扩展工业标准结构(extended industry standardarchitecture,简称EISA)总线等。该总线可以分为地址总线、数据总线、控制总线等。所述总线被设置为实现所述存储器11以及至少一个处理器10等之间的连接通信。The

所述通信接口13用于上述电子设备与其他设备之间的通信,包括网络接口和用户接口。可选地,所述网络接口可以包括有线接口和/或无线接口(如WI-FI接口、蓝牙接口等),通常用于在该电子设备与其他电子设备之间建立通信连接。所述用户接口可以是显示器(Display)、输入单元(比如键盘(Keyboard)),可选地,用户接口还可以是标准的有线接口、无线接口。可选地,在一些实施例中,显示器可以是LED显示器、液晶显示器、触控式液晶显示器以及OLED(Organic Light-Emitting Diode,有机发光二极管)触摸器等。其中,显示器也可以适当的称为显示屏或显示单元,用于显示在电子设备中处理的信息以及用于显示可视化的用户界面。The

图5仅示出了具有部件的电子设备,本领域技术人员可以理解的是,图5示出的结构并不构成对所述电子设备1的限定,可以包括比图示更少或者更多的部件,或者组合某些部件,或者不同的部件布置。FIG. 5 only shows an electronic device with components. Those skilled in the art can understand that the structure shown in FIG. 5 does not constitute a limitation on the electronic device 1, and may include fewer or more components than those shown in the drawings. components, or a combination of certain components, or a different arrangement of components.

例如,尽管未示出,所述电子设备还可以包括给各个部件供电的电源(比如电池),优选地,电源可以通过电源管理装置与所述至少一个处理器10逻辑相连,从而通过电源管理装置实现充电管理、放电管理、以及功耗管理等功能。电源还可以包括一个或一个以上的直流或交流电源、再充电装置、电源故障检测电路、电源转换器或者逆变器、电源状态指示器等任意组件。所述电子设备还可以包括多种传感器、蓝牙模块、Wi-Fi模块等,在此不再赘述。For example, although not shown, the electronic device may also include a power source (such as a battery) for powering the various components, preferably, the power source may be logically connected to the at least one

应该了解,所述实施例仅为说明之用,在专利申请范围上并不受此结构的限制。It should be understood that the embodiments are only used for illustration, and are not limited by this structure in the scope of the patent application.

所述电子设备1中的所述存储器11存储的基于用户画像的风险评估程序是多个指令的组合,在所述处理器10中运行时,可以实现:The user portrait-based risk assessment program stored in the

获取用户的贷前数据,根据所述贷前数据生成所述用户的基础风险画像,根据所述基础风险画像计算所述用户的初始风险值;Obtaining the user's pre-loan data, generating the user's basic risk profile according to the pre-loan data, and calculating the user's initial risk value according to the basic risk profile;

获取所述用户的贷后还款数据,根据所述贷后还款数据计算所述用户的还款意向值;Acquiring the post-loan repayment data of the user, and calculating the repayment intention value of the user according to the post-loan repayment data;

获取所述用户的贷后相关产品逾期数据,根据所述贷后相关产品逾期数据计算所述用户的风险调整系数;Obtain the overdue data of the post-loan related products of the user, and calculate the risk adjustment coefficient of the user according to the overdue data of the post-loan related products;

查询所述用户的关联用户,获取所述关联用户的历史还款数据,根据所述历史还款数据计算所述用户的潜在风险系数;query the associated users of the user, obtain historical repayment data of the associated user, and calculate the potential risk coefficient of the user according to the historical repayment data;

利用所述还款意向值、所述风险调整系数和所述潜在风险系数对所述初始风险值进行数值调整,得到所述用户的实际风险值。The initial risk value is numerically adjusted by using the repayment intention value, the risk adjustment coefficient and the potential risk coefficient to obtain the actual risk value of the user.

具体地,所述处理器10对上述指令的具体实现方法可参考附图对应实施例中相关步骤的描述,在此不赘述。Specifically, for the specific implementation method of the above-mentioned instruction by the

进一步地,所述电子设备1集成的模块/单元如果以软件功能单元的形式实现并作为独立的产品销售或使用时,可以存储在一个计算机可读存储介质中。所述计算机可读存储介质可以是易失性的,也可以是非易失性的。例如,所述计算机可读介质可以包括:能够携带所述计算机程序代码的任何实体或装置、记录介质、U盘、移动硬盘、磁碟、光盘、计算机存储器、只读存储器(ROM,Read-Only Memory)。Further, if the modules/units integrated in the electronic device 1 are implemented in the form of software functional units and sold or used as independent products, they may be stored in a computer-readable storage medium. The computer-readable storage medium may be volatile or non-volatile. For example, the computer-readable medium may include: any entity or device capable of carrying the computer program code, a recording medium, a USB flash drive, a removable hard disk, a magnetic disk, an optical disc, a computer memory, a read-only memory (ROM, Read-Only). Memory).

本发明还提供一种计算机可读存储介质,所述可读存储介质存储有计算机程序,所述计算机程序在被电子设备的处理器所执行时,可以实现:The present invention also provides a computer-readable storage medium, where the readable storage medium stores a computer program, and when executed by a processor of an electronic device, the computer program can realize:

获取用户的贷前数据,根据所述贷前数据生成所述用户的基础风险画像,根据所述基础风险画像计算所述用户的初始风险值;Obtaining the user's pre-loan data, generating the user's basic risk profile according to the pre-loan data, and calculating the user's initial risk value according to the basic risk profile;

获取所述用户的贷后还款数据,根据所述贷后还款数据计算所述用户的还款意向值;Acquiring the post-loan repayment data of the user, and calculating the repayment intention value of the user according to the post-loan repayment data;

获取所述用户的贷后相关产品逾期数据,根据所述贷后相关产品逾期数据计算所述用户的风险调整系数;Obtain the overdue data of the post-loan related products of the user, and calculate the risk adjustment coefficient of the user according to the overdue data of the post-loan related products;

查询所述用户的关联用户,获取所述关联用户的历史还款数据,根据所述历史还款数据计算所述用户的潜在风险系数;query the associated users of the user, obtain historical repayment data of the associated user, and calculate the potential risk coefficient of the user according to the historical repayment data;

利用所述还款意向值、所述风险调整系数和所述潜在风险系数对所述初始风险值进行数值调整,得到所述用户的实际风险值。The initial risk value is numerically adjusted by using the repayment intention value, the risk adjustment coefficient and the potential risk coefficient to obtain the actual risk value of the user.

在本发明所提供的几个实施例中,应该理解到,所揭露的设备,装置和方法,可以通过其它的方式实现。例如,以上所描述的装置实施例仅仅是示意性的,例如,所述模块的划分,仅仅为一种逻辑功能划分,实际实现时可以有另外的划分方式。In the several embodiments provided by the present invention, it should be understood that the disclosed apparatus, apparatus and method may be implemented in other manners. For example, the apparatus embodiments described above are only illustrative. For example, the division of the modules is only a logical function division, and there may be other division manners in actual implementation.

所述作为分离部件说明的模块可以是或者也可以不是物理上分开的,作为模块显示的部件可以是或者也可以不是物理单元,即可以位于一个地方,或者也可以分布到多个网络单元上。可以根据实际的需要选择其中的部分或者全部模块来实现本实施例方案的目的。The modules described as separate components may or may not be physically separated, and the components shown as modules may or may not be physical units, that is, may be located in one place, or may be distributed to multiple network units. Some or all of the modules may be selected according to actual needs to achieve the purpose of the solution in this embodiment.

另外,在本发明各个实施例中的各功能模块可以集成在一个处理单元中,也可以是各个单元单独物理存在,也可以两个或两个以上单元集成在一个单元中。上述集成的单元既可以采用硬件的形式实现,也可以采用硬件加软件功能模块的形式实现。In addition, each functional module in each embodiment of the present invention may be integrated into one processing unit, or each unit may exist physically alone, or two or more units may be integrated into one unit. The above-mentioned integrated units can be implemented in the form of hardware, or can be implemented in the form of hardware plus software function modules.

对于本领域技术人员而言,显然本发明不限于上述示范性实施例的细节,而且在不背离本发明的精神或基本特征的情况下,能够以其他的具体形式实现本发明。It will be apparent to those skilled in the art that the present invention is not limited to the details of the above-described exemplary embodiments, but that the present invention may be embodied in other specific forms without departing from the spirit or essential characteristics of the invention.

因此,无论从哪一点来看,均应将实施例看作是示范性的,而且是非限制性的,本发明的范围由所附权利要求而不是上述说明限定,因此旨在将落在权利要求的等同要件的含义和范围内的所有变化涵括在本发明内。不应将权利要求中的任何附关联图标记视为限制所涉及的权利要求。Therefore, the embodiments are to be regarded in all respects as illustrative and not restrictive, and the scope of the invention is to be defined by the appended claims rather than the foregoing description, which are therefore intended to fall within the scope of the claims. All changes within the meaning and range of the equivalents of , are included in the present invention. Any reference signs in the claims shall not be construed as limiting the involved claim.

本发明所指区块链是分布式数据存储、点对点传输、共识机制、加密算法等计算机技术的新型应用模式。区块链(Blockchain),本质上是一个去中心化的数据库,是一串使用密码学方法相关联产生的数据块,每一个数据块中包含了一批次网络交易的信息,用于验证其信息的有效性(防伪)和生成下一个区块。区块链可以包括区块链底层平台、平台产品服务层以及应用服务层等。The blockchain referred to in the present invention is a new application mode of computer technologies such as distributed data storage, point-to-point transmission, consensus mechanism, and encryption algorithm. Blockchain, essentially a decentralized database, is a series of data blocks associated with cryptographic methods. Each data block contains a batch of network transaction information to verify its Validity of information (anti-counterfeiting) and generation of the next block. The blockchain can include the underlying platform of the blockchain, the platform product service layer, and the application service layer.

本申请实施例可以基于人工智能技术对相关的数据进行获取和处理。其中,人工智能(Artificial Intelligence,AI)是利用数字计算机或者数字计算机控制的机器模拟、延伸和扩展人的智能,感知环境、获取知识并使用知识获得最佳结果的理论、方法、技术及应用系统。The embodiments of the present application may acquire and process related data based on artificial intelligence technology. Among them, artificial intelligence (AI) is a theory, method, technology and application system that uses digital computers or machines controlled by digital computers to simulate, extend and expand human intelligence, perceive the environment, acquire knowledge and use knowledge to obtain the best results. .

此外,显然“包括”一词不排除其他单元或步骤,单数不排除复数。系统权利要求中陈述的多个单元或装置也可以由一个单元或装置通过软件或者硬件来实现。第一、第二等词语用来表示名称,而并不表示任何特定的顺序。Furthermore, it is clear that the word "comprising" does not exclude other units or steps and the singular does not exclude the plural. Several units or means recited in the system claims can also be realized by one unit or means by means of software or hardware. The words first, second, etc. are used to denote names and do not denote any particular order.

最后应说明的是,以上实施例仅用以说明本发明的技术方案而非限制,尽管参照较佳实施例对本发明进行了详细说明,本领域的普通技术人员应当理解,可以对本发明的技术方案进行修改或等同替换,而不脱离本发明技术方案的精神和范围。Finally, it should be noted that the above embodiments are only used to illustrate the technical solutions of the present invention and not to limit them. Although the present invention has been described in detail with reference to the preferred embodiments, those of ordinary skill in the art should understand that the technical solutions of the present invention can be Modifications or equivalent substitutions can be made without departing from the spirit and scope of the technical solutions of the present invention.

Claims (10)

Translated fromChinesePriority Applications (1)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| CN202111524803.3ACN114187096B (en) | 2021-12-14 | 2021-12-14 | User-profile-based risk assessment method, device, equipment, and storage medium |

Applications Claiming Priority (1)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| CN202111524803.3ACN114187096B (en) | 2021-12-14 | 2021-12-14 | User-profile-based risk assessment method, device, equipment, and storage medium |

Publications (2)

| Publication Number | Publication Date |

|---|---|

| CN114187096Atrue CN114187096A (en) | 2022-03-15 |

| CN114187096B CN114187096B (en) | 2025-03-14 |

Family

ID=80543675

Family Applications (1)

| Application Number | Title | Priority Date | Filing Date |

|---|---|---|---|

| CN202111524803.3AActiveCN114187096B (en) | 2021-12-14 | 2021-12-14 | User-profile-based risk assessment method, device, equipment, and storage medium |

Country Status (1)

| Country | Link |

|---|---|

| CN (1) | CN114187096B (en) |

Cited By (5)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| CN114663215A (en)* | 2022-03-23 | 2022-06-24 | 平安普惠企业管理有限公司 | Overdue risk detection method and device, computer equipment and storage medium |

| CN115099680A (en)* | 2022-07-14 | 2022-09-23 | 平安科技(深圳)有限公司 | Risk management method, device, equipment and storage medium |

| CN116245636A (en)* | 2023-03-03 | 2023-06-09 | 中科柏诚科技(北京)股份有限公司 | Loan risk decision method, device, equipment and medium based on user portrait |

| CN116307736A (en)* | 2023-04-07 | 2023-06-23 | 平安科技(深圳)有限公司 | Method, device, equipment and storage medium for automatically generating risk image |

| CN116861243A (en)* | 2023-07-12 | 2023-10-10 | 三一重机有限公司 | Risk image model construction method, apparatus, electronic device and storage medium |

Citations (5)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| US20170039637A1 (en)* | 2015-08-05 | 2017-02-09 | Telefonica Digital Espana, S.L.U. | Computer-implemented method, a system and computer program products for assessing the credit worthiness of a user |

| CN108399509A (en)* | 2018-04-12 | 2018-08-14 | 阿里巴巴集团控股有限公司 | Determine the method and device of the risk probability of service request event |

| CN109389486A (en)* | 2018-08-27 | 2019-02-26 | 深圳壹账通智能科技有限公司 | Loan air control rule adjustment method, apparatus, equipment and computer storage medium |

| CN110175905A (en)* | 2019-04-17 | 2019-08-27 | 深圳壹账通智能科技有限公司 | Loan risk evaluation method and device, terminal and computer readable storage medium |

| CN110766541A (en)* | 2019-09-25 | 2020-02-07 | 平安科技(深圳)有限公司 | Loan risk assessment method, loan risk assessment device, loan risk assessment equipment and computer-readable storage medium |

- 2021

- 2021-12-14CNCN202111524803.3Apatent/CN114187096B/enactiveActive

Patent Citations (5)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| US20170039637A1 (en)* | 2015-08-05 | 2017-02-09 | Telefonica Digital Espana, S.L.U. | Computer-implemented method, a system and computer program products for assessing the credit worthiness of a user |

| CN108399509A (en)* | 2018-04-12 | 2018-08-14 | 阿里巴巴集团控股有限公司 | Determine the method and device of the risk probability of service request event |

| CN109389486A (en)* | 2018-08-27 | 2019-02-26 | 深圳壹账通智能科技有限公司 | Loan air control rule adjustment method, apparatus, equipment and computer storage medium |

| CN110175905A (en)* | 2019-04-17 | 2019-08-27 | 深圳壹账通智能科技有限公司 | Loan risk evaluation method and device, terminal and computer readable storage medium |

| CN110766541A (en)* | 2019-09-25 | 2020-02-07 | 平安科技(深圳)有限公司 | Loan risk assessment method, loan risk assessment device, loan risk assessment equipment and computer-readable storage medium |

Cited By (6)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| CN114663215A (en)* | 2022-03-23 | 2022-06-24 | 平安普惠企业管理有限公司 | Overdue risk detection method and device, computer equipment and storage medium |

| CN115099680A (en)* | 2022-07-14 | 2022-09-23 | 平安科技(深圳)有限公司 | Risk management method, device, equipment and storage medium |

| CN115099680B (en)* | 2022-07-14 | 2024-02-02 | 平安科技(深圳)有限公司 | Risk management method, apparatus, device and storage medium |

| CN116245636A (en)* | 2023-03-03 | 2023-06-09 | 中科柏诚科技(北京)股份有限公司 | Loan risk decision method, device, equipment and medium based on user portrait |

| CN116307736A (en)* | 2023-04-07 | 2023-06-23 | 平安科技(深圳)有限公司 | Method, device, equipment and storage medium for automatically generating risk image |

| CN116861243A (en)* | 2023-07-12 | 2023-10-10 | 三一重机有限公司 | Risk image model construction method, apparatus, electronic device and storage medium |

Also Published As

| Publication number | Publication date |

|---|---|

| CN114187096B (en) | 2025-03-14 |

Similar Documents

| Publication | Publication Date | Title |

|---|---|---|

| CN114187096A (en) | Risk assessment method, device, equipment and storage medium based on user portrait | |

| CN113449187A (en) | Product recommendation method, device and equipment based on double portraits and storage medium | |

| US11763180B2 (en) | Unsupervised competition-based encoding | |

| WO2022088632A1 (en) | User data monitoring and analysis method, apparatus, device, and medium | |

| CN112597135A (en) | User classification method and device, electronic equipment and readable storage medium | |

| CN115204971A (en) | Product recommendation method and device, electronic equipment and computer-readable storage medium | |

| CN113707302A (en) | Service recommendation method, device, equipment and storage medium based on associated information | |

| CN113434542B (en) | Data relationship identification method and device, electronic equipment and storage medium | |

| CN112214556B (en) | Label generation method, label generation device, electronic equipment and computer readable storage medium | |

| CN115238179A (en) | Project pushing method and device, electronic equipment and computer readable storage medium | |

| CN114219544A (en) | Consumption tendency analysis method, device, equipment and storage medium | |

| CN114756669A (en) | Intelligent analysis method and device for problem intention, electronic equipment and storage medium | |

| CN115146792A (en) | Multi-task learning model training method, device, electronic device and storage medium | |

| CN115186188A (en) | Product recommendation method, device and equipment based on behavior analysis and storage medium | |

| CN115048174A (en) | User-based personalized menu generation method, device, equipment and storage medium | |

| CN114066664A (en) | Risk level assessment method, device, equipment and medium based on behavior portrait | |

| CN113704411A (en) | Word vector-based similar passenger group mining method, device, equipment and storage medium | |

| CN113723114A (en) | Semantic analysis method, device and equipment based on multi-intent recognition and storage medium | |

| CN114240560B (en) | Product ranking method, device, equipment and storage medium based on multidimensional analysis | |

| CN114780688A (en) | Text quality inspection method, device and equipment based on rule matching and storage medium | |

| CN116468547A (en) | Credit card resource allocation method and system based on data mining | |

| CN115237941A (en) | Data reporting method and device, electronic equipment and computer readable storage medium | |

| CN114518993A (en) | System performance monitoring method, device, equipment and medium based on business characteristics | |

| CN114610807A (en) | Data import template configuration method, device, equipment and storage medium | |

| CN114612225A (en) | Product recommendation method and device, electronic equipment and computer-readable storage medium |

Legal Events

| Date | Code | Title | Description |

|---|---|---|---|

| PB01 | Publication | ||

| PB01 | Publication | ||

| SE01 | Entry into force of request for substantive examination | ||

| SE01 | Entry into force of request for substantive examination | ||

| GR01 | Patent grant | ||

| GR01 | Patent grant |