CN110827142A - User credit evaluation method, system, server and storage medium - Google Patents

User credit evaluation method, system, server and storage mediumDownload PDFInfo

- Publication number

- CN110827142A CN110827142ACN201911082107.4ACN201911082107ACN110827142ACN 110827142 ACN110827142 ACN 110827142ACN 201911082107 ACN201911082107 ACN 201911082107ACN 110827142 ACN110827142 ACN 110827142A

- Authority

- CN

- China

- Prior art keywords

- user information

- user

- request signal

- control system

- credit

- Prior art date

- Legal status (The legal status is an assumption and is not a legal conclusion. Google has not performed a legal analysis and makes no representation as to the accuracy of the status listed.)

- Pending

Links

Images

Classifications

- G—PHYSICS

- G06—COMPUTING OR CALCULATING; COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q40/00—Finance; Insurance; Tax strategies; Processing of corporate or income taxes

- G06Q40/03—Credit; Loans; Processing thereof

Landscapes

- Business, Economics & Management (AREA)

- Accounting & Taxation (AREA)

- Finance (AREA)

- Engineering & Computer Science (AREA)

- Development Economics (AREA)

- Economics (AREA)

- Marketing (AREA)

- Strategic Management (AREA)

- Technology Law (AREA)

- Physics & Mathematics (AREA)

- General Business, Economics & Management (AREA)

- General Physics & Mathematics (AREA)

- Theoretical Computer Science (AREA)

- Financial Or Insurance-Related Operations Such As Payment And Settlement (AREA)

Abstract

Description

Translated fromChinese技术领域technical field

本发明实施例涉及贷前风控技术,尤其涉及一种用户信用评估方法、系统、 服务器及存储介质。The embodiments of the present invention relate to a pre-loan risk control technology, and in particular, to a user credit evaluation method, system, server and storage medium.

背景技术Background technique

贷款是银行或其他金融机构按一定利率和必须归还等条件出借货币资金的 一种信用活动形式。广义的贷款指贷款、贴现、透支等出贷资金的总称。银 行通过贷款的方式将所集中的货币和货币资金投放出去,可以满足社会扩大再 生产对补充资金的需要,促进经济的发展,同时,银行也可以由此取得贷款利 息收入,增加银行自身的积累。A loan is a form of credit activity in which a bank or other financial institution lends monetary funds at a certain interest rate and must be repaid. Loans in a broad sense refer to the general term for lending funds such as loans, discounts, and overdrafts. Banks release the centralized currency and monetary funds through loans, which can meet the needs of supplementary funds for social expansion of reproduction and promote economic development. At the same time, banks can also obtain loan interest income and increase their own accumulation.

在贷前风控领域,需要对接很多外部数据渠道补充风控授信字段,如接入 学信网,同盾,增信通等等,每接入一家数据方,都需要去适配单独开发对接 流程,如请求参数拼接,校验,接口鉴权调用,接口结果解析返回风控使用方, 接口数据缓存。这样就存在接入流程繁琐、代码硬编码、重复工作量大和代码 上线周期长,无法很快的给风控新场景提供原数据支持,影响风控不能及时适 配市场欺诈的技术问题。In the field of pre-lending risk control, many external data channels need to be connected to supplement risk control and credit fields, such as access to Xuexin.com, Tongdun, Zengxintong, etc. Each time a data party is connected, it is necessary to adapt to the separate development and docking process , such as request parameter splicing, verification, interface authentication call, interface result analysis and return to the risk control user, and interface data cache. In this way, there are cumbersome access procedures, hard-coded codes, heavy repetitive workloads, and long code launch cycles, which cannot quickly provide original data support for new risk control scenarios, and affect the technical problems that risk control cannot adapt to market fraud in a timely manner.

发明内容SUMMARY OF THE INVENTION

本发明提供一种用户信用评估方法、系统、服务器及存储介质,以实现风 控系统与外部征信数据渠道的快速数据传输。The present invention provides a user credit evaluation method, system, server and storage medium, so as to realize fast data transmission between the risk control system and external credit reporting data channels.

第一方面,本发明实施例提供了一种用户信用评估方法,包括:In a first aspect, an embodiment of the present invention provides a user credit evaluation method, including:

获取风控系统发送的第一用户信息和第一请求信号;Obtain the first user information and the first request signal sent by the risk control system;

根据第一用户信息和第一请求信号发送第二请求信号到第三方系统并接收 第三方系统反馈的第二用户信息;Send the second request signal to the third-party system according to the first user information and the first request signal and receive the second user information fed back by the third-party system;

根据预设结构化规则对第二用户信息进行筛选和结构化处理,以得到第三 用户信息;Screening and structuring the second user information according to preset structural rules to obtain third user information;

将第三用户信息发送到风控系统以评估用户信用。Send the third user information to the risk control system to evaluate user credit.

进一步的,获取风控系统发送的第一用户信息和第一请求信号之后包括:Further, after obtaining the first user information and the first request signal sent by the risk control system, it includes:

根据预设校验规则判断第一用户信息是否完整。Whether the first user information is complete is determined according to a preset verification rule.

进一步的,根据第一用户信息和第一请求信号发送第二请求信号到第三方 系统并接收第三方系统反馈的第二用户信息包括:Further, sending the second request signal to the third-party system according to the first user information and the first request signal and receiving the second user information fed back by the third-party system include:

若第一用户信息完整,则根据第一用户信息和第一请求信号发送第二请求 信号到第三方系统并接收第三方系统反馈的第二用户信息;If the first user information is complete, then send the second request signal to the third-party system according to the first user information and the first request signal and receive the second user information fed back by the third-party system;

若第一用户信息不完整,则根据预设校验规则和预设数据库对第一用户信 息进行填充。If the first user information is incomplete, the first user information is filled according to the preset verification rule and the preset database.

进一步的,若第一用户信息完整,则根据第一用户信息和第一请求信号发 送第二请求信号到第三方系统并接收第三方系统反馈的第二用户信息包括:Further, if the first user information is complete, then send the second request signal to the third-party system according to the first user information and the first request signal and receive the second user information fed back by the third-party system includes:

若第一用户信息完整,生成第一用户信息的授权信号;If the first user information is complete, generating an authorization signal for the first user information;

根据授权信号、第一用户信息和第一请求信号发送第二请求信号到第三方 系统并接收第三方系统反馈的第二用户信息。The second request signal is sent to the third-party system according to the authorization signal, the first user information and the first request signal, and the second user information fed back by the third-party system is received.

进一步的,根据预设结构化规则对第二用户信息进行筛选和结构化处理, 以得到第三用户信息之后包括:Further, after screening and structuring the second user information according to the preset structuring rules, to obtain the third user information, the following steps are included:

判断第二用户信息是否完成筛选和结构化处理。It is judged whether the filtering and structuring processing of the second user information is completed.

进一步的,将第三用户信息发送到风控系统以评估用户信用包括:Further, sending the third user information to the risk control system to evaluate user credit includes:

若第二用户信息完成筛选和结构化处理,则将第三用户信息发送到风控系 统以评估用户信用;If the second user information is screened and structured, then the third user information is sent to the risk control system to evaluate user credit;

若第二用户信息未完成筛选和结构化处理,则根据预设结构化规则重新对 第二用户信息进行筛选和结构化处理。If the second user information has not been screened and structured, the second user information is screened and structured again according to a preset structured rule.

进一步的,根据预设结构化规则对第二用户信息进行筛选和结构化处理, 以得到第三用户信息之后还包括:Further, after screening and structuring the second user information according to the preset structuring rules, to obtain the third user information, the method further includes:

将第三用户信息存储到预设数据库中。The third user information is stored in the preset database.

第二方面,本发明实施例还提供了一种用户信用评估系统,包括:In a second aspect, an embodiment of the present invention also provides a user credit evaluation system, including:

获取模块,用于获取风控系统发送的第一用户信息和第一请求信号;an acquisition module, configured to acquire the first user information and the first request signal sent by the risk control system;

接收模块,用于根据第一用户信息和第一请求信号发送第二请求信号到第 三方系统并接收第三方系统反馈的第二用户信息;a receiving module, configured to send a second request signal to a third-party system according to the first user information and the first request signal and receive the second user information fed back by the third-party system;

组装模块,用于根据预设结构化规则对第二用户信息进行筛选和结构化处 理,以得到第三用户信息;an assembly module, used for screening and structuring the second user information according to the preset structuring rule, to obtain the third user information;

发送模块,用于将第三用户信息发送到风控系统以评估用户信用。The sending module is used for sending the third user information to the risk control system to evaluate the user's credit.

第三方面,本发明实施例还提供了一种服务器,包括存储器、处理器及存 储在存储器上并可在处理器上运行的计算机程序,处理器执行计算机程序时实 现上述实施例中任一项用户信用评估方法的步骤。In a third aspect, an embodiment of the present invention further provides a server, including a memory, a processor, and a computer program stored in the memory and running on the processor, and any one of the foregoing embodiments is implemented when the processor executes the computer program The steps of the user credit assessment method.

第四方面,本发明实施例还提供了一种计算机可读存储介质,其上存储有 计算机程序,计算机程序被处理器执行时实现上述实施例中任一项用户信用评 估方法的步骤。In a fourth aspect, an embodiment of the present invention further provides a computer-readable storage medium on which a computer program is stored, and when the computer program is executed by a processor, implements the steps of any one of the user credit evaluation methods in the foregoing embodiments.

本发明通过将外部征信数据渠道反馈的数据统一接入风控系统,实现了根 据风控系统的要求对风控系统发送的数据进行配置化、校验和鉴权操作,并针 对外部征信数据渠道反馈的征信数据,根据风控系统的需求,进行校验和组装, 从而使外部征信数据渠道能高效接入风控系统并简化操作的技术效果。The invention realizes the configuration, verification and authentication operations of the data sent by the wind control system according to the requirements of the wind control system by uniformly connecting the data fed back by the external credit reporting data channel to the wind control system, and for external credit reporting The credit data fed back by the data channel is verified and assembled according to the requirements of the risk control system, so that the external credit data channel can be efficiently connected to the risk control system and the technical effect of simplifying the operation.

附图说明Description of drawings

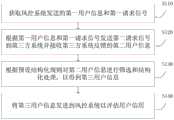

图1为本发明实施例一提供的一种用户信用评估方法的流程图;1 is a flowchart of a user credit evaluation method provided in Embodiment 1 of the present invention;

图2为本发明实施例二提供的一种用户信用评估方法的流程图;2 is a flowchart of a user credit evaluation method provided in Embodiment 2 of the present invention;

图3为本发明实施例三提供的一种用户信用评估系统的结构示意图;3 is a schematic structural diagram of a user credit evaluation system according to Embodiment 3 of the present invention;

图4为本发明实施例四提供的一种服务器的结构示意图。FIG. 4 is a schematic structural diagram of a server according to Embodiment 4 of the present invention.

具体实施方式Detailed ways

下面结合附图和实施例对本发明作进一步的详细说明。可以理解的是,此 处所描述的具体实施例用于解释本发明,而非对本发明的限定。另外还需要说 明的是,为了便于描述,附图中仅示出了与本发明相关的部分而非全部结构。The present invention will be further described in detail below in conjunction with the accompanying drawings and embodiments. It is to be understood that the specific embodiments described herein are used to explain the present invention, but not to limit the present invention. In addition, it should be noted that, for the convenience of description, the drawings only show some but not all structures related to the present invention.

在更加详细地讨论示例性实施例之前应当提到的是,一些示例性实施例被 描述成作为流程图描绘的处理或方法。虽然流程图将各步骤描述成顺序的处理, 但是其中的许多步骤可以被并行地、并发地或者同时实施。此外,各步骤的顺 序可以被重新安排。当其操作完成时处理可以被终止,但是还可以具有未包括 在附图中的附加步骤。处理可以对应于方法、函数、规程、子例程、子程序等 等。Before discussing the exemplary embodiments in greater detail, it should be mentioned that some exemplary embodiments are described as processes or methods depicted as flowcharts. Although the flowchart depicts the steps as a sequential process, many of the steps may be performed in parallel, concurrently, or concurrently. Furthermore, the order of the steps can be rearranged. The process may be terminated when its operation is complete, but may also have additional steps not included in the figures. A process may correspond to a method, function, procedure, subroutine, subroutine, or the like.

此外,术语“第一”、“第二”等可在本文中用于描述各种方向、动作、步 骤或元件等,但这些方向、动作、步骤或元件不受这些术语限制。这些术语仅 用于将第一个方向、动作、步骤或元件与另一个方向、动作、步骤或元件区分。 举例来说,在不脱离本申请的范围的情况下,可以将第一用户信息称为第二用 户信息,且类似地,可将第二用户信息称为第一用户信息。第一用户信息和第 二用户信息两者都是用户信息,但其不是同一用户信息。术语“第一”、“第二” 等不能理解为指示或暗示相对重要性或者隐含指明所指示的技术特征的数量。 由此,限定有“第一”、“第二”的特征可以明示或者隐含地包括一个或者更多 个特征。在本发明实施例的描述中,“多个”的含义是至少两个,例如两个,三 个等,除非另有明确具体的限定。Furthermore, the terms "first", "second", etc. may be used herein to describe various directions, acts, steps or elements, etc., but are not limited by these terms. These terms are only used to distinguish a first direction, act, step or element from another direction, act, step or element. For example, first user information may be referred to as second user information, and similarly, second user information may be referred to as first user information, without departing from the scope of this application. Both the first user information and the second user information are user information, but they are not the same user information. The terms "first", "second" etc. shall not be understood as indicating or implying relative importance or implying the number of indicated technical features. Thus, a feature defined as "first", "second" may expressly or implicitly include one or more of the features. In the description of the embodiments of the present invention, "a plurality of" means at least two, such as two, three, etc., unless otherwise expressly and specifically defined.

实施例一Example 1

图1为本发明实施例一提供的一种用户信用评估方法的流程图,本实施例 可适用于需要对进行贷款的用户进行征信评估的情况,该方法可以由征信数据 统一传输平台来执行,如图1所示,一种用户信用评估方法,包括:FIG. 1 is a flowchart of a user credit evaluation method provided in Embodiment 1 of the present invention. This embodiment can be applied to the situation where credit evaluation needs to be performed on users who make loans, and the method can be implemented by a unified credit data transmission platform. Execute, as shown in Figure 1, a user credit evaluation method, including:

步骤S110、获取风控系统发送的第一用户信息和第一请求信号;Step S110, acquiring the first user information and the first request signal sent by the risk control system;

具体的,风险控制是指风险管理者采取各种措施和方法,消灭或减少风险 事件发生的各种可能性,或风险控制者减少风险事件发生时造成的损失。总会 有些事情是不能控制的,风险总是存在的。作为管理者会采取各种措施减小风 险事件发生的可能性,或者把可能的损失控制在一定的范围内,以避免在风险 事件发生时带来的难以承担的损失。风险控制的四种基本方法是:风险回避、损 失控制、风险转移和风险保留。Specifically, risk control means that risk managers take various measures and methods to eliminate or reduce various possibilities of risk events, or risk controllers reduce losses caused by risk events. There will always be things out of your control and there will always be risks. As a manager, various measures will be taken to reduce the possibility of risk events, or to control possible losses within a certain range, so as to avoid unbearable losses when risk events occur. The four basic methods of risk control are: risk avoidance, loss control, risk transfer and risk retention.

在本实施例中,第一用户信息可以是用户的基础信息,如用户姓名、年龄 和手机号。当用户需要进行网贷时,可以在移动智能终端的相关软件上或网页 上进行申请并填写基本信息,风控系统在接收到用户提交的网贷申请和用户基 本信息后,风控系统会将用户的基本信息(即第一用户信息)和第一请求信号 (当征信数据统一传输平台接收到第一请求信息后才会访问其他的外部征信数 据渠道进行征信数据的获取)发送第一用户信息到征信数据统一传输平台中。In this embodiment, the first user information may be basic information of the user, such as the user's name, age and mobile phone number. When the user needs to make an online loan, he can apply and fill in the basic information on the relevant software of the mobile smart terminal or on the web page. After the risk control system receives the online loan application and the basic user information submitted by the user, the risk control system will The basic information of the user (that is, the first user information) and the first request signal (only after the unified credit data transmission platform receives the first request information will it access other external credit data channels to obtain the credit data) to send the first request signal. A user information is sent to the unified transmission platform for credit information data.

步骤S120、根据第一用户信息和第一请求信号发送第二请求信号到第三方 系统并接收第三方系统反馈的第二用户信息;Step S120, send the second request signal to the third-party system according to the first user information and the first request signal and receive the second user information fed back by the third-party system;

具体的,在征信数据统一传输平台接收到风控系统发送的第一用户信息和 第一请求信号后,才会根据第一用户信息在外部征信数据渠道(即第三方系统) 中进行对应第一用户信息的征信数据获取,这些外部征信数据渠道可以是同盾、 增信通和学信网。在本实施例中,第二用户信息可以是身份证号、学历、职业、 所属公司和亲属关系等。Specifically, after the unified credit data transmission platform receives the first user information and the first request signal sent by the risk control system, it will conduct correspondence in the external credit data channel (ie, third-party system) according to the first user information. To obtain the credit data of the first user information, these external credit data channels can be Tongdun, Zengxintong and Xuexin.com. In this embodiment, the second user information may be ID number, education background, occupation, company to which he belongs, and kinship.

步骤S130、根据预设结构化规则对第二用户信息进行筛选和结构化处理, 以得到第三用户信息;Step S130, screening and structuring the second user information according to a preset structuring rule to obtain third user information;

具体的,在本实施例中,预设结构化规则可以是指根据风控系统的要求对 第二用户信息进行一个有一定规则的处理。举例来说,当第二用户信息有用户 职业、身份证号、家庭住址和学历时,而风控系统需要接收的用户信息仅仅是 用户的身份证号和职业时,即家庭住址和学历这两种信息并不是风控系统需要 的用户信息,那么征信数据统一传输平台可以将第二用户信息中的身份证号和 职业这两种信息通过预设结构化规则组合起来,即得到第三用户信息。Specifically, in this embodiment, the preset structured rules may refer to processing the second user information with certain rules according to the requirements of the risk control system. For example, when the second user information includes the user's occupation, ID number, home address and educational background, and the user information that the risk control system needs to receive is only the user's ID number and occupation, that is, the home address and educational background. This information is not the user information required by the risk control system, then the unified credit data transmission platform can combine the ID number and occupation in the second user information through preset structured rules to obtain the third user information.

步骤S140、将第三用户信息发送到风控系统以评估用户信用。Step S140, sending the third user information to the risk control system to evaluate the user's credit.

具体的,在通过步骤S130得到第三用户信息后,将第三用户信息发送到风 控系统中,从而在风控系统中完成对用户信用的评估。Specifically, after obtaining the third user information through step S130, the third user information is sent to the risk control system, so that the user credit evaluation is completed in the risk control system.

本发明实施例一的有益效果在于通过将外部征信数据渠道反馈的数据统一 接入风控系统,实现了根据风控系统的要求对风控系统发送的数据进行配置化、 校验和鉴权操作,并针对外部征信数据渠道反馈的征信数据,根据风控系统的 需求,进行校验和组装,从而使外部征信数据渠道能高效接入风控系统并简化 操作的技术效果。The beneficial effect of the first embodiment of the present invention is that by uniformly connecting the data fed back by the external credit reporting data channel to the risk control system, the configuration, verification and authentication of the data sent by the risk control system are realized according to the requirements of the risk control system. According to the credit data fed back by the external credit data channel, according to the requirements of the risk control system, the verification and assembly are carried out, so that the external credit data channel can be efficiently connected to the risk control system and the technical effect of simplifying the operation.

实施例二Embodiment 2

本发明实施例二是在实施例一的基础上做的进一步优化。图2为本发明实 施例二提供的一种用户信用评估方法的流程图。如图2所示,本实施例的用户 信用评估方法,包括:The second embodiment of the present invention is further optimized on the basis of the first embodiment. Fig. 2 is a flowchart of a user credit evaluation method provided in Embodiment 2 of the present invention. As shown in Figure 2, the user credit evaluation method of the present embodiment includes:

步骤S210、获取风控系统发送的第一用户信息和第一请求信号;Step S210, acquiring the first user information and the first request signal sent by the risk control system;

具体的,风险控制是指风险管理者采取各种措施和方法,消灭或减少风险 事件发生的各种可能性,或风险控制者减少风险事件发生时造成的损失。总会 有些事情是不能控制的,风险总是存在的。作为管理者会采取各种措施减小风 险事件发生的可能性,或者把可能的损失控制在一定的范围内,以避免在风险 事件发生时带来的难以承担的损失。风险控制的四种基本方法是:风险回避、损 失控制、风险转移和风险保留。Specifically, risk control means that risk managers take various measures and methods to eliminate or reduce various possibilities of risk events, or risk controllers reduce losses caused by risk events. There will always be things out of your control and there will always be risks. As a manager, various measures will be taken to reduce the possibility of risk events, or to control possible losses within a certain range, so as to avoid unbearable losses when risk events occur. The four basic methods of risk control are: risk avoidance, loss control, risk transfer and risk retention.

在本实施例中,第一用户信息可以是用户的基础信息,如用户姓名、年龄 和手机号。当用户需要进行网贷时,可以在移动智能终端的相关软件上或网页 上进行申请并填写基本信息,风控系统在接收到用户提交的网贷申请和用户基 本信息后,风控系统会将用户的基本信息(即第一用户信息)和第一请求信号 (当征信数据统一传输平台接收到第一请求信息后才会访问其他的外部征信数 据渠道进行征信数据的获取)发送第一用户信息到征信数据统一传输平台中In this embodiment, the first user information may be basic information of the user, such as the user's name, age and mobile phone number. When the user needs to make an online loan, he can apply and fill in the basic information on the relevant software of the mobile smart terminal or on the web page. After the risk control system receives the online loan application and the basic user information submitted by the user, the risk control system will The basic information of the user (that is, the first user information) and the first request signal (only after the unified credit data transmission platform receives the first request information will it access other external credit data channels to obtain the credit data) to send the first request signal. One user information to the unified transmission platform of credit data

步骤S220、根据预设校验规则判断第一用户信息是否完整;Step S220, judging whether the first user information is complete according to a preset verification rule;

具体的,在征信数据统一传输平台接收到风控系统发送的第一用户信息后, 可以根据预设校验规则判断第一用户信息是否完整。在本实施例中,预设校验 规则可以通过第一用户信息的字段属性(如int、string等)来判断第一用户 信息是否完整。Specifically, after the unified transmission platform for credit reporting data receives the first user information sent by the risk control system, it can determine whether the first user information is complete according to a preset verification rule. In this embodiment, the preset verification rule may determine whether the first user information is complete or not according to the field attributes (such as int, string, etc.) of the first user information.

在本实施例中,当第一用户信息是完整的,则执行步骤S231和步骤S232。In this embodiment, when the first user information is complete, steps S231 and S232 are executed.

步骤S231、若第一用户信息完整,生成第一用户信息的授权信号;Step S231, if the first user information is complete, generate an authorization signal for the first user information;

具体的,当第一用户信息完整时,征信数据统一传输平台会生成一个对应 第一用户信息的授权信号。在本实施例中,授权信号是指能允许征信数据统一 传输平台的数据传输接口与外部征信数据渠道的接口进行数据的访问和传输的 一种命令。Specifically, when the first user information is complete, the unified transmission platform for credit reporting data will generate an authorization signal corresponding to the first user information. In this embodiment, the authorization signal refers to a command that allows the data transmission interface of the unified credit data transmission platform and the interface of the external credit data channel to access and transmit data.

步骤S232、根据授权信号、第一用户信息和第一请求信号发送第二请求信 号到第三方系统并接收第三方系统反馈的第二用户信息;Step S232, send the second request signal to the third-party system according to the authorization signal, the first user information and the first request signal and receive the second user information fed back by the third-party system;

具体的,在生成了对应第一用户信息的授权信息后,征信数据统一传输平 台会向外部征信数据渠道发送第二请求信号,这里的第二请求信号是指一种用 于请求允许访问本系统其他模块或其他系统的命令。在本实施例中,第二用户 信息可以是身份证号、学历、职业、所属公司和亲属关系等。当外部征信数据 渠道(即第三方系统)确实接收到第二请求信号后,第三方系统会根据第一用 户信息在自己的数据库中进行搜索,得到对应第一用户信息的第二用户信息。Specifically, after generating the authorization information corresponding to the first user information, the unified credit data transmission platform will send a second request signal to the external credit data channel, where the second request signal refers to a request for permission to access Commands of other modules of this system or other systems. In this embodiment, the second user information may be ID number, education background, occupation, company to which he belongs, and kinship. When the external credit data channel (that is, the third-party system) does receive the second request signal, the third-party system will search in its own database according to the first user information, and obtain the second user information corresponding to the first user information.

在本实施例中,当第一用户信息不是完整的,则执行步骤S233。In this embodiment, when the first user information is not complete, step S233 is performed.

步骤S233、若第一用户信息不完整,则根据预设校验规则和预设数据库对 第一用户信息进行填充;Step S233, if the first user information is incomplete, then fill the first user information according to the preset verification rule and the preset database;

具体的,当第一用户信息不完整时,可以根据之前预设的校验规则在征信 数据统一传输平台的预设数据库中对第一用户信息中缺失的信息进行填充。Specifically, when the first user information is incomplete, the information missing in the first user information can be filled in the preset database of the unified credit data transmission platform according to the previously preset verification rules.

步骤S240、根据预设结构化规则对第二用户信息进行筛选和结构化处理, 以得到第三用户信息;Step S240, screening and structuring the second user information according to a preset structuring rule to obtain third user information;

具体的,在本实施例中,预设结构化规则可以是指根据风控系统的要求对 第二用户信息进行一个有一定规则的处理。举例来说,当第二用户信息有用户 职业、身份证号、家庭住址和学历时,而风控系统需要接收的用户信息仅仅是 用户的身份证号和职业时,即家庭住址和学历这两种信息并不是风控系统需要 的用户信息,那么征信数据统一传输平台可以将第二用户信息中的身份证号和 职业这两种信息通过预设结构化规则组合起来,即得到第三用户信息。Specifically, in this embodiment, the preset structured rules may refer to processing the second user information with certain rules according to the requirements of the risk control system. For example, when the second user information includes the user's occupation, ID number, home address and educational background, and the user information that the risk control system needs to receive is only the user's ID number and occupation, that is, the home address and educational background. This information is not the user information required by the risk control system, then the unified credit data transmission platform can combine the ID number and occupation in the second user information through preset structured rules to obtain the third user information.

步骤S250、判断第二用户信息是否完成筛选和结构化处理;Step S250, judging whether the second user information has been screened and structured;

步骤S261、若第二用户信息完成筛选和结构化处理,则将第三用户信息发 送到风控系统以评估用户信用;Step S261, if the second user information is screened and structured, then the third user information is sent to the risk control system to assess user credit;

具体的,当第二用户信息完成了筛选和结构化处理后,将得到的第三用户 信息发送到风控系统中。举例来说,当第二用户信息是学历、职业、身份证号 和亲属关系,而风控系统需要的信息是学历和身份证号时,对第二用户信息进 行筛选和结构化处理,得到的第三用户信息如果就是学历和身份证号时,说明 第二用户信息完成了筛选和结构化处理,这时可以将第三用户信息发送到风控 系统中以完成对该被征信用户的信用评估。Specifically, after the second user information is screened and structured, the obtained third user information is sent to the risk control system. For example, when the second user information is education, occupation, ID number and kinship, and the information required by the risk control system is education and ID number, the second user information is screened and structured, and the result is obtained. If the third user information is the educational background and ID number, it means that the second user information has been screened and structured. At this time, the third user information can be sent to the risk control system to complete the credit of the credited user. Evaluate.

步骤S262、若第二用户信息未完成筛选和结构化处理,则根据预设结构化 规则重新对第二用户信息进行筛选和结构化处理;Step S262, if the second user information does not complete screening and structuring, then according to the preset structuring rule, the second user information is screened and structured again;

具体的,当第二用户信息未完成筛选和结构化处理后,征信数据统一传输 平台可以根据之前的预设结构化规则重新对第二用户信息进行筛选和结构化处 理。举例来说,当第二用户信息是学历、职业、身份证号和亲属关系,而风控 系统需要的信息是学历和身份证号时,对第二用户信息进行筛选和结构化处理 后,得到的第三用户信息如果就是学历、身份证号和亲属关系时,说明第二用 户信息未完成,这时可以将第三用户信息发送到风控系统中以完成对该被征信 用户的信用评估。Specifically, when the second user information has not been screened and structured, the unified credit data transmission platform can re-screen and structured the second user information according to the previous preset structured rules. For example, when the second user information is education, occupation, ID number and kinship, and the information required by the risk control system is education and ID number, the second user information is screened and structured to get If the information of the third user is the educational background, ID number and kinship, it means that the information of the second user has not been completed. At this time, the information of the third user can be sent to the risk control system to complete the credit evaluation of the credited user. .

步骤S270、将第三用户信息存储到预设数据库中。Step S270: Store the third user information in a preset database.

具体的,在本实施例中,还可以根据风控系统的需求对第三用户信息进行 存储。举例来说,当风控系统需要多次对该用户的征信数据进行调用时,征信 数据统一传输平台可以将该用户的第三用户信息暂存在预设的数据库中,以方 便风控系统能对该用户的征信数据进行低成本、便捷的调用,这种暂存可以是 只存储一天或特定时间期限,当超过特定时间期限后,征信数据统一传输平台 可以将第三用户信息从预设数据库中删除。Specifically, in this embodiment, the third user information may also be stored according to the requirements of the risk control system. For example, when the risk control system needs to call the user's credit data multiple times, the unified credit data transmission platform can temporarily store the user's third user information in a preset database to facilitate the risk control system. The user's credit data can be called in a low-cost and convenient way. This temporary storage can be stored for only one day or a specific time limit. When the specific time limit is exceeded, the unified credit data transmission platform can transfer the third user's information from the third user's information. Deleted from the preset database.

本发明实施例二的有益效果在于通过将外部征信数据渠道反馈的数据统一 接入风控系统,实现了根据风控系统的要求对风控系统发送的数据进行配置化、 校验和鉴权操作,并针对外部征信数据渠道反馈的征信数据,根据风控系统的 需求,进行校验和组装,减少重复工作量,使外部征信数据渠道能简单、高效 接入风控系统的技术效果。The beneficial effect of the second embodiment of the present invention is that by uniformly connecting the data fed back by the external credit reporting data channel to the risk control system, the configuration, verification and authentication of the data sent by the risk control system are realized according to the requirements of the risk control system. operation, and according to the credit data fed back by the external credit data channel, according to the needs of the risk control system, the verification and assembly are carried out to reduce the repetitive workload, so that the external credit data channel can be easily and efficiently connected to the technology of the risk control system Effect.

实施例三Embodiment 3

图3为本发明实施例三提供的一种用户信用评估系统的结构示意图。如图3所示,本实施例的用户信用评估系统300,包括:FIG. 3 is a schematic structural diagram of a user credit evaluation system according to Embodiment 3 of the present invention. As shown in FIG. 3 , the user credit evaluation system 300 of this embodiment includes:

获取模块310,用于获取风控系统发送的第一用户信息和第一请求信号;an obtaining module 310, configured to obtain the first user information and the first request signal sent by the risk control system;

接收模块320,用于根据第一用户信息和第一请求信号发送第二请求信号 到第三方系统并接收第三方系统反馈的第二用户信息;The receiving module 320 is used to send the second request signal to the third-party system according to the first user information and the first request signal and receive the second user information fed back by the third-party system;

组装模块330,用于根据预设结构化规则对第二用户信息进行筛选和结构 化处理,以得到第三用户信息;The assembly module 330 is used for screening and structuring the second user information according to the preset structuring rule to obtain the third user information;

发送模块340,用于将第三用户信息发送到风控系统以评估用户信用。The sending module 340 is configured to send the third user information to the risk control system to evaluate the user's credit.

在本实施例中,用户信用评估系统300还包括:In this embodiment, the user credit evaluation system 300 further includes:

第一判断模块350,用于根据预设校验规则判断第一用户信息是否完整。The first judging module 350 is configured to judge whether the first user information is complete according to a preset verification rule.

在本实施例中,接收模块320包括:In this embodiment, the receiving module 320 includes:

第一执行单元,用于若第一用户信息完整,则根据第一用户信息和第一请 求信号发送第二请求信号到第三方系统并接收第三方系统反馈的第二用户信 息;The first execution unit is used to send the second request signal to the third-party system according to the first user information and the first request signal and receive the second user information fed back by the third-party system if the first user information is complete;

第二执行单元,用于若第一用户信息不完整,则根据预设校验规则和预设 数据库对第一用户信息进行填充。The second execution unit is configured to fill in the first user information according to the preset verification rule and the preset database if the first user information is incomplete.

在本实施例中,第一执行单元包括:In this embodiment, the first execution unit includes:

生成单元,用于若第一用户信息完整,生成第一用户信息的授权信号;a generating unit, configured to generate an authorization signal of the first user information if the first user information is complete;

接收单元,用于根据授权信号、第一用户信息和第一请求信号发送第二请 求信号到第三方系统并接收第三方系统反馈的第二用户信息。The receiving unit is configured to send a second request signal to the third-party system according to the authorization signal, the first user information and the first request signal, and receive the second user information fed back by the third-party system.

在本实施例中,用户信用评估系统300还包括:In this embodiment, the user credit evaluation system 300 further includes:

第二判断模块360,用于判断第二用户信息是否完成筛选和结构化处理。The second judging module 360 is configured to judge whether the screening and structuring processing of the second user information is completed.

在本实施例中,发送模块340包括:In this embodiment, the sending module 340 includes:

发送单元,用于若第二用户信息完成筛选和结构化处理,则将第三用户信 息发送到风控系统以评估用户信用;A sending unit, used to send the third user information to the risk control system to evaluate user credit if the second user information completes the screening and structured processing;

若第二用户信息未完成筛选和结构化处理,则根据预设结构化规则重新对 第二用户信息进行筛选和结构化处理。If the second user information has not been screened and structured, the second user information is screened and structured again according to a preset structured rule.

在本实施例中,用户信用评估系统300还包括:In this embodiment, the user credit evaluation system 300 further includes:

存储模块370,用于将第三用户信息存储到预设数据库中。The storage module 370 is configured to store the third user information in a preset database.

本发明实施例所提供的用户信用评估系统可执行本发明任意实施例所提供 的用户信用评估方法,具备执行方法相应的功能模块和有益效果。The user credit evaluation system provided by the embodiment of the present invention can execute the user credit evaluation method provided by any embodiment of the present invention, and has corresponding functional modules and beneficial effects of the execution method.

实施例四Embodiment 4

图4为本发明实施例四提供的一种服务器的结构示意图,如图4所示,该 服务器包括处理器410、存储器420、输入装置430和输出装置440;服务器中 处理器410的数量可以是一个或多个,图4中以一个处理器410为例;服务器 中的处理器410、存储器420、输入装置430和输出装置440可以通过总线或其 他方式连接,图4中以通过总线连接为例。FIG. 4 is a schematic structural diagram of a server according to Embodiment 4 of the present invention. As shown in FIG. 4 , the server includes a

存储器410作为一种计算机可读存储介质,可用于存储软件程序、计算机 可执行程序以及模块,如本发明实施例中的用户信用评估系统对应的程序指令/ 模块(例如,用户信用评估系统中的获取模块、接收模块、组装模块、发送模 块、第一判断模块、第二判断模块和存储模块)。处理器410通过运行存储在存 储器420中的软件程序、指令以及模块,从而执行服务器的各种功能应用以及 数据处理,即实现上述的用户信用评估方法。As a computer-readable storage medium, the

也即:That is:

获取风控系统发送的第一用户信息和第一请求信号;Obtain the first user information and the first request signal sent by the risk control system;

根据第一用户信息和第一请求信号发送第二请求信号到第三方系统并接收 第三方系统反馈的第二用户信息;Send the second request signal to the third-party system according to the first user information and the first request signal and receive the second user information fed back by the third-party system;

根据预设结构化规则对第二用户信息进行筛选和结构化处理,以得到第三 用户信息;Screening and structuring the second user information according to preset structural rules to obtain third user information;

将第三用户信息发送到风控系统以评估用户信用。Send the third user information to the risk control system to evaluate user credit.

存储器420可主要包括存储程序区和存储数据区,其中,存储程序区可存 储操作系统、至少一个功能所需的应用程序;存储数据区可存储根据终端的使 用所创建的数据等。此外,存储器420可以包括高速随机存取存储器,还可以 包括非易失性存储器,例如至少一个磁盘存储器件、闪存器件、或其他非易失 性固态存储器件。在一些实例中,存储器420可进一步包括相对于处理器410 远程设置的存储器,这些远程存储器可以通过网络连接至服务器。上述网络的 实例包括但不限于互联网、企业内部网、局域网、移动通信网及其组合。The

输入装置430可用于接收输入的数字或字符信息,以及产生与服务器的用 户设置以及功能控制有关的键信号输入。输出装置440可包括显示屏等显示设 备。The

实施例五Embodiment 5

本发明实施例五还提供一种包含计算机可执行指令的存储介质,计算机可 执行指令在由计算机处理器执行时用于执行一种用户信用评估方法,该方法包 括:Embodiment 5 of the present invention also provides a storage medium containing computer-executable instructions, and the computer-executable instructions are used to execute a user credit evaluation method when executed by a computer processor, and the method includes:

获取风控系统发送的第一用户信息和第一请求信号;Obtain the first user information and the first request signal sent by the risk control system;

根据第一用户信息和第一请求信号发送第二请求信号到第三方系统并接收 第三方系统反馈的第二用户信息;Send the second request signal to the third-party system according to the first user information and the first request signal and receive the second user information fed back by the third-party system;

根据预设结构化规则对第二用户信息进行筛选和结构化处理,以得到第三 用户信息;Screening and structuring the second user information according to preset structural rules to obtain third user information;

将第三用户信息发送到风控系统以评估用户信用。Send the third user information to the risk control system to evaluate user credit.

当然,本发明实施例所提供的一种包含计算机可执行指令的存储介质,其计 算机可执行指令不限于如上的方法操作,还可以执行本发明任意实施例所提供 的用户信用评估方法中的相关操作.Of course, a storage medium containing computer-executable instructions provided by the embodiments of the present invention is not limited to the above method operations, and can also execute the relevant information in the user credit evaluation method provided by any embodiment of the present invention. operate.

通过以上关于实施方式的描述,所属领域的技术人员可以清楚地了解到, 本发明可借助软件及必需的通用硬件来实现,当然也可以通过硬件实现,但很 多情况下前者是更佳的实施方式。基于这样的理解,本发明的技术方案本质上 或者说对现有技术做出贡献的部分可以以软件产品的形式体现出来,该计算机 软件产品可以存储在计算机可读存储介质中,如计算机的软盘、只读存储器 (Read-Only Memory,ROM)、随机存取存储器(RandomAccess Memory,RAM)、 闪存(FLASH)、硬盘或光盘等,包括若干指令用以使得一台计算机设备(可以 是个人计算机,服务器,或者网络设备等)执行本发明各个实施例的方法。From the above description of the embodiments, those skilled in the art can clearly understand that the present invention can be realized by software and necessary general-purpose hardware, and of course can also be realized by hardware, but in many cases the former is a better embodiment . Based on such understanding, the technical solutions of the present invention can be embodied in the form of software products in essence or the parts that make contributions to the prior art, and the computer software products can be stored in a computer-readable storage medium, such as a floppy disk of a computer , read-only memory (Read-Only Memory, ROM), random access memory (Random Access Memory, RAM), flash memory (FLASH), hard disk or CD, etc., including several instructions to make a computer device (which can be a personal computer, A server, or a network device, etc.) executes the methods of the various embodiments of the present invention.

值得注意的是,上述用户信用评估系统的实施例中,所包括的各个单元和 模块只是按照功能逻辑进行划分的,但并不局限于上述的划分,只要能够实现 相应的功能即可;另外,各功能单元的具体名称也只是为了便于相互区分,并 不用于限制本发明的保护范围。It is worth noting that in the above-mentioned embodiment of the user credit evaluation system, the units and modules included are only divided according to functional logic, but are not limited to the above-mentioned division, as long as the corresponding functions can be realized; in addition, The specific names of the functional units are only for the convenience of distinguishing from each other, and are not used to limit the protection scope of the present invention.

注意,上述仅为本发明的较佳实施例及所运用技术原理。本领域技术人员 会理解,本发明不限于这里的特定实施例,对本领域技术人员来说能够进行各 种明显的变化、重新调整和替代而不会脱离本发明的保护范围。因此,虽然通 过以上实施例对本发明进行了较为详细的说明,但是本发明不仅仅限于以上实 施例,在不脱离本发明构思的情况下,还可以包括更多其他等效实施例,而本 发明的范围由所附的权利要求范围决定。Note that the above are only preferred embodiments of the present invention and applied technical principles. Those skilled in the art will understand that the present invention is not limited to the specific embodiments herein, and various obvious changes, readjustments and substitutions can be made to those skilled in the art without departing from the protection scope of the present invention. Therefore, although the present invention has been described in detail through the above embodiments, the present invention is not limited to the above embodiments, and can also include more other equivalent embodiments without departing from the concept of the present invention. The scope is determined by the scope of the appended claims.

Claims (10)

Priority Applications (1)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| CN201911082107.4ACN110827142A (en) | 2019-11-07 | 2019-11-07 | User credit evaluation method, system, server and storage medium |

Applications Claiming Priority (1)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| CN201911082107.4ACN110827142A (en) | 2019-11-07 | 2019-11-07 | User credit evaluation method, system, server and storage medium |

Publications (1)

| Publication Number | Publication Date |

|---|---|

| CN110827142Atrue CN110827142A (en) | 2020-02-21 |

Family

ID=69553164

Family Applications (1)

| Application Number | Title | Priority Date | Filing Date |

|---|---|---|---|

| CN201911082107.4APendingCN110827142A (en) | 2019-11-07 | 2019-11-07 | User credit evaluation method, system, server and storage medium |

Country Status (1)

| Country | Link |

|---|---|

| CN (1) | CN110827142A (en) |

Cited By (2)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| CN111782696A (en)* | 2020-06-29 | 2020-10-16 | 广东粤财金融云科技股份有限公司 | A method and device for processing credit data |

| CN111861732A (en)* | 2020-07-31 | 2020-10-30 | 重庆富民银行股份有限公司 | Risk assessment system and method |

Citations (5)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| TW200905604A (en)* | 2007-07-26 | 2009-02-01 | Shacom Com Inc | Credit investigation/grant system and method of network-effect credit extension |

| CN106780012A (en)* | 2016-12-29 | 2017-05-31 | 深圳微众税银信息服务有限公司 | A kind of internet credit methods and system |

| CN108346096A (en)* | 2018-02-23 | 2018-07-31 | 岭尚(上海)科技发展有限公司 | Air control system and air control method |

| CN108564286A (en)* | 2018-04-19 | 2018-09-21 | 天合泽泰(厦门)征信服务有限公司 | A kind of artificial intelligence finance air control credit assessment method and system based on big data reference |

| CN110135971A (en)* | 2019-04-15 | 2019-08-16 | 上海良鑫网络科技有限公司 | Assessing credit risks System and method for based on weak variable data |

- 2019

- 2019-11-07CNCN201911082107.4Apatent/CN110827142A/enactivePending

Patent Citations (5)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| TW200905604A (en)* | 2007-07-26 | 2009-02-01 | Shacom Com Inc | Credit investigation/grant system and method of network-effect credit extension |

| CN106780012A (en)* | 2016-12-29 | 2017-05-31 | 深圳微众税银信息服务有限公司 | A kind of internet credit methods and system |

| CN108346096A (en)* | 2018-02-23 | 2018-07-31 | 岭尚(上海)科技发展有限公司 | Air control system and air control method |

| CN108564286A (en)* | 2018-04-19 | 2018-09-21 | 天合泽泰(厦门)征信服务有限公司 | A kind of artificial intelligence finance air control credit assessment method and system based on big data reference |

| CN110135971A (en)* | 2019-04-15 | 2019-08-16 | 上海良鑫网络科技有限公司 | Assessing credit risks System and method for based on weak variable data |

Cited By (2)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| CN111782696A (en)* | 2020-06-29 | 2020-10-16 | 广东粤财金融云科技股份有限公司 | A method and device for processing credit data |

| CN111861732A (en)* | 2020-07-31 | 2020-10-30 | 重庆富民银行股份有限公司 | Risk assessment system and method |

Similar Documents

| Publication | Publication Date | Title |

|---|---|---|

| US20240045989A1 (en) | Systems and methods for secure data aggregation and computation | |

| CN111401558B (en) | Data processing model training method, data processing device and electronic equipment | |

| CN109981679B (en) | Method and apparatus for performing transactions in a blockchain network | |

| CN110096857B (en) | Authority management method, device, equipment and medium for block chain system | |

| KR102121159B1 (en) | Event-driven blockchain workflow processing | |

| CN109716707B (en) | Server apparatus and method for distributed electronic recording and transaction history | |

| CN111681091B (en) | Financial risk prediction method and device based on time domain information and storage medium | |

| US20200302315A1 (en) | Digital blockchain for lending | |

| US11720527B2 (en) | API for implementing scoring functions | |

| WO2019001139A1 (en) | Method and device for running chaincode | |

| CN109472678B (en) | Accounting book management method based on block chain, electronic device and readable storage medium | |

| CN111580874B (en) | System safety control method and system for data application and computer equipment | |

| TWI871165B (en) | A computer based method for performing a desired verb action in a model | |

| CN110727580A (en) | Response data generation method, full-flow interface data processing method and related equipment | |

| WO2023207146A1 (en) | Service simulation method and apparatus for esop system, and device and storage medium | |

| CN111427971A (en) | Business modeling method, device, system and medium for computer system | |

| CN108718337A (en) | Website account login, verification, verification information processing method, apparatus and system | |

| CN105684027A (en) | House resource verifying method and system for real estate network | |

| CN110827142A (en) | User credit evaluation method, system, server and storage medium | |

| CN110555761A (en) | Method and apparatus for conducting financial mortgage on blockchain | |

| CN116756002A (en) | A method and system for generating virtual electronic ID cards | |

| CN116467156A (en) | Joint debugging test method and device, storage medium and electronic equipment | |

| CN114581073B (en) | Account information processing method, device, electronic device and medium | |

| US20250225046A1 (en) | Systems and methods for a shared common microservice | |

| CN116112508B (en) | Data processing method based on block chain network, related equipment and storage medium |

Legal Events

| Date | Code | Title | Description |

|---|---|---|---|

| PB01 | Publication | ||

| PB01 | Publication | ||

| SE01 | Entry into force of request for substantive examination | ||

| SE01 | Entry into force of request for substantive examination | ||

| RJ01 | Rejection of invention patent application after publication | Application publication date:20200221 | |

| RJ01 | Rejection of invention patent application after publication |