CN101443782A - Modular web-based ASP application for multiple products - Google Patents

Modular web-based ASP application for multiple productsDownload PDFInfo

- Publication number

- CN101443782A CN101443782ACNA2006800455335ACN200680045533ACN101443782ACN 101443782 ACN101443782 ACN 101443782ACN A2006800455335 ACNA2006800455335 ACN A2006800455335ACN 200680045533 ACN200680045533 ACN 200680045533ACN 101443782 ACN101443782 ACN 101443782A

- Authority

- CN

- China

- Prior art keywords

- application

- information data

- applications

- business

- entity

- Prior art date

- Legal status (The legal status is an assumption and is not a legal conclusion. Google has not performed a legal analysis and makes no representation as to the accuracy of the status listed.)

- Pending

Links

Images

Landscapes

- Financial Or Insurance-Related Operations Such As Payment And Settlement (AREA)

Abstract

Translated fromChineseDescription

Translated fromChinese技术领域technical field

本发明涉及用于传送商业信息和服务的系统,更具体地,涉及用于在单个平台中合并各种商业信息产品和服务的系统。The present invention relates to a system for delivering business information and services, and more particularly, to a system for consolidating various business information products and services in a single platform.

背景技术Background technique

传统的数据集成系统通常更新和验证来自众多的源的数据,以确保商业信息数据是准确、完整、及时和全球准确的,以使客户能够对其重要的商业决策有信心。Traditional data integration systems typically update and validate data from numerous sources to ensure that business information data is accurate, complete, timely and globally accurate so that customers can have confidence in their important business decisions.

数据集成系统结合下述过程,包括每天从数以千计的源中收集、聚合、编辑和验证数据,以使客户能够使用这些信息以为其商业做出有利的决策。在2003年2月18日提交的未决美国专利申请No.10/368,072中描述了实例性的数据集成系统,其内容在此被包括作为参考。数据集成系统和过程的另一个例子是由邓白氏(D&B)公司提供的DUNSRightTM。这样的数据集成的基础是质量保证,其包括数以千计的单独的自动检查,加上许多人工检查,以确保数据达到质量标准。另外,如图1所示,五个质量驱动器连续地工作以收集和增加数据。全球数据收集1从全世界的各种源中收集数据。数据通过实体匹配2被集成到全球数据库6中,该实体匹配2产生每个商业的单一的更准确的描写。在步骤3,唯一的公司标识符,如D-U-N-号码,被用作通过商业的生命和活动中的每个步骤来在全球识别和跟踪商业的唯一方式。公司关联步骤4使客户能够查看其在相关的商业中的总风险或机会。最后,预测指标5使用统计分析以评价某个商业的过去的绩效和指示该商业未来有多大可能以相同的方式执行。数据集成信息是指数据,包括商业信息数据,其已经过上述的过程步骤中的至少一个或多个。Data integration systems combine the processes of collecting, aggregating, editing and validating data from thousands of sources on a daily basis to enable customers to use the information to make beneficial decisions for their businesses. An exemplary data integration system is described in co-pending US Patent Application No. 10/368,072, filed February 18, 2003, the contents of which are incorporated herein by reference. Another example of a data integration system and process is DUNSRight(TM) offered by Dun & Bradstreet (D&B). Fundamental to such data integration is quality assurance, which includes thousands of individual automated checks, plus many manual checks, to ensure the data meets quality standards. In addition, as shown in Figure 1, five mass drives work continuously to collect and augment data. Global data collection1 collects data from various sources around the world. The data is integrated into the

公司开发各种风险管理解决方案,以帮助客户通过有效的风险管理来提高盈利能力,而该风险管理使用通过数据集成过程收集和验证的商业信息。这样的解决方案使客户能够通过快速识别可能支付缓慢或即将破产的账户来改善现金流,通过将全世界的应收账款合并到单个数据库中来管理总风险暴露,通过更多利用现有的人事资源,诸如通过自动决策解决方案,来提升营运利润率,建立符合所有内部审计和外部管理规定的决策,并通过用信贷余额快速识别低风险客户来增加收入。The company develops various risk management solutions to help clients improve profitability through effective risk management using business information collected and validated through a data integration process. Such a solution enables clients to improve cash flow by quickly identifying accounts that may be slow to pay or are about to go bankrupt, manage total exposure by consolidating accounts receivable from around the world into a single database, and leverage existing Personnel resources, such as through automated decision-making solutions, to improve operating margins, establish decision-making compliance with all internal audit and external management regulations, and increase revenue by quickly identifying low-risk customers with credit balances.

如图2所示,客户可访问各种产品和服务以优化其商业信息的使用,上述产品和服务包括风险管理解决方案,即解决方案。定制营销解决方案(CMS)通过批处理使用数据集成信息。用户可通过链路订购各种报告,诸如订购商业信息报告和警报服务。用户还可以访问工具箱(Toolkits),包括风险评估管理器(RAM,eRAM)和全球决策者(GDM)。As shown in Figure 2, customers have access to a variety of products and services to optimize their use of business information, including risk management solutions, ie solutions. Custom Marketing Solutions (CMS) use data to integrate information through batch processing. Users can order various reports through the links, such as ordering business information reports and alert services. Users also have access to Toolkits, including Risk Assessment Manager (RAM, eRAM) and Global Decision Maker (GDM).

目前对客户存在许多障碍,这妨碍他们通过现有的解决方案体验可用的数据集成的所有好处。There are currently many barriers to customers preventing them from experiencing the full benefits of data integration available through existing solutions.

这样的障碍包括混淆产品讯息、特点和好处,重叠性能,在不同的解决方案之间没有逻辑或物理的迁移路径,升级和维护困难的全异技术平台,以及不同产品之间的数据不一致。这些障碍已经限制了最高价值解决方案的认识和采用,从而已经妨碍了客户获得由这些技术方案提供全部利益。Such barriers include confusing product messaging, features, and benefits, overlapping capabilities, no logical or physical migration paths between different solutions, disparate technology platforms that are difficult to upgrade and maintain, and data inconsistencies between different products. These barriers have limited awareness and adoption of the highest value solutions, thereby preventing customers from reaping the full benefits provided by these technology solutions.

需要有一种系统和方法,其允许使用在单个技术平台上的各种产品和/或服务,使用认购定价模型,可为特定的客户细分创建服务,使产品易于理解和使用,并允许无限制、灵活地访问实时数据。There is a need for a system and method that allows for the use of various products and/or services on a single technology platform, uses a subscription pricing model, creates services for specific customer segments, makes products easy to understand and use, and allows unlimited , Flexible access to real-time data.

发明内容Contents of the invention

提供一种模块化的、优选为基于Web的ASP(应用服务提供商)应用,其为各种或多个产品和服务提供单个平台。这样的产品和服务包括风险管理解决方案、由用户提供的所选择的应用以及各种服务。A modular, preferably web-based ASP (Application Service Provider) application is provided that provides a single platform for various or multiple products and services. Such products and services include risk management solutions, selected applications provided by users, and various services.

DNBi是交互式可定制的Web应用,其向用户提供最完整和最新的DUNSRightTM可用信息,以及全面的监控和投资组合分析,所有针对一个规定价格。通过提供对D&B全球数据库中有关超过100万家公司的最完整和最新的信息的在线访问,DNBi使用户能够制定更精明、有效和有见识的信贷决策。DNBi is an interactive, customizable web application that provides users with the most complete and up-to-date DUNSRightTM information available, as well as comprehensive monitoring and portfolio analysis, all for one stated price. By providing online access to the most complete and up-to-date information on more than 1 million companies in D&B's global database, DNBi enables users to make more astute, efficient and informed credit decisions.

DNBi提供两种可选择的附加模块:DNBi决策者和DNBi客户(账户)管理器。DNBi offers two optional add-on modules: DNBi Decision Maker and DNBi Client (Account) Manager.

DNBi决策者是基于Web的自动的信贷决策和工作流程解决方案。其根据用户设定的信贷政策,向信贷专业人员和销售团队成员提供即时、自动的信贷决策和信贷额度。DNBi决策者具有DNBi的所有主要特点,包括访问最完整、最新的DUNSRightTM信息。DNBi Decision Maker is a web-based automated credit decision and workflow solution. It provides credit professionals and sales team members with instant, automated credit decisions and lines of credit based on user-defined credit policies. DNBi Decision Maker has all the key features of DNBi, including access to the most complete and up-to-date DUNSRightTM information.

决策者通过将最新和最完整的D&B信息应用于用户的信贷策略,生成关于新申请人的即时信贷决策。决策者通过提供下述内容来变换信贷决策过程:Decision Maker generates instant credit decisions on new applicants by applying the latest and most complete D&B information to the user's credit strategy. Decision Makers transform the credit decision process by providing:

●决策记分卡:允许用户根据最新的D&B商业信息建立用于评估信贷申请的规则。决策者自动将规则应用于所有的新申请人。• Decision Scorecard: Allows users to establish rules for evaluating credit applications based on the latest D&B business information. The decision maker automatically applies the rule to all new applicants.

●自动信贷决策:对于新的信贷申请人,决策者生成即时决策和信贷额度,或者使要求进一步复核的申请逐步升级,为信贷过程带来速度和一致性。● Automated Credit Decision: For new credit applicants, decision makers generate instant decisions and credit lines, or escalate applications requiring further review, bringing speed and consistency to the credit process.

●全面的审计跟踪:平衡关键事件的自动的加了时间戳的文件,确保每个决策在整个信贷决策过程中被备份和记录。●Comprehensive Audit Trail: Automatically time-stamped files of balance key events, ensuring that each decision is backed up and recorded throughout the credit decision process.

●用户批准额度:为每个用户分配批准额度,决策者自动将申请传送到适当的团队成员用于复核。●User Approval Quota: Assign an approval quota to each user, and the decision maker automatically sends the application to the appropriate team member for review.

DNBi客户管理器是自动的客户管理解决方案,其通过识别客户风险的变化、根据用户的信贷策略推荐应采取的行动、并将信贷专业人员的注意力集中到最需要它的客户上来降低信贷风险。DNBi客户管理器具有DNBi的所有主要特征,包括访问最完整、最新的DUNSRightTM信息。DNBi Client Manager is an automated client management solution that reduces credit risk by identifying changes in client risk, recommending actions based on the user's credit strategy, and focusing credit professionals' attention on clients who need it most . DNBi Client Manager has all the main features of DNBi, including access to the most complete and up-to-date DUNSRightTM information.

客户管理器通过结合用户的信贷策略、用户的应收账款数据以及最新和最完整的D&B信息以告诉用户何时需要对现有的客户采取行动来使用户可以管理其整个客户群的风险。Client Manager enables users to manage the risk of their entire client base by combining their credit policies, their accounts receivable data, and the latest and most complete D&B information to tell them when they need to take action on existing clients.

客户管理器通过提供下述内容来变换客户复核过程:Client Manager transforms the client review process by providing:

●决策记分卡:允许用户根据最新的D&B信息和用户的应收账款建立用于评估现有客户的定制规则。● Decision Scorecard: Allows the user to establish custom rules for evaluating existing customers based on the latest D&B information and the user's accounts receivable.

●自动日常客户审查:客户管理器审查用户的投资组合中的每个客户,并在信贷状态可能发生变化时通知用户。● Automatic Daily Client Review: The Client Manager reviews each client in the user's portfolio and notifies the user when credit status may change.

●集中式电子信贷档案:查看每个客户的账龄、最新的D&B商业信息和对该客户采取的所有动作的完整描述。●Centralized Electronic Credit File: View the aging of each customer, the latest D&B business information and a complete description of all actions taken by the customer.

●审计跟踪:在客户管理器中记录每一个决策。● Audit trail: record every decision in the client manager.

附图说明Description of drawings

图1表示数据集成质量保证过程;Figure 1 represents the data integration quality assurance process;

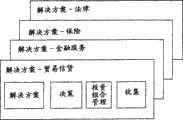

图2是客户可用的各种解决方案的框图;Figure 2 is a block diagram of the various solutions available to customers;

图3是客户可用的各种解决方案的另一个框图;Figure 3 is another block diagram of the various solutions available to customers;

图4是根据本发明的系统的实施例的框图;Figure 4 is a block diagram of an embodiment of a system according to the invention;

图5是展示本发明的实施例的系统的模块的框图;Figure 5 is a block diagram illustrating the modules of the system of an embodiment of the invention;

图6是展示本发明的实施例的系统的模块的另一个框图;Figure 6 is another block diagram illustrating the modules of the system of an embodiment of the invention;

图7是根据本发明的基于Web的实施例的网页的屏幕快照;Figure 7 is a screen shot of a webpage according to a web-based embodiment of the present invention;

图8是根据本发明的基于Web的实施例的另一个网页的屏幕快照;Figure 8 is a screenshot of another webpage according to a web-based embodiment of the present invention;

图9是根据本发明的基于Web的实施例的再一个网页的屏幕快照;Figure 9 is a screenshot of yet another web page according to a Web-based embodiment of the present invention;

图10是根据本发明的基于Web的实施例的网页的再一个例子的屏幕快照;Figure 10 is a screenshot of yet another example of a web page according to a Web-based embodiment of the present invention;

图11是根据本发明的基于Web的实施例的网页的再一个例子的屏幕快照;Figure 11 is a screenshot of yet another example of a web page according to a Web-based embodiment of the present invention;

图12表示根据本发明的系统的实施例。Figure 12 shows an embodiment of a system according to the invention.

具体实施方式Detailed ways

本发明提供模块化的基于Web的ASP(应用服务提供商)应用,其对多种或多个产品和服务提供单个平台。该平台可以是基于Web的平台或者诸如由用户提供的多种软件平台中的任何一种。The present invention provides a modular web-based ASP (Application Service Provider) application that provides a single platform for multiple or multiple products and services. The platform may be a web-based platform or any of a variety of software platforms such as provided by the user.

优选地,系统使用认购定价模型,以允许用户通过单个定期付款而访问单个平台中的多个解决方案。另外,系统可以建立在单个的基于Web的技术平台上。Preferably, the system uses a subscription pricing model to allow users to access multiple solutions in a single platform through a single recurring payment. Alternatively, the system can be built on a single web-based technology platform.

图3显示了现有技术的传送体系结构,示出各种解决方案或产品,诸如eRAM和RAM(风险评估管理器)、DRP(DUNS参考加(ReferencePlus))和GDM(全球决策者)。这些产品中的每一个代表在单独的平台上呈现给客户的唯一的访问和传送、功能、定价和技术的组件(Bundle)。如图3所示,每个产品包括存储器300、服务305和与每个解决方案对应的应用310。Figure 3 shows a prior art delivery architecture showing various solutions or products such as eRAM and RAM (Risk Assessment Manager), DRP (DUNS Reference Plus) and GDM (Global Decision Maker). Each of these products represents a unique bundle of access and delivery, functionality, pricing and technology presented to customers on a separate platform. As shown in FIG. 3, each product includes

本发明包括更简单、更灵活的体系结构,如图4所概括表示的。如图所示,包括商业信息数据和上述数据集成过程所涉及的数据的数据400被输入到各种共享服务405中,诸如自动决策,这些服务都与单个接口410相关联,如web服务接口。通过该接口,诸如基于Web的应用的各种解决方案415、所嵌入的数据和应用420、以及各种服务425通过单个平台传送给客户430。The present invention includes a simpler, more flexible architecture, as schematically represented in FIG. 4 . As shown,

解决方案415代表多个单独的应用,诸如各种风险管理解决方案。在优选的实施例中,解决方案415被呈现为模块化的基于Web的ASP应用,以对所有应用、解决方案和服务提供单个平台。所嵌入的数据和应用420代表与解决方案415分开的数据和应用,其通过接口410传送给客户430。

优选地,解决方案415和应用420通过公共接口410一起传送给客户430。在另一个实施例中,优选地,接口410是基于XML的Web服务接口,其允许客户除了接收在客户430选择的任何应用420内的数据外,还接收DUNSRight功能的值。应用420可以包括各种会计包或CRM(客户关系管理)应用。Preferably, the

服务425还通过接口410被客户430访问。优选地,这些服务包括旨在特别帮助客户430以提供使用解决方案415所需的专业知识的支持服务。服务425包括外购、建议和定制建模。

包括解决方案415、应用420和服务425的所传送的产品都基于共享服务405,并通过接口410呈现。Delivered

因此,例如来自DUNSRight储存库的数据400通过各种共享服务进行处理,接着,通过在第三方应用中嵌入的ASP解决方案,或者通过由提供商公司的工作人员管理的专业服务,经由Web服务接口传送给客户。Thus, for example,

解决方案如图5和6所示,图中显示了解决方案平台的模块。如图5和6所示,“解决方案组件”代表可定制的一组解决方案。该解决方案组件可以是模块化的,允许客户根据其需要的扩大无缝地添加额外的功能。这种功能可以包括额外的决策解决方案、投资组合管理解决方案和收集解决方案。解决方案组件的不同版本,包括不同类型的解决方案,可以被定制以满足特定客户细分的需要。例如,用于贸易信贷、金融服务、保险和法律的解决方案组件版本。The solution is shown in Figures 5 and 6, which show the modules of the solution platform. As shown in Figures 5 and 6, a "solution component" represents a customizable set of solutions. The solution components can be modular, allowing customers to seamlessly add additional functionality as their needs expand. Such functionality may include additional decision-making solutions, portfolio management solutions and collection solutions. Different versions of solution components, including different types of solutions, can be tailored to meet the needs of specific customer segments. For example, solution component versions for trade credit, financial services, insurance and legal.

在一个实施例中,解决方案组件是交互式的。这种交互使客户能够请求来自其它商业的金融,平衡标准的通用信贷申请,并提供对商业的访问,以获取数据和生成指导。该交互还可以鼓励客户上传贸易数据以接收分析,使客户能够更新自己的数据并提供关于其它商业的反馈,提供创建在线交易组的可能,其使客户能够以受控的方式相互通信。In one embodiment, solution components are interactive. This interaction enables customers to request financing from other businesses, balances standard universal credit applications, and provides access to businesses for data and guidance generation. This interaction may also encourage customers to upload trade data to receive analysis, enable customers to update their own data and provide feedback on other businesses, provide the possibility to create online trade groups that enable customers to communicate with each other in a controlled manner.

图7-10示出从根据本发明的模块化的基于Web的ASP应用中获取的屏幕快照的例子。在这个实施例中,客户可与如图7-10所示的基于Web的平台进行交互,以访问一个或多个实体的各种类型的商业信息。该应用提供单个平台,客户可通过该平台访问各种类型的商业报告和有关一个或多个公司的各种类型的信息。优选地,该服务针对认购费用,允许客户访问对于单次费用可得的所有数据。7-10 illustrate examples of screenshots taken from a modular Web-based ASP application according to the present invention. In this embodiment, a customer may interact with a web-based platform as shown in FIGS. 7-10 to access various types of business information for one or more entities. The application provides a single platform through which customers can access various types of business reports and various types of information about one or more companies. Preferably, the service is for a subscription fee, allowing the customer to access all data available for a single fee.

图7示出所选择的实体的商业信息的概要。该信息包括所选择的商业实体的列表和有关每个商业实体的信息,诸如它的识别DUNS号码和财务压力指标。该概要还可包括有关一组商业实体的信息,诸如一组实体的风险分布信息和风险趋势,诸如某一特定行业。如图8所示,客户可以访问所选择的实体的商业信息的概要,优选地,其包括有关该实体的其它信息。图9示出用户关于将要显示的信息的类型的定制,以及关于信息在诸如图8所示的公司概要中如何以及在哪里显示的定制。Fig. 7 shows a summary of business information of a selected entity. This information includes a list of selected business entities and information about each business entity, such as its identifying DUNS number and indicators of financial stress. The summary may also include information about a group of business entities, such as risk distribution information and risk trends for a group of entities, such as a particular industry. As shown in Figure 8, the customer can access a summary of the business information for the selected entity, which preferably includes other information about the entity. FIG. 9 illustrates user customizations as to the type of information to be displayed, as well as customizations as to how and where information is displayed in a company profile such as that shown in FIG. 8 .

图10示出本发明的其它特征,其中,客户可以访问提供实体的各种子公司和/或各种相关实体的可视表示的“家族树”。各种实体级别或分支表明每个实体之间的关系。每个实体还可以具有可视表示,诸如相关的颜色,以指明一个实体的风险状态或其它状态。例如,图10所示的每个公司可以被涂上绿色、黄色或红色以分别指明低信贷风险、中等信贷风险或高信贷风险。Figure 10 illustrates a further feature of the present invention in which a customer can access a "family tree" that provides a visual representation of an entity's various subsidiaries and/or various related entities. Various entity levels or branches indicate the relationship between each entity. Each entity may also have a visual representation, such as an associated color, to indicate an entity's risk status or other status. For example, each company shown in Figure 10 may be colored green, yellow, or red to indicate low credit risk, medium credit risk, or high credit risk, respectively.

图12示出全面并灵活的用于传送基于Web的应用的应用架构。该架构被设计为支持多个应用开发成果。该架构的模块允许更好的便携性,允许访问数据库的应用独立于平台。因此,用户能够通过应用环境访问实时的商业数据。Figure 12 shows a comprehensive and flexible application architecture for delivering web-based applications. The architecture is designed to support multiple application development efforts. The modularity of the architecture allows greater portability, allowing applications accessing the database to be platform independent. Therefore, users can access real-time business data through the application environment.

在另一个实施例中,如果与所选择的实体有关的信贷信息或其它信息发生某种变化,则系统还可以诸如通过电子邮件通知来向客户提供警报。例如,客户可以定制系统以在所选择的指标增加或减少到所选择的值时向客户提供警报。这种指标可以包括诸如D&B的指标的支付业绩指标或财务压力指标。In another embodiment, the system may also provide an alert to the customer, such as by email notification, if there is some change in credit information or other information related to the selected entity. For example, a customer may customize the system to provide an alert to the customer when a selected metric increases or decreases to a selected value. Such indicators can include indicators such as D&B Indicators of payment performance indicators or indicators of financial stress.

优选地,系统使用认购定价模型以允许用户通过使用单个定期支付而访问单个平台中的多个解决方案。在一个实施例中,在进行或更新认购之前,认购定价模型基于用户以前使用的可用解决方案是可变的。价格可基于用户使用的在各种平台上分别可用的解决方案,或者基于用户使用的对于单笔费用在单个平台中以前可用的各种解决方案。系统可以基于预先选择的标准进行认购价格计算,该标准可以是诸如用户使用解决方案的频率、所使用的解决方案的类型和模拟的未来使用机会。Preferably, the system uses a subscription pricing model to allow users to access multiple solutions in a single platform using a single recurring payment. In one embodiment, the subscription pricing model is variable based on the available solutions previously used by the user prior to placing or renewing the subscription. The price may be based on the user's use of solutions that are separately available on various platforms, or on the user's use of various solutions that were previously available in a single platform for a single fee. The system may base subscription price calculations on pre-selected criteria such as frequency of use of the solution by the user, type of solution used, and simulated future use opportunities.

在一个实施例中,数据400与商业实体的信息有关。该信息可与诸如信贷风险的风险信息和诸如实体的结构、经营业绩、行为和与其它公司的关系的其它信息有关。In one embodiment,

本发明的系统的优点包括允许无限制、灵活地访问实时数据,并能够从客户获取其它数据。系统允许对所选择的特定客户细分快速创建和配置额外的解决方案或服务。系统还允许解决方案的自我管理,包括易于使用的配置向导,其简化在系统中建立自动信用策略和记分卡的过程。Advantages of the system of the present invention include allowing unlimited, flexible access to real-time data and the ability to obtain other data from clients. The system allows for the rapid creation and configuration of additional solutions or services for selected specific customer segments. The system also allows for self-management of the solution, including an easy-to-use configuration wizard that simplifies the process of establishing automated credit policies and scorecards in the system.

应当理解,本领域的普通技术人员可以设想到在此所描述的教导的各种替换、组合和修改。本发明旨在包括位于所附权利要求的范围内的所有的替换、修改和变形。It should be understood that various alternatives, combinations and modifications of the teachings described herein may be devised by those of ordinary skill in the art. The present invention is intended to embrace all alternatives, modifications and variations that come within the scope of the appended claims.

Claims (20)

Translated fromChinesePriority Applications (1)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| CN201410045237.1ACN103824177B (en) | 2005-10-05 | 2006-10-05 | Modular web-based ASP application for multiple products |

Applications Claiming Priority (3)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| US72385405P | 2005-10-05 | 2005-10-05 | |

| US60/723,854 | 2005-10-05 | ||

| US60/817,936 | 2006-06-30 |

Related Child Applications (1)

| Application Number | Title | Priority Date | Filing Date |

|---|---|---|---|

| CN201410045237.1ADivisionCN103824177B (en) | 2005-10-05 | 2006-10-05 | Modular web-based ASP application for multiple products |

Publications (1)

| Publication Number | Publication Date |

|---|---|

| CN101443782Atrue CN101443782A (en) | 2009-05-27 |

Family

ID=40727186

Family Applications (1)

| Application Number | Title | Priority Date | Filing Date |

|---|---|---|---|

| CNA2006800455335APendingCN101443782A (en) | 2005-10-05 | 2006-10-05 | Modular web-based ASP application for multiple products |

Country Status (1)

| Country | Link |

|---|---|

| CN (1) | CN101443782A (en) |

Cited By (1)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| CN112707178A (en)* | 2020-09-11 | 2021-04-27 | 厦门集装箱码头集团有限公司 | Intelligent loading and unloading platform and loading and unloading method |

- 2006

- 2006-10-05CNCNA2006800455335Apatent/CN101443782A/enactivePending

Cited By (2)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| CN112707178A (en)* | 2020-09-11 | 2021-04-27 | 厦门集装箱码头集团有限公司 | Intelligent loading and unloading platform and loading and unloading method |

| CN112707178B (en)* | 2020-09-11 | 2022-05-10 | 厦门集装箱码头集团有限公司 | Intelligent loading and unloading platform and loading and unloading method |

Similar Documents

| Publication | Publication Date | Title |

|---|---|---|

| US7708196B2 (en) | Modular web-based ASP application for multiple products | |

| US8140367B2 (en) | Open marketplace for distributed service arbitrage with integrated risk management | |

| US8156028B2 (en) | Technology portfolio health assessment system and method | |

| US20200410583A1 (en) | Financial regulatory compliance platform | |

| US7747572B2 (en) | Method and system for supply chain product and process development collaboration | |

| US20140149170A1 (en) | System and method for facilitating strategic sourcing and vendor management | |

| US7788114B2 (en) | Method and article of manufacture for performing clinical trial budget analysis | |

| US20130166355A1 (en) | Dynamic multi-dimensional and multi-view pricing system | |

| Lin et al. | An integrated framework for supply chain performance measurement using six-sigma metrics | |

| Glykas | Effort based performance measurement in business process management | |

| US20020035500A1 (en) | Multi-dimensional management method and system | |

| Pourshahid et al. | Business Process Monitoring and Alignment: An Approach Based on the User Requirements Notation and Business Intelligence Tools. | |

| US20110029450A1 (en) | Computer-implemented method, system, and computer program product for connecting contract management and claim management | |

| Meier et al. | Enterprise Management with SAP SEM™/Business Analytics | |

| GB2481820A (en) | Parallel workflow engine for classified data elements in workflow | |

| CN101443782A (en) | Modular web-based ASP application for multiple products | |

| Baskarada et al. | IQM-CMM: a framework for assessing organizational information quality management capability maturity | |

| Golzarpoor | Industry Foundation Processes (IFP) | |

| HK1132064A (en) | Modular web-based asp application for multiple products | |

| HK1197768B (en) | Modular web-based asp application for multiple products | |

| HK1197768A (en) | Modular web-based asp application for multiple products | |

| Lin et al. | Managing data quality in the health care industry: Some critical issues | |

| Mostafa | ISO 9001: 2015 Quality System Manual Development and Implementation for Business and Commerce with Expanded Emphasis on Risk Management | |

| WO2006116805A1 (en) | Method and apparatus for calculating business unit statistics using distributed data | |

| van der Kooij | A Framework for Business Performance Management |

Legal Events

| Date | Code | Title | Description |

|---|---|---|---|

| C06 | Publication | ||

| PB01 | Publication | ||

| C10 | Entry into substantive examination | ||

| SE01 | Entry into force of request for substantive examination | ||

| REG | Reference to a national code | Ref country code:HK Ref legal event code:DE Ref document number:1132064 Country of ref document:HK | |

| C12 | Rejection of a patent application after its publication | ||

| RJ01 | Rejection of invention patent application after publication | Application publication date:20090527 | |

| REG | Reference to a national code | Ref country code:HK Ref legal event code:WD Ref document number:1132064 Country of ref document:HK |