- Home

- Briefing Room

- From the News Room

- Latest NewsRead the latest blog posts from 1600 Pennsylvania Ave

- Share-WorthyCheck out the most popular infographics and videos

- PhotosView the photo of the day and other galleries

- Video GalleryWatch behind-the-scenes videos and more

- Live EventsTune in to White House events and statements as they happen

- Music & Arts PerformancesSee the lineup of artists and performers at the White House

- From the Press Office

- From the News Room

- Issues

- Popular Topics

- Top Issues

- More

- More

- The Administration

- People

- Executive Offices

- Initiatives

- Special Events

- Participate

- Digital

- Join Us

- Speak Out

- 1600 Penn

- Inside the White House

- History & Grounds

- Our Government

Economic Rescue, Recovery, and Rebuilding on a New Foundation

In 2008, the American people turned to Barack Obama to lead the country through the worst economic crisis since the Great Depression. His North Star was to make the economy work for the middle class and for those fighting to join it. He took steps to create jobs, rescue the auto industry, and rebuild the economy on a new foundation for growth and prosperity.

Stabilized an Economy in Crisis and Laid the Groundwork for Long-Term Growth

Took steps to help the hardest-hit Americans. Without the Recovery Act’s boost to household incomes, the poverty rate would have risen an additional 1.7 percentage points—which translates into about 5.3 million additional people that would have slipped into poverty in 2010

Helping the Hardest-Hit Americans

- Expanded and extended emergency unemployment benefits ten times, helping a total of 21 million Americans.

- Increased benefits and expanded access tothe Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps lifting more than 500,000 households out of food insecurity.

- Provided additional subsidies so that workers who lost their jobs could continue their health insurance coverage.

- Provided incentives for companies tohire unemployed veterans and disconnected youth.

- Boosted federal Medicaid payments to help states provide health coverage.

- Provided funding to states to supportsubsidized jobs for 260,000 low-income parents and youth and provided more than $1 billion for youth summer jobs.

- Oversaw 250,000 rural jobs created in 2014 and 2015 combined, and a 3.4 percent increase in rural household incomes from 2014 to 2015.Read more about how rural America is back in business.

Invested in building the economy of the future, from physical and technological infrastructure — including roads, bridges, and broadband — to scientific research to the largest investment in clean energy in history

Critical Investments in the Future

- Invested over $5 billion to lay and upgrade over 114,500 miles of fiber-optic cable, connecting community anchors around the nation to fast broadband Internet.

- Provided billions of dollars in the Recovery Act to improve nearly 42,000 miles of road, repair or replace more than 2,700 bridges, help transit agencies purchase more than 12,220 transit vehicles, upgrade or construct more than 6,000 miles of better performing rail, and increase safety and convenience with more than 360 airport and runway projects.

- Created the Transportation Investment Generating Economic Recovery (TIGER) program, which has invested billions of dollars in high-impact transportation projects around the country.

- Funded investments in smart grid technology, renewable energy, and energy efficiency programs.

- Created Build America Bonds, a new financing vehicle that supported $181 billion of public capital investments such as schools, bridges, and hospitals, and saved states $20 billion in borrowing costs, as well as Recovery Zone Bonds for hard-hit cities.

- USDA convened private and philanthropic partners to create a new U.S. Rural Infrastructure Opportunity Fund, with commitments of $10 billion of private funds to finance rural infrastructure projects.Read more about the Rural Infrastructure Investment Fund.

Brought Stability to a Financial Sector in Crisis

Brought Stability to The Housing Sector

Made it easier for responsible homeowners to stay in their homes — avoiding foreclosures that would have hurt them and the economy and helping underwater homeowners refinance. In all, more than 10 million mortgage modification and other forms of mortgage assistance were completed to help mitigate the foreclosure crisis

Helped Families Stay in Their Homes

- Establisheda loan modification program to help more than 1.5 million homeowners lower their mortgages and avoid foreclosure, with more than 4.5 million more homeowners receiving private modifications that built on the framework provided by the government model.

- Helped underwater homeowners avoid foreclosure through programs that allow them to sell their home or reduce payments on—or extinguish—their second lien.

- Provided a delayed payment plan of up to 12 months for unemployed homeowners.

- Launched an Office of Housing Counseling and worked with HUD-approved housing counselors to assist millions of families in making smart and informed financial decisions, including by providing housing counseling for unemployed homeowners at job training centers.

Saved the American Auto Industry

Launched “Cash for Clunkers” to spur auto sales

Did 'Cash-for-Clunkers' work as intended?

A plausible interpretation of the available data, in fact, is that many of the auto sales catalyzed by the CARS program were to the kinds of thrifty people who can afford to buy a new car but normally wait until the old one is thoroughly worn out. Stimulating spending by such people acted as an incredibly positive countercyclical fiscal policy in an economy suffering from temporarily low aggregate demand.

Read More

Reformed Wall Street

Set higher capital and liquidity standards for financial institutions both domestically and internationally

Also required the largest, most complex firms in the U.S. to meet higher capital, liquidity, and risk management standards than other firms that pose less systemic risk.

Since the crisis, banks have addedmore than $600 billion of additional capital, which is money they can lend and which increases their resiliency.

Laid the Groundwork for a Manufacturing Resurgence and Fostered U.S. Competitiveness

Signed into law the first long-term surface transportation bill in a decade, with increased investment levels — ending the era of short-term patches

The Fixing America's Surface Transportation Act (FAST Act), a 5 year, $305 billion surface transportation bill that increases Federal surface transportation investments by 11 percent, an important first step in addressing the significant infrastructure deficit in the U.S. The FAST Act also created the country’s first dedicated freight program and reformed the Federal infrastructure permitting process.

Helped Small Businesses Get Back on Track and More Entrepreneurs Start New Businesses

Prioritized inclusive entrepreneurship, including hosting the first-ever White House Demo Day

- FACT SHEET: Celebrating President Obama’s Top 10 Actions to Advance Entrepreneurship, and Announcing New Steps to Build on These Successes

- FACT SHEET: President Obama Announces New Commitments from Investors, Companies, Universities, and Cities to Advance Inclusive Entrepreneurship at First-Ever White House Demo Day

Raised Academic Standards in Our Schools and Made New Investments From Preschool Through 12th Grade

Expanded access to high-quality preschool for children from low-income families through the Preschool Development Grants, which provided resources to 18 states, and through investments in the Race to the Top–Early Learning Challenge competition.

Since the President’s call to action, 38 states have boosted their investments in preschool. Between 2013 and 2016, increased investments totaled over $1.5 billion and 30 states increased their preschool enrollment from 2009-2014.Read more.

Raised the bar on quality through enactment of bipartisan child care legislation that raised health, safety, and quality standards for federally-subsidized child care. Made significant reforms to Head Start and secured funding to increase number of programs in all 50 states.

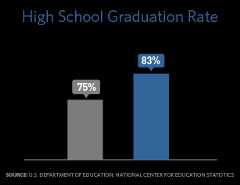

Reached a record high graduation rate of 83 percent. Graduation gaps are closing for students of color, students from low-income families, and students with disabilities and English learners.

U.S. High School Graduation Rate Hits New Record High

Cut the number of so-called "dropout factories" — high schools where no more than 60 percent of students who start as freshmen make it to their senior year — nearly in half since 2008.

Expanded access to high-quality preschool through the Preschool Development Grants competition, which has provided development and expansion grants to 18 states to support high-quality early childhood education programs for children from low-income families

Many states have boosted their investments in early childhood education; in FY 2014-2015 alone, 28 states and the District of Columbia increased their own investments in preschool.

Raised the bar on quality throughenactment of bipartisan child care legislation, a Race to the Top in early learning, and Head Start reforms including requiring programs that don’t meet certain standards to compete for continued funding and securing funding to increase the number of programs providing a full school day and year program.

Expanded Scholarships, Made Student Loans More Affordable, and Kept College Within Reach for More Americans

Made student loans more affordable

- Ended student loan subsidies for private financial institutions and banks, shifting more than $60 billion in savings back to students.

- Signed bipartisan legislation to cut student loan interest rates, setting it at historic lows, and saving the average student $1,000 or more over the life of the loan.

- Capped student loan payments at 10 percent of income for all students through the Pay-As-You-Earn repayment plans.

- Created the Student Aid Bill of Rights to strengthen loan servicing and make it easier for students to choose repayment plans.

Encouraged greater transparency for students and families and accountability for institutions through the College Scorecard, which provides the clearest, most accessible, and most reliable national data on college cost, graduation, debt, and post-college

Information about college costs, graduation rates, and earnings will be featured front and center in hundreds of millions of Google searches related to colleges and universities.

FACT SHEET: Empowering Students to Choose the College that is Right for Them

Expanded and Improved Job-Training Opportunities

Invested $2 billion to significantly expand partnerships between employers and community colleges to prepare students for in-demand jobs in fields like health care, information technology and energy

The Trade Adjustment Assistance and Community College and Career Training grants have created 2,300 in-demand education and training programs at community colleges in all 50 states. Nearly 300,000 participants have enrolled in these programs, which are helping job seekers get the skills they need for in-demand jobs in industries like information technology, health care, energy, and advanced manufacturing. Programs targeting high-demand jobs have been launched at more than half of community colleges across the country.

Improved Retirement Security

Finalized rules to protect Americans’ hard-earned savings by ensuring that retirement advisers provide advice in their clients’ best interest

Weekly Address: Ensuring Hard-Working Americans Retire with Dignity

Watch on YouTube, Read the Transcript

We’re cracking down on conflicts of interest in retirement advice to protect your savings.

Made the Tax System Fairer

Fought for Working Families

Led a national push for an increased minimum wage, supporting minimum wage increases in 22 states and the District of Columbia as well as over 60 cities and counties, which will increase wages for 7 million workers

Signed the Lilly Ledbetter Fair Pay Act, empowering workers to recover wages lost to discrimination by extending the time period for parties to bring pay discrimination claims, and took other steps helping to shrink the gender pay gap by more than 10 percent

Lilly Ledbetter Fair Pay Act

- Signed an April 2014 Executive Order that prohibits federal contractors from discriminating against employees who choose to discuss their compensation, further strengthening equal pay laws.

- Issued Presidential Memorandum instructing the Secretary of Labor to propose a rule requiring federal contractors to submit summary data on compensation paid to their employees and to use such data to enhance enforcement.

FACT SHEET: Helping Working Americans Get Ahead by Expanding Paid Sick Leave and Fighting for Equal Pay:

Took critical steps to help families pay for child care

Affordable Child Care

- Signed the Child Care and Development Block Grant Act into law to improve the quality of child care by requiring more training for caregivers and more enrichment for children and to improve child safety by instituting background checks for staff and better inspection of facilities.

- Provided $2 billion in supplemental funding to provide child care assistance for an additional 300,000 children and families during the height of the recession.

- Launched the Early Head Start — Child Care Partnerships program in 2014, which links child care centers and family child care providers with Early Head Start programs to expand access to high-quality early care and education to tens of thousands of infants and toddlers.

Led the way on paid sick and family leave, promoting state and local action and signing an Executive Order requiring federal contractors to offer 7 paid sick days to workers. Since taking office, the number of private sector workers with paid sick leave has grown by 10.6 million and with paid family leave by 6.2 million.

Paid Sick and Family Leave

- Funded research to support the development or implementation of state paid leave programs.

- Signed an Executive Order requiring federal contractors to provide up to 7 paid sick days to employees working on federal contracts, and called on Congress to pass legislation providing the same paid leave to most Americans.

- Signed a Presidential Memorandum directing agencies to advance up to six weeks of paid sick leave for parents with a new child and called on Congress to pass legislation giving federal employees an additional six weeks of paid parental leave.

FACT SHEET: Helping Working Americans Get Ahead by Expanding Paid Sick Leave and Fighting for Equal Pay:

Tapped the Full Potential of the Digital Age While Ensuring All Americans Share in The Benefits

Supported the FCC’s move to pre-empt state laws that restrict the expansion of municipal broadband networks

Signed the America Invents Act into law to reform the nation’s patent laws for the 21st Century, helping companies and inventors avoid costly delays — especially in key industries like biotechnology, medical devices, telecommunications, the Internet, and advanced manufacturing, that depend on a strong and healthy intellectual property system

Began work on over a dozen Executive Actions designed to combat patent trolls who make a business model out of threatening innocent companies with infringement — actions that allowed companies to focus on innovation, not costly and needless litigation

Launched the Startup America campaign to encourage federal agencies to streamline technology-transfer procedures, support government-industry collaboration, and encourage the commercialization of novel technologies flowing from federal laboratories

Worked with industry to collaboratively develop a “cybersecurity framework” of baseline standards that is helping to protect critical infrastructure from disruptive cyberattack

Ordered government agencies that process payments to employ enhanced security features, including chip-and-PIN technology, to reduce fraud and better protect Americans’ personal financial information

Following a petition drive launched on WhiteHouse.gov, signed legislation to restore the basic consumer freedom to “unlock” cell phones, allowing customers to switch carriers without purchasing new equipment

Successfully encouraged companies to sign a voluntary pledge to protect student privacy by banning the sale of personal data collected in the classroom to third parties for marketing purposes

Released first-of-their-kind sanctions tools to dissuade and deter foreign hackers and nation-states that would seek to steal our trade secrets or disrupt our economic wellbeing

Launched ConnectHome, an initiative to help communities build partnerships with the private sector to expand high-speed Internet to all Americans by delivering low-cost in-home broadband, digital literacy, and devices for low-income families living in public and assisted housing

Encouraged the safe and responsible testing and deployment of automated and connected vehicles on American roads and streets to save lives and transform mobility, productivity, and sustainability

We released first ever Federal policy to guide the responsible testing and deployment of automated vehicles, which has the potential to save tens of thousands of lives in the United States.

Read more about the policy.See what President Obama had to say.

We released a proposed rule that would mandate vehicle-to-vehicle (V2V) communication on light vehicles, allowing cars to “talk” to each other and prevent hundreds of thousands of vehicle crashes.

Made Government More Efficient, Transparent, and Technology Savvy

Signed the Memorandum on Transparency and Open Government on the first day of the administration to usher in a new era of open and accountable government in order to bridge the gap between the American people and their government

Launched Data.gov to increase access to government information that the public can readily find and use

Launched open-data initiatives in health, energy, education, and public safety to make information about government operations more readily available and useful

Signed the Telework Enhancement Act requiring federal agencies to promote the use of telework

Established the Presidential Innovation Fellows program to recruit technology innovators to spend six months working on special projects for the federal government

Increased tracking of how government uses federal dollars with easy-to-understand websites like Recovery.gov, USASpending.gov, and the IT Dashboard

Launched Challenge.gov, a one-stop shop where entrepreneurs and citizens compete to solve problems based on creative thinking and innovation

Launched the Government Accountability and Transparency Board to root out misspent tax dollars and making government spending more accessible and transparent

Established the National Science and Technology Council Task Force on Smart Disclosure to promote better disclosure policies and aid in the timely release of complex information in standardized, machine-readable formats

Expanded access to Trusted Traveler Programs allowing expedited security screening for participants, including a major expansion of Global Entry and creating TSA Precheck

Accelerated international arrivals process at key airports through new passport control technology and other important improvements

Expanded the validity of business and tourist visas from 1 to 10 years between China and the United States, and from 1 to 5 years for students, leading to an economy-boosting surge in Chinese travelers and tourists

Streamlined legal immigration to boost our economy, including by providing portable work authorizations for high-skilled workers and their spouses, enhancing options for entrepreneurs and making key improvements to the H-1B program

Established the National Science and Technology Council subcommittee on around-the-corner technologies and emergent sectors to identify new potential industry growth areas, as well as new target-rich environments for follow on research and development

Created the U.S. Digital Service, 18F at the General Services Administration (GSA), and the Presidential Innovation Fellows program.

Learn more here: https://www.usds.gov/,https://presidentialinnovationfellows.gov, andhttps://18f.gsa.gov/

Supporting International Growth and Financial Reform

At the depth of the financial crisis in early 2009, succeeded in arresting the freefall in the global economy and financial system through coordinated policy action by governments around the world that injected $5 trillion in global fiscal stimulus to raise global output, support growth, and restart international trade

Elevated the G-20 to be the premier forum for international economic policy coordination, giving key dynamic emerging economies a seat at the table for major decisions

Mobilized more than $1 trillion for international financial institutions, including through general capital increases at the multilateral development banks that expanded their capacity to promote growth and combat extreme poverty around the world, while enhancing the voice and vote of emerging economies

Worked with the G-20 to establish the Financial Stability Board to coordinate international efforts on financial reform, and through that channel agreed on rules to increase the quality and consistency of bank capital, to strengthen global liquidity standards so that banks are less vulnerable to runs, and introduced an internationally consistent leverage ratio

Signed into law the 2010 IMF quota and governance reforms that modernize the IMF and better anchor fast-growing emerging economies in the multilateral system led by the United States, while preserving our veto over major IMF decisions

Launched Power Africa to bring together technical and legal experts, the private sector, and governments from around the world to work in partnership to increase the number of people with access to power

Signed the Korea, Panama and Colombia Free Trade Agreements

Signed into law a renewed and improved ten-year extension of the African Growth and Opportunity Act (AGOA)

Challenged unfair trade practices by foreign countries at an unprecedented rate at the World Trade Organization, setting up an Interagency Trade Enforcement Center to mobilize the resources of the government to defend

Secured strong commitments against currency manipulation by G-20 countries

Negotiated organic equivalency arrangements with Canada, the E.U., Japan, Korea and Switzerland, providing U.S. organic farmers and businesses with streamlined access to international organic markets valued at over $35 billion

Read more about how this Administration strengthened organic agriculture and local food systems.

Spurred Competition

Undertook steps towards reform of occupational licensing to reduce the prevalence of unnecessary and overly broad labor requirements that are hurting workers and consumers

- Put out acall to action andset of best practices for state policymakers to enact reforms to diminish the pervasiveness of unnecessary occupational licenses that can artificially create higher costs for consumers and prohibit skilled American workers like florists or hairdressers from entering jobs in which they could otherwise excel. In 2016 alone, over 11 states haveproposed or passed reform bills in line with the White House best practices.

- Made available $7.5 million in federal fundingfor organizations to work with groups of states to design and implement approaches that enhance the portability of licenses across states and reduce overly burdensome licensing restrictions in general.

- Directed federal departments and agencies to ensure that federally-issued occupational licenses are not presumptively denied on the basis of a criminal record.

Launched the Competition Initiative, which mandated federal departments and agencies to act within 60-days to identify competition barriers and to encourage a fair, efficient, and competitive marketplace for American workers, businesses, entrepreneurs, and consumers using every tool at their disposal outside of the enforcement and merger review context

The Initiative was issued through an Executive Order ("Steps to Increase Competition and Better Inform Consumers and Workers to Support Continued Growth of the American Economy").

Acted to create a more competitive airline market, one that makes traveling simpler and fairer for consumers

- Took steps to promote more fair and transparent competition in the airline industry, including: the first step toward a rulemaking to require refunds for delayed baggage; requiring airlines not to “cherry-pick” the data they report on on-time arrivals by requiring them to share information on their smaller, “code-sharing” partners; requiring online ticket agents (Trip Advisor, Kayak, etc.) to disclose any biasing of their results; and requiring disclosure of mishandling of wheelchairs so disabled passengers have better information.

Combated anti-competitive employer practices that have inhibited the ability of workers to earn competitive wages and limited workers’ ability to seek employment at another employer

- Releasedreports from Treasury and theWhite House on the overuse of non-competes. Followed up that work with acall to action and set of best practices for state policymakers to enact reforms to reduce the prevalence of non-compete agreements that are hurting workers and regional economies. Elected officials in Connecticut, Hawaii, Illinois, New York, and Utah signed on in support of the call to action.

- Issued a brief by White House Council of Economic Advisers (CEA) on monopsony power, which occurs when companies with power in labor markets can set the wages they pay at lower levels and hire fewer workers than if there was strong competition. These lower wages have real consequences for families and the economy more broadly.

- Provided guidance for HR professionals on how to spot and report wage collusion among competing employers that may violate antitrust laws.

Took steps to eliminate barriers in the hearing aid market and make it easier for nearly 30 million Americans currently suffering from hearing loss to shop for and purchase hearing aids

- Announced that the FDA does not intend to enforce the requirement for American adults to get a medical evaluation before obtaining most hearing aids.

- Launched a process to facilitate the availability of over-the-counter hearing aids that could deliver new, innovative, and lower-cost products to millions of consumers.

The Work Ahead

President Obama asked each member of his Cabinet to write an Exit Memo on the progress we’ve made, their vision for the country’s future, and the work that remains in order to achieve that vision. Here are their key points on the work ahead on economic progress.

Raising the Minimum Wage

“Congress must increase the federal minimum wage. The current minimum wage of $7.25 is simply not enough to sustain an individual, not to mention a family; too many Americans work 40- or 50-hour weeks and still have to need help from their local food pantry. Congress has repeatedly failed to respond to President Obama’s call to action. It’s time for them to stop their obstruction.”

—Secretary Perez

Giving Every Child a Shot from the Start

“Despite significant progress over the past eight years, six out of every 10 four-year-olds are still not enrolled in publicly funded preschool programs. States and districts, in collaboration with the federal government, must take additional steps to expand access to high-quality early learning so that all children enter kindergarten ready for success in school and beyond. More also must be done to ensure early learning is inclusive of students who are historically underserved and most vulnerable, including children with disabilities and dual language learners.”

—Secretary King

Investing in the Infrastructure of the Future

“The next Secretary of Transportation will not simply work on building roads and bridges and ensuring safe travel. The next administration is entering a period of advanced automated technologies in transportation, an infrastructure system that continues to work for some and against others in society, dramatic demographic shifts, an increase in extreme weather events due to climate change, and a backlog of projects needed across the country with not enough resources to address it. Future administrations should, if the United States is to remain competitive in the global economy, devote significant time and energy to securing the resources needed to keep America competitive.”

—Secretary Foxx

Building the Digital Economy

“The federal government is currently not properly organized to face the challenges posed by the 21st century digital economy. Looking forward, there needs to be a government-wide focus to address five critical issues: access, trust and security online, promoting a free and open Internet globally, addressing the challenges and opportunities of emerging technologies, and preparing workers for jobs in the digital economy.”

—Secretary Pritzker

Reforming our Business Tax Code

“President Obama’s proposed plan for business tax reform sets out a framework for modernizing our business tax system…Enacting such a plan would enhance our competitiveness and create an environment in which business rather than tax considerations drive decision-making. The President’s framework is also fiscally responsible, ensuring that business tax reform does not add to deficits over the long-term. I am hopeful that this framework will help to equip the new Congress to take responsible action on business tax reform.”

—Secretary Lew