- Notifications

You must be signed in to change notification settings - Fork4

CollinErickson/GauPro

Folders and files

| Name | Name | Last commit message | Last commit date | |

|---|---|---|---|---|

Repository files navigation

This package allows you to fit a Gaussian process regression model to adataset. A Gaussian process (GP) is a commonly used model in computersimulation. It assumes that the distribution of any set of points ismultivariate normal. A major benefit of GP models is that they provideuncertainty estimates along with their predictions.

You can install like any other package through CRAN.

install.packages('GauPro')The most up-to-date version can be downloaded from my Github account.

# install.packages("devtools")devtools::install_github("CollinErickson/GauPro")This simple shows how to fit the Gaussian process regression model todata. The functiongpkm creates a Gaussian process kernel model fit tothe given data.

library(GauPro)#> Loading required package: mixopt#> Loading required package: dplyr#>#> Attaching package: 'dplyr'#> The following objects are masked from 'package:stats':#>#> filter, lag#> The following objects are masked from 'package:base':#>#> intersect, setdiff, setequal, union#> Loading required package: ggplot2#> Loading required package: splitfngr#> Loading required package: numDeriv#> Loading required package: rmarkdown#> Loading required package: tidyr

n<-12x<- seq(0,1,length.out=n)y<- sin(6*x^.8)+ rnorm(n,0,1e-1)gp<- gpkm(x,y)#> * Argument 'kernel' is missing. It has been set to 'matern52'. See documentation for more details.

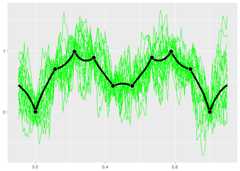

Plotting the model helps us understand how accurate the model is and howmuch uncertainty it has in its predictions. The green and red lines arethe 95% intervals for the mean and for samples, respectively.

gp$plot1D()

The model fit usinggpkm can also be used with data/formula input andcan properly handle factor data.

In this example, thediamonds data set is fit by specifying theformula and passing a data frame with the appropriate columns.

library(ggplot2)diamonds_subset<-diamonds[sample(1:nrow(diamonds),60), ]dm<- gpkm(price~carat+cut+color+clarity+depth,diamonds_subset)#> * Argument 'kernel' is missing. It has been set to 'matern52'. See documentation for more details.

Callingsummary on the model gives details about the model, includingdiagnostics about the model fit and the relative importance of thefeatures.

summary(dm)#> Formula:#> price ~ carat + cut + color + clarity + depth#>#> Residuals:#> Min. 1st Qu. Median Mean 3rd Qu. Max.#> -6589.09 -217.68 37.85 -165.28 181.42 1619.37#>#> Feature importance:#> carat cut color clarity depth#> 1.5497 0.2130 0.3275 0.3358 0.0003#>#> AIC: 1008.96#>#> Pseudo leave-one-out R-squared : 0.901367#> Pseudo leave-one-out R-squared (adj.): 0.8427204#>#> Leave-one-out coverage on 60 samples (small p-value implies bad fit):#> 68%: 0.7 p-value: 0.7839#> 95%: 0.95 p-value: 1

We can also plot the model to get a visual idea of how each inputaffects the output.

plot(dm)In this case, the kernel was chosen automatically by looking at whichdimensions were continuous and which were discrete, and then using aMatern 5/2 on the continuous dimensions (1,5), and separate orderedfactor kernels on the other dimensions since those columns in the dataframe are all ordinal factors. We can construct our own kernel usingproducts and sums of any kernels, making sure that the continuouskernels ignore the factor dimensions.

Suppose we want to construct a kernel for this example that uses thepower exponential kernel for the two continuous dimensions, orderedkernels oncut andcolor, and a Gower kernel onclarity. First weconstruct the power exponential kernel that ignores the 3 factordimensions. Then we construct

cts_kernel<- k_IgnoreIndsKernel(k=k_PowerExp(D=2),ignoreinds= c(2,3,4))factor_kernel2<- k_OrderedFactorKernel(D=5,xindex=2,nlevels=nlevels(diamonds_subset[[2]]))factor_kernel3<- k_OrderedFactorKernel(D=5,xindex=3,nlevels=nlevels(diamonds_subset[[3]]))factor_kernel4<- k_GowerFactorKernel(D=5,xindex=4,nlevels=nlevels(diamonds_subset[[4]]))# Multiply themdiamond_kernel<-cts_kernel*factor_kernel2*factor_kernel3*factor_kernel4

Now we can pass this kernel intogpkm and it will use it.

dm<- gpkm(price~carat+cut+color+clarity+depth,diamonds_subset,kernel=diamond_kernel)dm$plotkernel()

A key modeling decision for Gaussian process models is the choice ofkernel. The kernel determines the covariance and the behavior of themodel. The default kernel is the Matern 5/2 kernel (Matern52), and isa good choice for most cases. The Gaussian, or squared exponential,kernel (Gaussian) is a common choice but often leads to a bad fitsince it assumes the process the data comes from is infinitelydifferentiable. Other common choices that are available include theExponential, Matern 3/2 (Matern32), Power Exponential (PowerExp),Cubic, Rational Quadratic (RatQuad), and Triangle (Triangle).

These kernels only work on numeric data. For factor data, the kernelwill default to a Latent Factor Kernel (LatentFactorKernel) forcharacter and unordered factors, or an Ordered Factor Kernel(OrderedFactorKernel) for ordered factors. As long as the input isgiven in as a data frame and the columns have the proper types, then thedefault kernel will properly handle it by applying the numeric kernel tothe numeric inputs and the factor kernel to the factor and characterinputs.

Kernels are stored as R6 objects. They can all be created using the R6object generator (e.g.,Matern52$new()), or using thek_<kernel name> shortcut function (e.g.,k_Matern52()). The latteris easier to use (and recommended) since R will show the functionarguments and autocomplete.

The following table shows details on all the kernels available.

| Kernel | Function | Continuous/ discrete | Equation | Notes |

|---|---|---|---|---|

| Gaussian | k_Gaussian | cts | Often causes issues since it assumes infinite differentiability. Experts don’t recommend using it. | |

| Matern 3/2 | k_Matern32 | cts | Assumes one time differentiability. This is often too low of an assumption. | |

| Matern 5/2 | k_Matern52 | cts | Assumes two time differentiability. Generally the best. | |

| Exponential | k_Exponential | cts | Equivalent to Matern 1/2. Assumes no differentiability. | |

| Triangle | k_Triangle | cts | ||

| Power exponential | k_PowerExp | cts | ||

| Periodic | k_Periodic | cts | The only kernel that takes advantage of periodic data. But there is often incoherence far apart, so you will likely want to multiply by one of the standard kernels. | |

| Cubic | k_Cubic | cts | ||

| Rational quadratic | k_RatQuad | cts | ||

| Latent factor kernel | k_LatentFactorKernel | factor | This embeds each discrete value into a low dimensional space and calculates the distances in that space. This works well when there are many discrete values. | |

| Ordered factor kernel | k_OrderedFactorKernel | factor | This maintains the order of the discrete values. E.g., if there are 3 levels, it will ensure that 1 and 2 have a higher correlation than 1 and 3. This is similar to embedding into a latent space with 1 dimension and requiring the values to be kept in numerical order. | |

| Factor kernel | k_FactorKernel | factor | This fits a parameter for every pair of possible values. E.g., if there are 4 discrete values, it will fit 6 (4 choose 2) values. This doesn’t scale well. When there are many discrete values, use any of the other factor kernels. | |

| Gower factor kernel | k_GowerFactorKernel | factor | $k(x,y) = \begin{cases} 1, & \text{if } x=y \ p, & \text{if } x \neq y \end{cases}$ | This is a very simple factor kernel. For the relevant dimension, the correlation will either be 1 if the value are the same, or |

| Ignore indices | k_IgnoreIndsKernel | N/A | Use this to create a kernel that ignores certain dimensions. Useful when you want to fit different kernel types to different dimensions or when there is a mix of continuous and discrete dimensions. |

Factor kernels: note that these all only work on a single dimension. Ifthere are multiple factor dimensions in your input, then they each willbe given a different factor kernel.

Kernels can be combined by multiplying or adding them directly.

The following example uses the product of a periodic and a Matern 5/2kernel to fit periodic data.

x<-1:20y<- sin(x)+.1*x^1.3combo_kernel<- k_Periodic(D=1)* k_Matern52(D=1)gp<- gpkm(x,y,kernel=combo_kernel,nug.min=1e-6)#> * nug is at minimum value after optimizing. Check the fit to see it this caused a bad fit. Consider changing nug.min. This is probably fine for noiseless data.gp$plot()

For an example of a more complex kernel being constructed, see thediamonds section above.

(This section used to be the main vignette on CRAN for this package.)

This R package provides R code for fitting Gaussian process models todata. The code is created using theR6 class structure, which is why$ is used to access object methods.

A Gaussian process fits a model to a dataset, which gives a functionthat gives a prediction for the mean at any point along with a varianceof this prediction.

Suppose we have the data below

x<- seq(0,1,l=10)y<- abs(sin(2*pi*x))^.8ggplot(aes(x,y),data=cbind(x,y))+ geom_point()

A linear model (LM) will fit a straight line through the data andclearly does not describe the underlying function producing the data.

ggplot(aes(x,y),data=cbind(x,y))+ geom_point()+ stat_smooth(method='lm')#> `geom_smooth()` using formula = 'y ~ x'

A Gaussian process is a type of model that assumes that the distributionof points follows a multivariate distribution.

In GauPro, we can fit a GP model with Gaussian correlation functionusing the functiongpkm.

library(GauPro)gp<- gpkm(x,y,kernel=k_Gaussian(D=1),parallel=FALSE)

Now we can plot the predictions given by the model. Shown below, thismodel looks much better than a linear model.

gp$plot1D()

A very useful property of GP’s is that they give a predicted error. Thered lines give an approximate 95% confidence interval for the value ateach point (measure value, not the mean). The width of the predictioninterval is largest between points and goes to zero near data points,which is what we would hope for.

GP models give distributions for the predictions. Realizations fromthese distributions give an idea of what the true function may looklike. Calling$cool1Dplot() on the 1-D gp object shows 20realizations. The realizations are most different away from the designpoints.

if (requireNamespace("MASS",quietly=TRUE)) {gp$cool1Dplot()}

The kernel, or covariance function, has a large effect on the Gaussianprocess being estimated. Many different kernels are available in thegpkm() function which creates the GP object.

The example below shows what the Matern 5/2 kernel gives.

kern<- k_Matern52(D=1)gpk<- gpkm(matrix(x,ncol=1),y,kernel=kern,parallel=FALSE)if (requireNamespace("MASS",quietly=TRUE)) { plot(gpk)}

The exponential kernel is shown below. You can see that it has a hugeeffect on the model fit. The exponential kernel assumes the correlationbetween points dies off very quickly, so there is much more uncertaintyand variation in the predictions and sample paths.

kern.exp<- k_Exponential(D=1)gpk.exp<- gpkm(matrix(x,ncol=1),y,kernel=kern.exp,parallel=FALSE)if (requireNamespace("MASS",quietly=TRUE)) { plot(gpk.exp)}

Along with the kernel the trend can also be set. The trend determineswhat the mean of a point is without any information from the otherpoints. I call it a trend instead of mean because I refer to theposterior mean as the mean, whereas the trend is the mean of the normaldistribution. Currently the three options are to have a mean 0, aconstant mean (default and recommended), or a linear model.

With the exponential kernel above we see some regression to the mean.Between points the prediction reverts towards the mean of 0.2986876.Also far away from any data the prediction will near this value.

Below when we use a mean of 0 we do not see this same reversion.

kern.exp<- k_Exponential(D=1)trend.0<-trend_0$new()gpk.exp<- gpkm(matrix(x,ncol=1),y,kernel=kern.exp,trend=trend.0,parallel=FALSE)if (requireNamespace("MASS",quietly=TRUE)) { plot(gpk.exp)}

About

R package for Gaussian process modeling

Resources

Uh oh!

There was an error while loading.Please reload this page.

Stars

Watchers

Forks

Packages0

Uh oh!

There was an error while loading.Please reload this page.

Contributors3

Uh oh!

There was an error while loading.Please reload this page.