- Notifications

You must be signed in to change notification settings - Fork915

Ultra-fast matching engine written in Java based on LMAX Disruptor, Eclipse Collections, Real Logic Agrona, OpenHFT, LZ4 Java, and Adaptive Radix Trees.

License

exchange-core/exchange-core

Folders and files

| Name | Name | Last commit message | Last commit date | |

|---|---|---|---|---|

Repository files navigation

Exchange-core is anopen source market exchange core based onLMAX Disruptor,Eclipse Collections (ex. Goldman Sachs GS Collections),Real Logic Agrona,OpenHFT Chronicle-Wire,LZ4 Java,andAdaptive Radix Trees.

Exchange-core includes:

- orders matching engine

- risk control and accounting module

- disk journaling and snapshots module

- trading, admin and reports API

Designed for high scalability and pauseless 24/7 operation under high-load conditions and providing low-latency responses:

- 3M users having 10M accounts in total

- 100K order books (symbols) having 4M pending orders in total

- less than 1ms worst wire-to-wire target latency for 1M+ operations per second throughput

- 150ns per matching for large market orders

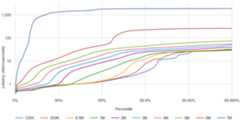

Single order book configuration is capable to process 5M operations per second on 10-years old hardware (Intel® Xeon® X5690) with moderate latency degradation:

| rate | 50.0% | 90.0% | 95.0% | 99.0% | 99.9% | 99.99% | worst |

|---|---|---|---|---|---|---|---|

| 125K | 0.6µs | 0.9µs | 1.0µs | 1.4µs | 4µs | 24µs | 41µs |

| 250K | 0.6µs | 0.9µs | 1.0µs | 1.4µs | 9µs | 27µs | 41µs |

| 500K | 0.6µs | 0.9µs | 1.0µs | 1.6µs | 14µs | 29µs | 42µs |

| 1M | 0.5µs | 0.9µs | 1.2µs | 4µs | 22µs | 31µs | 45µs |

| 2M | 0.5µs | 1.2µs | 3.9µs | 10µs | 30µs | 39µs | 60µs |

| 3M | 0.7µs | 3.6µs | 6.2µs | 15µs | 36µs | 45µs | 60µs |

| 4M | 1.0µs | 6.0µs | 9µs | 25µs | 45µs | 55µs | 70µs |

| 5M | 1.5µs | 9.5µs | 16µs | 42µs | 150µs | 170µs | 190µs |

| 6M | 5µs | 30µs | 45µs | 300µs | 500µs | 520µs | 540µs |

| 7M | 60µs | 1.3ms | 1.5ms | 1.8ms | 1.9ms | 1.9ms | 1.9ms |

Benchmark configuration:

- Single symbol order book.

- 3,000,000 inbound messages are distributed as follows: 9% GTC orders, 3% IOC orders, 6% cancel commands, 82% move commands. About 6% of all messages are triggering one or more trades.

- 1,000 active user accounts.

- In average ~1,000 limit orders are active, placed in ~750 different price slots.

- Latency results are only for risk processing and orders matching. Other stuff like network interface latency, IPC, journaling is not included.

- Test data is not bursty, meaning constant interval between commands (0.2~8µs depending on target throughput).

- BBO prices are not changing significantly throughout the test. No avalanche orders.

- No coordinated omission effect for latency benchmark. Any processing delay affects measurements for next following messages.

- GC is triggered prior/after running every benchmark cycle (3,000,000 messages).

- RHEL 7.5, network-latency tuned-adm profile, dual X5690 6 cores 3.47GHz, one socket isolated and tickless, spectre/meltdown protection disabled.

- Java version 8u192, newer Java 8 versions can have aperformance bug

- HFT optimized. Priority is a limit-order-move operation mean latency (currently ~0.5µs). Cancel operation takes ~0.7µs, placing new order ~1.0µs;

- In-memory working state for accounting data and order books.

- Event-sourcing - disk journaling and journal replay support, state snapshots (serialization) and restore operations, LZ4 compression.

- Lock-free and contention-free orders matching and risk control algorithms.

- No floating-point arithmetic, no loss of significance is possible.

- Matching engine and risk control operations are atomic and deterministic.

- Pipelined multi-core processing (based on LMAX Disruptor): each CPU core is responsible for certain processing stage, user accounts shard, or symbol order books shard.

- Two different risk processing modes (specified per symbol): direct-exchange and margin-trade.

- Maker/taker fees (defined in quote currency units).

- Two order books implementations: simple implementation ("Naive") and performance implementation ("Direct").

- Order types: Immediate-or-Cancel (IOC), Good-till-Cancel (GTC), Fill-or-Kill Budget (FOK-B)

- Testing - unit-tests, integration tests, stress tests, integrity/consistency tests.

- Low GC pressure, objects pooling, single ring-buffer.

- Threads affinity (requires JNA).

- User suspend/resume operation (reduces memory consumption).

- Core reports API (user balances, open interest).

- Install library into your Maven's local repository by running

mvn install - Add the following Maven dependency to your project's

pom.xml:

<dependency> <groupId>exchange.core2</groupId> <artifactId>exchange-core</artifactId> <version>0.5.3</version></dependency>Alternatively, you can clone this repository and run theexample test.

Create and start empty exchange core:

// simple async events handlerSimpleEventsProcessoreventsProcessor =newSimpleEventsProcessor(newIEventsHandler() {@OverridepublicvoidtradeEvent(TradeEventtradeEvent) {System.out.println("Trade event: " +tradeEvent); }@OverridepublicvoidreduceEvent(ReduceEventreduceEvent) {System.out.println("Reduce event: " +reduceEvent); }@OverridepublicvoidrejectEvent(RejectEventrejectEvent) {System.out.println("Reject event: " +rejectEvent); }@OverridepublicvoidcommandResult(ApiCommandResultcommandResult) {System.out.println("Command result: " +commandResult); }@OverridepublicvoidorderBook(OrderBookorderBook) {System.out.println("OrderBook event: " +orderBook); }});// default exchange configurationExchangeConfigurationconf =ExchangeConfiguration.defaultBuilder().build();// no serializationSupplier<ISerializationProcessor>serializationProcessorFactory = () ->DummySerializationProcessor.INSTANCE;// build exchange coreExchangeCoreexchangeCore =ExchangeCore.builder() .resultsConsumer(eventsProcessor) .serializationProcessorFactory(serializationProcessorFactory) .exchangeConfiguration(conf) .build();// start up disruptor threadsexchangeCore.startup();// get exchange API for publishing commandsExchangeApiapi =exchangeCore.getApi();

Create new symbol:

// currency code constantsfinalintcurrencyCodeXbt =11;finalintcurrencyCodeLtc =15;// symbol constantsfinalintsymbolXbtLtc =241;// create symbol specification and publish itCoreSymbolSpecificationsymbolSpecXbtLtc =CoreSymbolSpecification.builder() .symbolId(symbolXbtLtc)// symbol id .type(SymbolType.CURRENCY_EXCHANGE_PAIR) .baseCurrency(currencyCodeXbt)// base = satoshi (1E-8) .quoteCurrency(currencyCodeLtc)// quote = litoshi (1E-8) .baseScaleK(1_000_000L)// 1 lot = 1M satoshi (0.01 BTC) .quoteScaleK(10_000L)// 1 price step = 10K litoshi .takerFee(1900L)// taker fee 1900 litoshi per 1 lot .makerFee(700L)// maker fee 700 litoshi per 1 lot .build();future =api.submitBinaryDataAsync(newBatchAddSymbolsCommand(symbolSpecXbtLtc));

Create new users:

// create user uid=301future =api.submitCommandAsync(ApiAddUser.builder() .uid(301L) .build());// create user uid=302future =api.submitCommandAsync(ApiAddUser.builder() .uid(302L) .build());

Perform deposits:

// first user deposits 20 LTCfuture =api.submitCommandAsync(ApiAdjustUserBalance.builder() .uid(301L) .currency(currencyCodeLtc) .amount(2_000_000_000L) .transactionId(1L) .build());// second user deposits 0.10 BTCfuture =api.submitCommandAsync(ApiAdjustUserBalance.builder() .uid(302L) .currency(currencyCodeXbt) .amount(10_000_000L) .transactionId(2L) .build());

Place orders:

// first user places Good-till-Cancel Bid order// he assumes BTCLTC exchange rate 154 LTC for 1 BTC// bid price for 1 lot (0.01BTC) is 1.54 LTC => 1_5400_0000 litoshi => 10K * 15_400 (in price steps)future =api.submitCommandAsync(ApiPlaceOrder.builder() .uid(301L) .orderId(5001L) .price(15_400L) .reservePrice(15_600L)// can move bid order up to the 1.56 LTC, without replacing it .size(12L)// order size is 12 lots .action(OrderAction.BID) .orderType(OrderType.GTC)// Good-till-Cancel .symbol(symbolXbtLtc) .build());// second user places Immediate-or-Cancel Ask (Sell) order// he assumes wost rate to sell 152.5 LTC for 1 BTCfuture =api.submitCommandAsync(ApiPlaceOrder.builder() .uid(302L) .orderId(5002L) .price(15_250L) .size(10L)// order size is 10 lots .action(OrderAction.ASK) .orderType(OrderType.IOC)// Immediate-or-Cancel .symbol(symbolXbtLtc) .build());

Request order book:

future =api.requestOrderBookAsync(symbolXbtLtc,10);

GtC orders manipulations:

// first user moves remaining order to price 1.53 LTCfuture =api.submitCommandAsync(ApiMoveOrder.builder() .uid(301L) .orderId(5001L) .newPrice(15_300L) .symbol(symbolXbtLtc) .build());// first user cancel remaining orderfuture =api.submitCommandAsync(ApiCancelOrder.builder() .uid(301L) .orderId(5001L) .symbol(symbolXbtLtc) .build());

Check user balance and GtC orders:

Future<SingleUserReportResult>report =api.processReport(newSingleUserReportQuery(301),0);

Check system balance:

// check fees collectedFuture<TotalCurrencyBalanceReportResult>totalsReport =api.processReport(newTotalCurrencyBalanceReportQuery(),0);System.out.println("LTC fees collected: " +totalsReport.get().getFees().get(currencyCodeLtc));

- latency test: mvn -Dtest=PerfLatency#testLatencyMargin test

- throughput test: mvn -Dtest=PerfThroughput#testThroughputMargin test

- hiccups test: mvn -Dtest=PerfHiccups#testHiccups test

- serialization test: mvn -Dtest=PerfPersistence#testPersistenceMargin test

- market data feeds (full order log, L2 market data, BBO, trades)

- clearing and settlement

- reporting

- clustering

- FIX and REST API gateways

- cryptocurrency payment gateway

- more tests and benchmarks

- NUMA-aware and CPU layout custom configuration

Exchange-core is an open-source project and contributions are welcome!

About

Ultra-fast matching engine written in Java based on LMAX Disruptor, Eclipse Collections, Real Logic Agrona, OpenHFT, LZ4 Java, and Adaptive Radix Trees.

Topics

Resources

License

Uh oh!

There was an error while loading.Please reload this page.

Stars

Watchers

Forks

Packages0

Uh oh!

There was an error while loading.Please reload this page.

Contributors10

Uh oh!

There was an error while loading.Please reload this page.